APX Holder Turns $226K Into $7M—Why Early Crypto Bets Still Create Massive Fortunes

In crypto, fortunes are made not by following the crowd, but by moving before the world catches on. This truth was reinforced again when an APX investor who put in about $226,000 back in 2022 saw their holdings surge to more than $7 million during the recent ASTER swap rally.

The story shows how powerful early-stage investments can be. It also sparks a big question: where will the next wave of wealth come from? The APX success proves that timing matters. Vision matters. And today, many investors are looking toward presales like MAGAX.

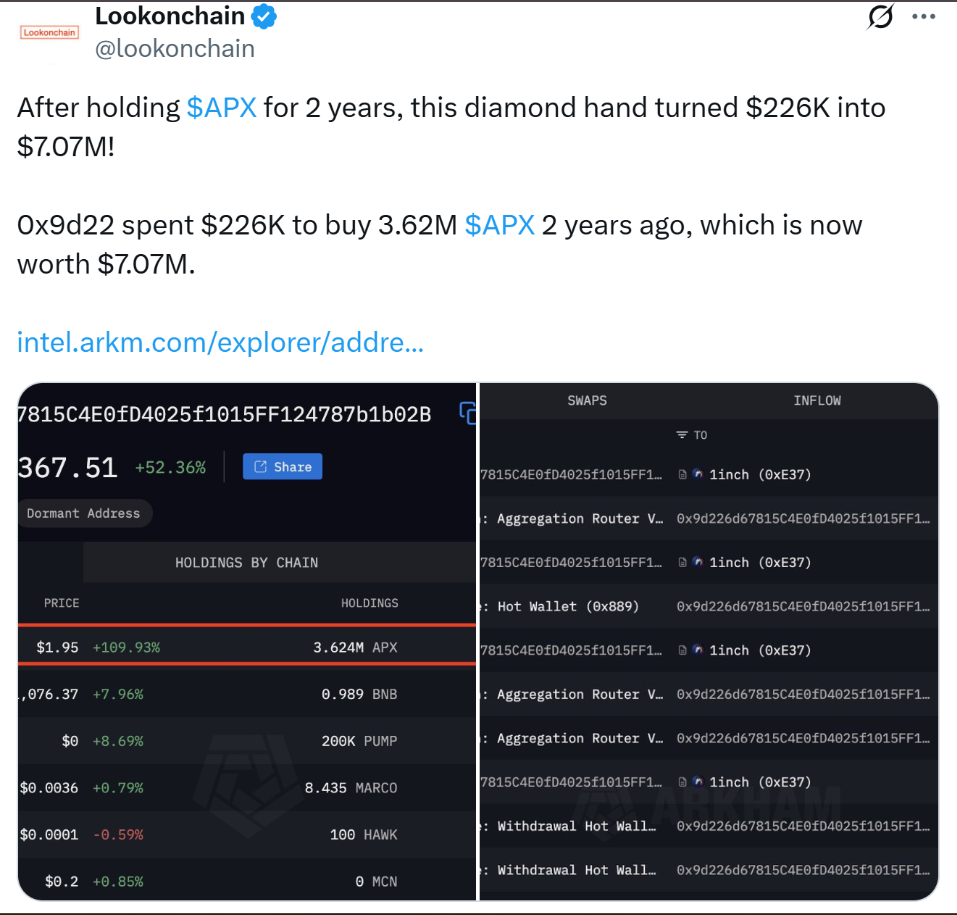

Source: Lookonchain

How APX Delivered a Multi-Million Dollar Payoff

APX Finance began as a decentralized exchange offering leveraged trading and derivatives on chains like BNB and Arbitrum. The platform rewarded early supporters, but its real turning point came with the launch of the ASTER swap in 2025.

During this upgrade, APX holders were allowed to swap tokens for ASTER, the new native token. A tiered system rewarded those who moved quickly, and the excitement pushed APX’s price up by 120% in just 24 hours, briefly hitting $1.98.

One early wallet, which had invested in 2022 when APX was near rock bottom, suddenly saw its holdings balloon to $7 million. For those who had the conviction to buy early, the payoff was extraordinary.

The Lesson: Early Entry Creates the Biggest Multipliers

APX’s story is not unique. Time and again, crypto rewards those who enter before the rush. Ethereum traded for under $1 in presale. Solana was nearly free before its DeFi boom. Shiba Inu turned meme culture into billions of dollars.

What unites these examples is simple: by the time tokens hit major exchanges, much of the upside is gone. The biggest fortunes are made when investors see the vision early and position themselves before mainstream adoption.

Moonshot MAGAX and the Rise of Meme-to-Earn Culture

This is where MAGAX enters the conversation. While APX succeeded by innovating in decentralized trading, MAGAX is redefining what meme tokens can achieve. Instead of being driven only by hype, MAGAX introduces a Meme-to-Earn model, where users are rewarded for creating and sharing memes that fuel the community’s growth.

With tokens priced at just $0.000293 in Stage 2, MAGAX sits in the same position APX once did—an ambitious project that the wider market hasn’t fully noticed yet. But unlike many meme coins, it has structural features that strengthen long-term value.

DeFi Innovation Sets MAGAX Apart From Traditional Meme Tokens

APX proved its strength in DeFi by building one of the busiest decentralized derivatives platforms, showing that real liquidity thrives beyond centralized exchanges. MAGAX follows a similar path but through culture.

It blends meme virality with DeFi incentives, turning engagement into real yield. This makes it more than a meme coin—it’s a cultural token rooted in DeFi, powered by both community and blockchain.

Why Joining the MAGAX Community Is a Strategic Move

Communities make or break crypto projects. APX benefited from strong early believers who trusted the project during its quiet years. MAGAX is already building that same loyalty at a much earlier stage.

With over 80,000 participants in its presale, MAGAX isn’t just growing in numbers—it’s creating a collaborative environment where creativity pays. Members can earn through meme creation, sharing, and promoting content, making the community itself an engine of value.

For investors, joining MAGAX means plugging into a cycle where growth is self-sustaining. Every new meme isn’t just entertainment—it’s marketing, culture, and adoption rolled into one.

Learning From APX Without Competing Against It

The rise of APX proved how DeFi can turn early conviction into massive wealth. It didn’t compete with bigger players—it created its own lane in leveraged trading.

MAGAX is taking a similar path but through culture. It introduces Meme-to-Earn within a DeFi framework, rewarding creativity while strengthening utility. This isn’t just hype; it’s a new model of decentralized growth. APX showed that innovation and timing equal results. MAGAX is ready to write the next chapter with its own unique approach.

Joining the Meme Presale is the Next Big Move, Just like APX

The APX story proved that early conviction pays off. A modest DeFi project turned into a $7M windfall for those who acted before the crowd.

MAGAX is now offering a similar moment—only bigger. By blending DeFi principles with meme culture, it creates both financial rewards and social incentives for participation. It isn’t just a presale; it’s the start of a self-sustaining Meme-to-Earn ecosystem powered by its community.

For investors, the choice is clear. XRP’s ETF shows crypto has gone mainstream, but the real multipliers are still in presales. MAGAX Stage 2 is live at $0.000293, and with momentum building fast, the window for entry is closing. The APX millionaire proved what’s possible—the next breakout could belong to those who join MAGAX today.

The post APX Holder Turns $226K Into $7M—Why Early Crypto Bets Still Create Massive Fortunes appeared first on Blockonomi.

You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

FCA, crackdown on crypto