TRUMP Struggles Below $5 as Unlock Adds Downside Pressure

One after another, the conviction of Official Trump TRUMP $5.00 24h volatility: 0.5% Market cap: $1.00 B Vol. 24h: $172.39 M meme coin holders is being tested. This time, Tokenomist data show that 4.89 million TRUMP tokens, worth roughly $24.84 million, are scheduled to unlock this week, representing 2.45% of the circulating supply.

The unlock places TRUMP among the largest linear releases this week, alongside sizable unlocks in RAIN and SOL.

At the time of writing, TRUMP trades at $5.05, down nearly 20% over the past month and close to 2% over the last 24 hours. According to CoinMarketCap data, trading volume has jumped 34%, indicating increased investor attention to the token.

TRUMP Price Analysis: What’s Next?

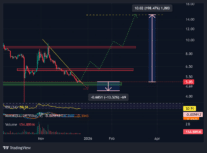

Token unlocks do not always lead to immediate sell-offs, but they tend to amplify existing trends. In TRUMP’s case, the broader trend remains bearish. Price has continued to respect a descending structure, with lower highs and lower lows dominating the chart.

Official Trump price | Source: TradingView

TRUMP is currently hovering just above a critical support band in the $4.70-$5 region. This area has previously acted as a demand zone, but repeated tests have weakened it.

If this support fails, the next downside move could extend toward the mid-$4 range. A clean breakdown below this zone would likely result in a retest of lower levels.

However, if TRUMP holds above the current support and reclaims the $6.30 to $6.50 resistance zone, a move toward the $8.50 to $9 region is possible. The chart above shows a retest of $15 if all of these levels are cleared.

TRUMP Loses Steam, but Bitcoin Layer-2 Project Packs Heat

For now, TRUMP token’s hype-driven phase looks to be fading. However, another project is showcasing serious potential, claiming to build “Bitcoin’s future.”

Bitcoin Hyper ($HYPER), a Bitcoin Layer-2 solution, is bringing the possibilities of DeFi on the Bitcoin Network with the help of Solana-based tech.

The project has already raised a massive $29.6 million in its ongoing presale. The believers are already staking their investments, buying $HYPE as it brings NFTs, games, DeFi, and other applications.

Bitcoin is plagued by slow transaction times and often incurs high fees. That is not the case with Bitcoin Hyper. It uses Layer-2 tech to reduce the figures drastically.

To buy the $HYPER token at the current price of $0.013465, visit the official Bitcoin Hyper presale website and connect a supported wallet (like Best Wallet).

nextThe post TRUMP Struggles Below $5 as Unlock Adds Downside Pressure appeared first on Coinspeaker.

You May Also Like

Intel’s stock surges as Nvidia invests $5 billion in the chipmaker

JPMorgan's Jamie Dimon doesn’t see more Fed rate cuts unless inflation drops