Gemini to Exit UK, EU, Aus Market, Shifts Accounts to Withdrawal-Only From March 5

Gemini has announced that it will cease operations in the United Kingdom, Europe and Australia marking another high-profile exit as the country transitions to a stricter regulatory regime for digital asset firms. The exchange will also be winding down operations in the European Union and Australia.

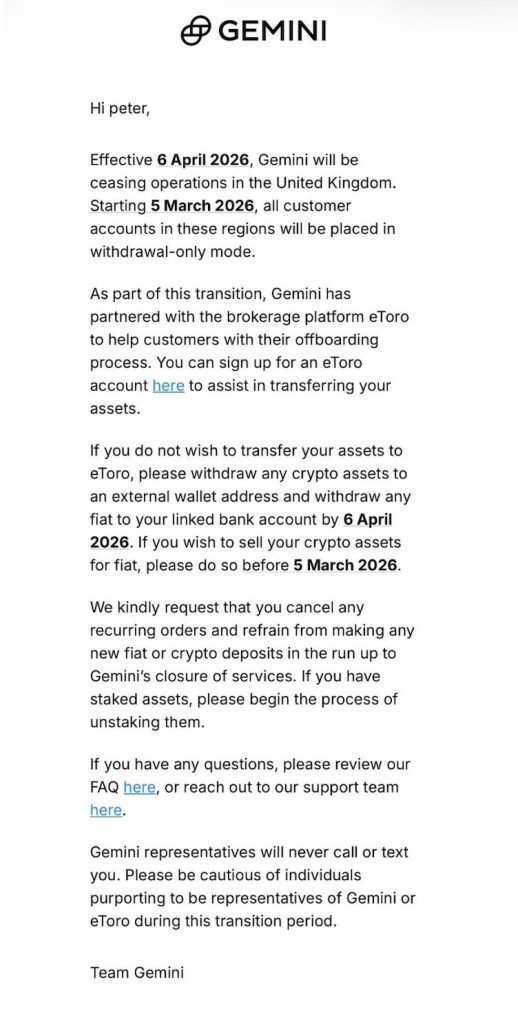

In a notice sent to customers, Gemini said UK operations will formally end on 6 April 2026, with all UK customer accounts placed into withdrawal-only mode from 5 March 2026.

The exchange advised users to either transfer assets to an external wallet or offboard via a partner platform ahead of the deadline.

Accounts Shift to Withdrawal-Only Mode

Under the transition plan, Gemini said customers will no longer be able to trade or make new deposits after 5 March. Users who wish to liquidate crypto holdings into fiat must do so before that date, while all crypto and fiat withdrawals must be completed by 6 April.

As part of the offboarding process, Gemini has partnered with eToro, offering customers the option to open an eToro account to assist with transferring assets. Gemini also urged users to cancel recurring orders and begin unstaking any staked assets ahead of the shutdown.

The company warned customers to remain vigilant against potential scams, stating that Gemini representatives will not contact users directly by phone or text during the transition.

According to Reuters, Gemini has approved a plan to cut up to 200 jobs globally and narrow its operations to the U.S. and Singapore as part of a broader cost-cutting effort. The layoffs, which affect roughly a quarter of the company’s workforce, will impact staff across Europe, the U.S. and Singapore, the company said.

Regulatory Pressure in the UK Market

Gemini’s exit comes as the UK moves from an interim crypto registration regime into full authorisation under the Financial Services and Markets Act (FSMA). The shift represents a material tightening of expectations around governance, operational resilience, and senior management accountability for digital asset firms operating in the country.

While the UK has positioned itself as open to financial innovation, the new framework introduces deeper regulatory scrutiny and ongoing supervisory engagement—a dynamic that has prompted several global crypto firms to reassess their UK footprint.

A Selective Regime Takes Shape

“Gemini’s decision to exit the UK raises a bigger question than any single firm’s strategy,” said one industry observer. “What does participation look like once the UK moves from a registration regime into full FSMA authorisation?”

The transition, they noted, is not merely about meeting higher standards on paper, but about sustained oversight, historical scrutiny, and personal accountability at the senior management level. For global firms, the calculus increasingly hinges on whether the UK market justifies that level of regulatory exposure in a fast-evolving sector. Some firms will decide the trade-off makes sense. Others may not.

Implications for the UK Crypto Environment

Gemini’s departure does not necessarily emphasize failure of the UK’s regulatory approach, but it does suggest the regime is intentionally selective. As authorisation moves from theory into delivery, success may depend less on scale and more on regulatory experience, judgement, and willingness to operate under continuous supervision.

Gemini was contacted for comment at press time, but did not respond.

‘Regulatory Theatre Is Driving Serious Crypto Players Out of the UK’

“As someone who established some of Europe’s first crypto ETPs and works extensively with crypto custodians, Gemini’s UK exit is entirely predictable,” said Laurent Kssis, director at CEC Capital and an ETF trading consultant, “The UK has created a convoluted regime that demands institutional-grade infrastructure while systematically destroying the business case for providing it.

“You can’t require segregated custody, FCA authorisation and complex compliance while simultaneously forcing crypto ETN liquidations through IFISA chaos, watching platforms refuse to offer products, and capturing just 0.59% of European trading volume,” explains Kssis.

“Switzerland, Germany and France show that crypto custody can thrive under clear regulation. The UK shows the opposite — that regulatory theatre drives serious players away. This exodus will accelerate unless there is fundamental reform. The UK is systematically undermining its own ‘crypto hub’ ambitions,” said Kssis.

You May Also Like

Tom Lee’s BitMine Hits 7-Month Stock Low as Ethereum Paper Losses Reach $8 Billion

MYX Finance price surges again as funding rate points to a crash