Bhutan Moves $14 Million in Bitcoin as State Holdings Continue to Decline

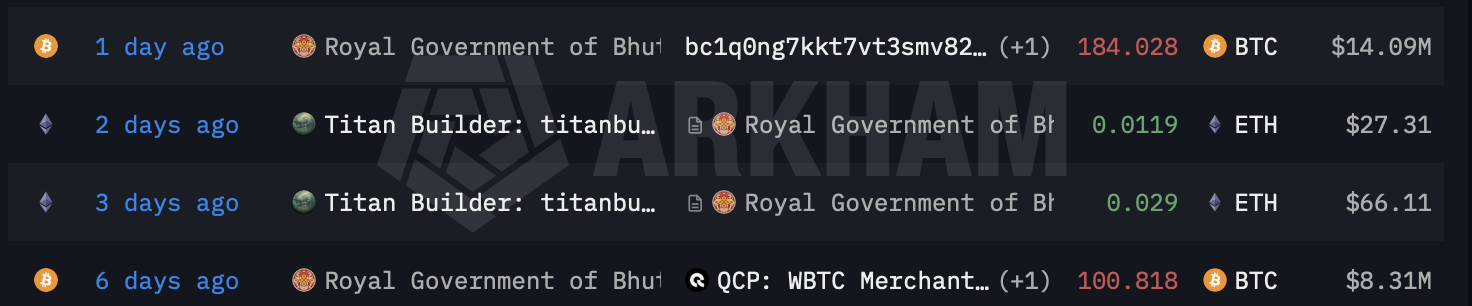

The Royal Government of Bhutan transferred 184 Bitcoin on February 4, 2026, marking its second significant on-chain movement in less than a week as the broader crypto market remains under pressure.

The transaction, valued at approximately $14.09 million, brings the total value of Bhutan’s recent Bitcoin transfers to roughly $22.3 million.

The funds were sent to a combination of new wallet addresses and known trading counterparties, including QCP Capitaland a Binance hot wallet, signaling either active balance-sheet management or potential liquidation during a period of heightened volatility.

Recent Transaction Activity

On February 4, Bhutan moved 184 BTC to a newly created address. Blockchain analysts note that such transfers often precede deposits to centralized exchanges or are used to facilitate over-the-counter (OTC) transactions, particularly when governments or large entities seek to minimize market impact.

Source: https://intel.arkm.com/explorer/entity/druk-holding-investments

Source: https://intel.arkm.com/explorer/entity/druk-holding-investments

This follows a prior transfer on January 30, when 100.8 BTC, worth approximately $8.3 million at the time, was sent directly to QCP Capital, a firm known for providing institutional liquidity and derivatives services.

Following these transactions, Bhutan’s reported Bitcoin holdings have declined to around 5,700 BTC, down sharply from a peak of 13,295 BTC recorded in October 2024.

Strategic Context Behind the Transfers

The timing of the transfers coincides with a challenging market environment. Bitcoin has fallen nearly 43% from its October 2024 all-time high of $126,080, significantly reducing the valuation of sovereign and institutional crypto portfolios.

Bhutan’s total on-chain Bitcoin holdings are now estimated at approximately $412 million, a steep drop from their $1.4 billion peak valuation during the prior market cycle. The recent movements suggest a reassessment of exposure as volatility persists.

Mining Economics Under Pressure

Bhutan’s Bitcoin strategy is closely tied to its state-owned investment arm, Druk Holding and Investments (DHI), which operates mining facilities powered primarily by hydroelectric energy.

However, mining economics have deteriorated since the 2024 Bitcoin halving, which effectively doubled production costs while reducing block rewards. This shift has led to lower output and tighter margins, increasing pressure on state miners to manage reserves more actively.

Global Positioning

Despite the recent transfers, Bhutan remains the seventh-largest nation-state holder of Bitcoin, trailing countries such as the United States, China, and the United Kingdom. While its holdings have decreased significantly from peak levels, the country continues to rank among the most active sovereign participants in the crypto market.

Market Takeaway

Bhutan’s latest Bitcoin transfers point to active portfolio management rather than passive holding as market conditions tighten. With mining economics under pressure and Bitcoin trading well below prior highs, the government appears to be adjusting its exposure while maintaining a meaningful strategic position.

The key signal is not the size of the transfers themselves, but their frequency and counterparties, suggesting a more dynamic approach to managing sovereign crypto reserves amid a prolonged market downturn.

The post Bhutan Moves $14 Million in Bitcoin as State Holdings Continue to Decline appeared first on ETHNews.

You May Also Like

ZEC Technical Analysis Feb 5

White House launches direct to consumer drug site