Circle Partners Polymarket to Integrate Native USDC, Eliminating Bridge Risk

Circle and Polymarket announced a partnership today that will bring native USDC to the prediction market over the next few months, replacing the bridged stablecoin version traders currently use.

Polymarket runs entirely on Bridged USDC (USDC.e) through Polygon right now. Native USDC comes directly from Circle’s regulated entities and can be redeemed one-to-one for US dollars. Bridged tokens need intermediary protocols to move between blockchains, creating extra steps, issues and costs. Native versions eliminate that middleman, making transactions faster and more reliable for users trading billions monthly.

Some crypto analysts on X say that with this upgrade, Polymarket is eliminating bridging risk. It is well known in the industry that cross-chain bridges are the weakest link in hacking blockchains.

Polymarket Volume Growth Pushes Upgrade

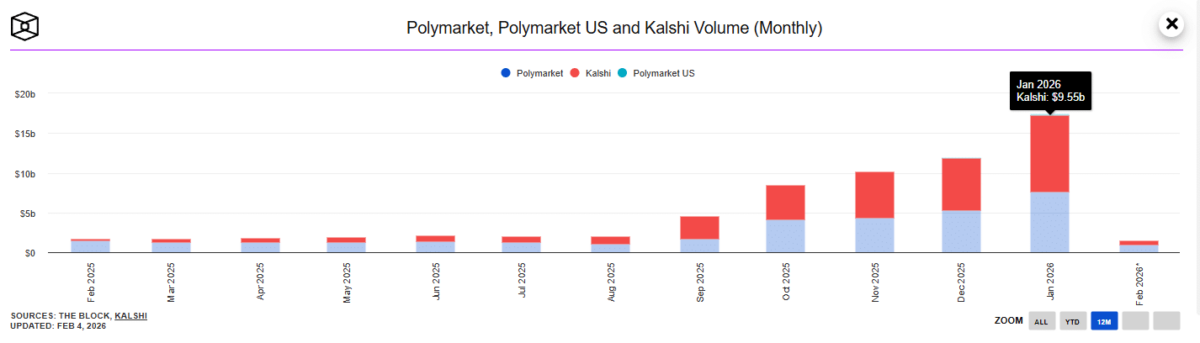

Polymarket handled $3 billion in trading volume on Polygon during October 2025 with over 338,000 traders, and more than $22 billion in notional trading across the first eleven months of 2025—a 57% increase from 2024. Monthly volume stood at $7.66 billion in January 2026, according to The Block data, making it the second-largest prediction market worldwide.

Currently, Kalshi is the largest prediction market, with $9.55 billion in volume over the last month, likely driven by its alliance with Coinbase.

Monthly volume for Polymarket and Kalshi | Source: The Block data

Other platforms made similar switches in 2025 to improve liquidity and reduce settlement friction, as did the Aptos blockchain. Each migration streamlines how money moves through these systems.

The shift positions Polymarket closer to the settlement standards that major financial institutions expect. With regulators watching crypto prediction markets more closely, even jurisdictions like Portugal ordering a stop to political betting, standardized stablecoin infrastructure provides the platform with a stronger foundation as it scales toward mainstream finance.

nextThe post Circle Partners Polymarket to Integrate Native USDC, Eliminating Bridge Risk appeared first on Coinspeaker.

You May Also Like

Tom Lee’s BitMine Hits 7-Month Stock Low as Ethereum Paper Losses Reach $8 Billion

Crypto-Fueled Rekt Drinks Sells 1 Millionth Can Amid MoonPay Collab