Binance Alpha points are intensifying, but the truth is not so good

Author: Frank, PANews

Binance Alpha's points game is pushing "involution" to the extreme at an unprecedented speed. When the points threshold once exceeded the 200-point mark, and the airdrop income dropped sharply to around US$25, the decline in the user input-output ratio triggered widespread community discussion.

In this seemingly winner-takes-all feast, there is a view that its huge traffic is "overflowing" to other ecosystems such as Sui and Solana, injecting vitality into them. However, what is the true situation of this spillover effect? What kind of far-reaching impact will this "hair-pulling" carnival ignited by Binance Alpha ultimately have on the industry?

The reality and illusion of traffic “spillover”: Sui’s observation on the Alpha effect

The Binance Alpha points game mechanism has been introduced in detail in the previous article , so I will not repeat it here. But in general, as more and more users participate, the final result is that there is a clear upper limit to the income of each airdrop, and the threshold for points is getting higher and higher. In this case, users have to further reduce costs in order to retain profit margins.

Recently, Binance Alpha started to list Sui ecosystem tokens. Subsequently, several Alpha projects of Sui ecosystem were announced. The addition of Sui ecosystem just provides a new cost trough for users who want to increase trading volume. On May 14, @lianyanshe and other KOLs proposed that projects such as NAVX of Sui ecosystem have lower gas fees when increasing trading volume, will not be attacked by clamp robots, and have lower overall wear and tear. Therefore, several projects of Sui ecosystem will become the "new volume kings" of Binance Alpha.

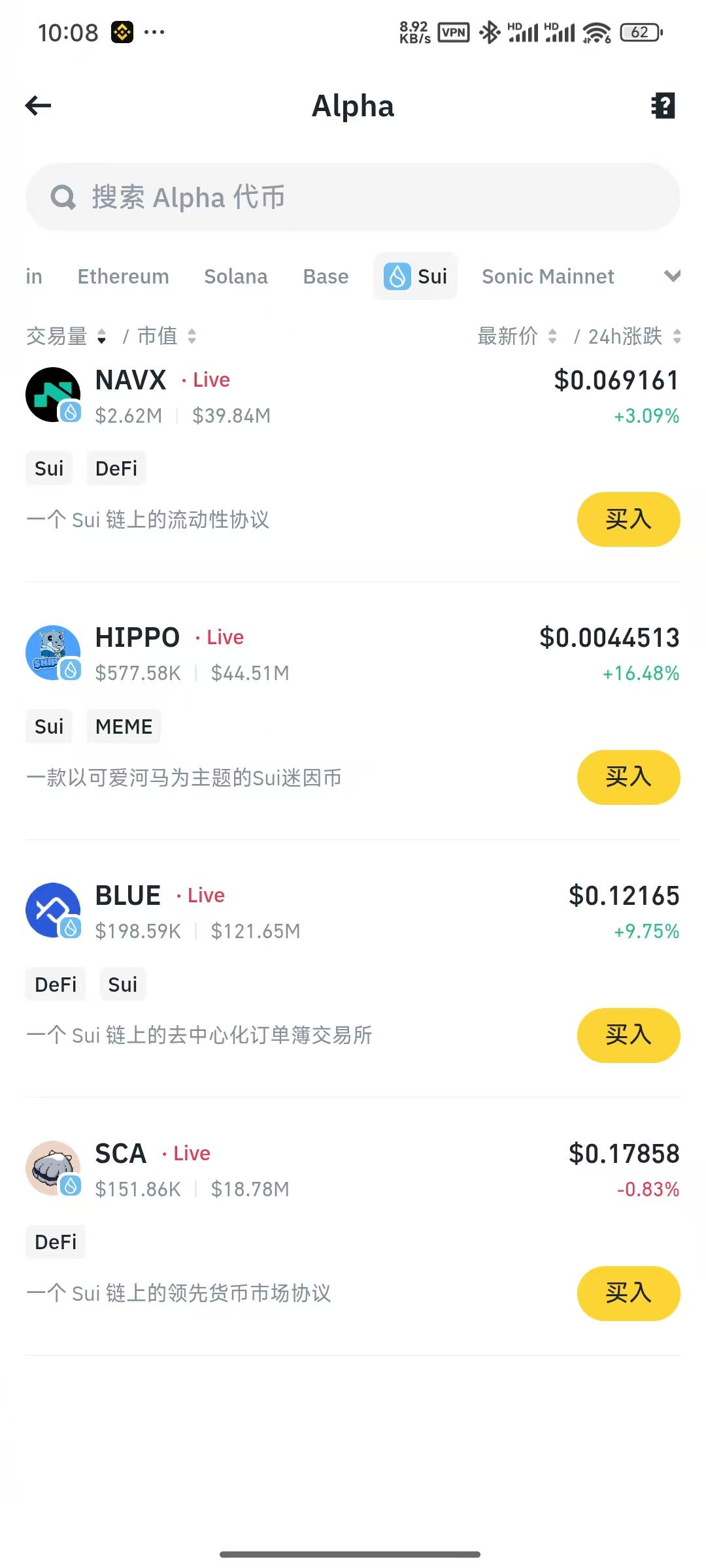

If most users choose this form, it can indeed bring a lot of trading volume and token popularity to the Sui ecosystem. However, in reality, there seems to be no similar effect. According to PANews's investigation, the trading volume of Sui ecosystem tokens in Alpha is not large. The highest NAVX has a 24-hour trading volume of only 3.34 million US dollars, and the rest of HIPPO, BLUE, SCA and other trading volumes are even only between hundreds of thousands and tens of thousands of US dollars. In contrast, the trading volume of several projects on the Solana chain is basically above 10 million US dollars, and the trading volume of several head projects of BSC is as high as more than 200 million US dollars. However, for NAVX, the listing of Binance Alpha has indeed increased its trading volume. On May 13, the trading volume of the NAVX main pool reached 1.6 million US dollars, while the trading volume the day before was only a few thousand US dollars.

In the actual transaction process, it can be found that the official cross-chain bridge of Binance Wallet has not yet opened up the exchange of assets on the Sui ecosystem and the BSC chain. Users cannot directly exchange assets such as BNB for USDC on Sui. If they want to save this wear and tear, they have to bear the wear and tear of other cross-chain bridges.

Solana head MEME unexpectedly receives capital inflow

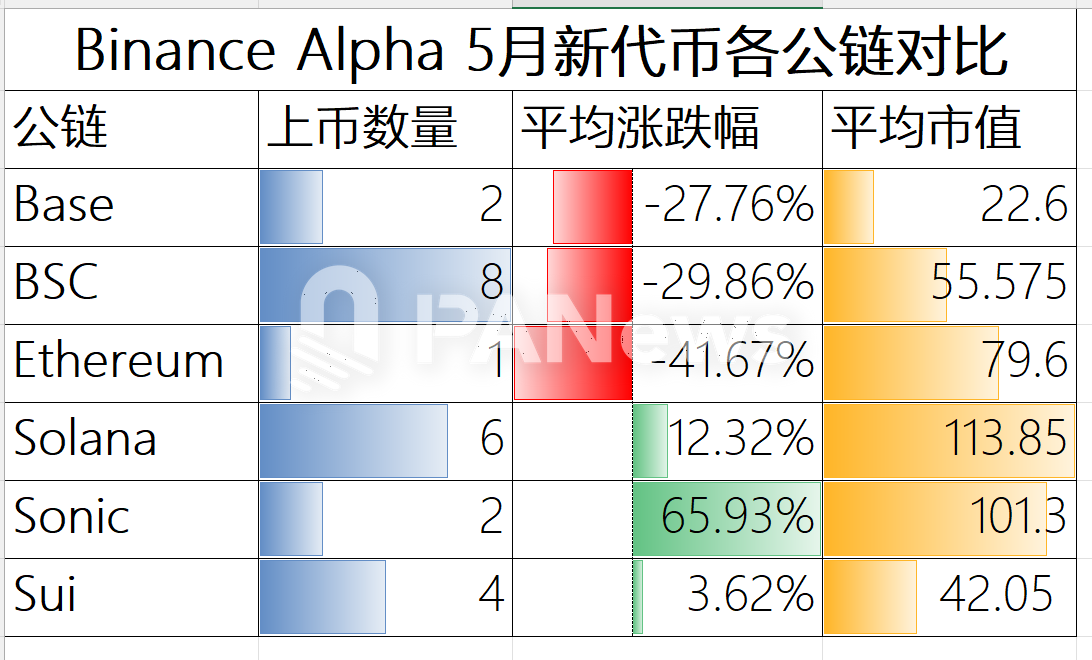

Solana is one of the ecosystems with the most projects launched on Binance Alpha besides BSC. Since May, Solana's overall DEX trading volume has indeed increased significantly. On May 4, Solana DEX's trading volume was US$2.2 billion. By May 15, this figure had increased to US$4.59 billion, more than doubling. Several leading tokens on Binance Alpha, such as MOODENG and jellyjelly, have indeed seen a huge increase in trading volume in recent times, and have also seen a significant increase. Among them, MOODENG's price rose by 140% from its launch to May 14. The average increase of the six tokens of the Solana ecosystem launched on Binance Alpha in May also reached 12.32%, making it one of the few ecosystems with positive performance among several public chains.

In addition to Sui and Solana ecosystems, the Sonic ecosystem may benefit the most from this spillover effect in the near future. As a new brand of Fantom, what Sonic needs most is exposure and capital inflow. Although there are only three Sonic ecosystem projects on Binance Alpha, in terms of price trends, the average increase of the two tokens launched in May reached 65.93% (data as of May 14), ranking the highest among all ecosystems. However, due to the small number of tokens launched, it cannot be said that the tokens of the Sonic ecosystem have higher potential.

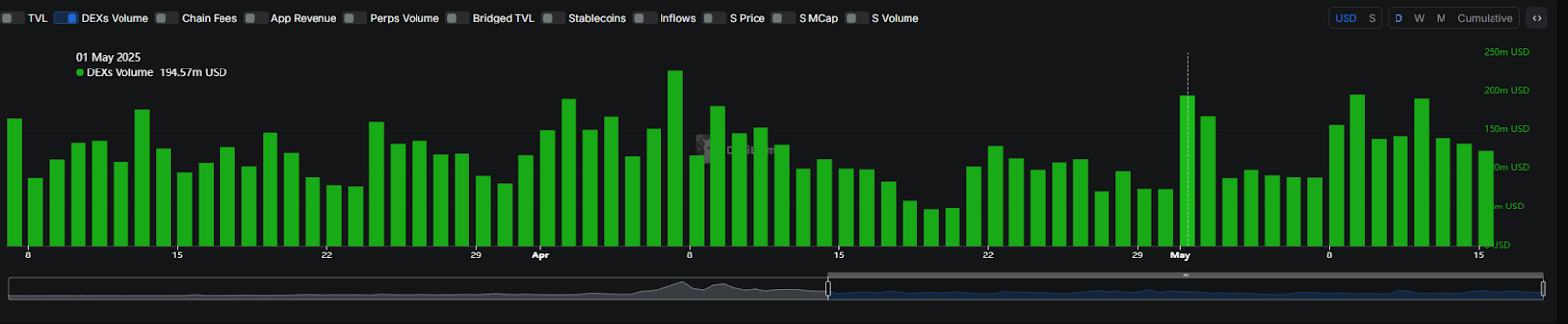

However, on May 1, when Binance Alpha announced the launch of two Sonic ecosystem projects, the DEX trading volume of Sonic ecosystem did see a significant increase, soaring from more than $73.4 million the previous day to $194 million.

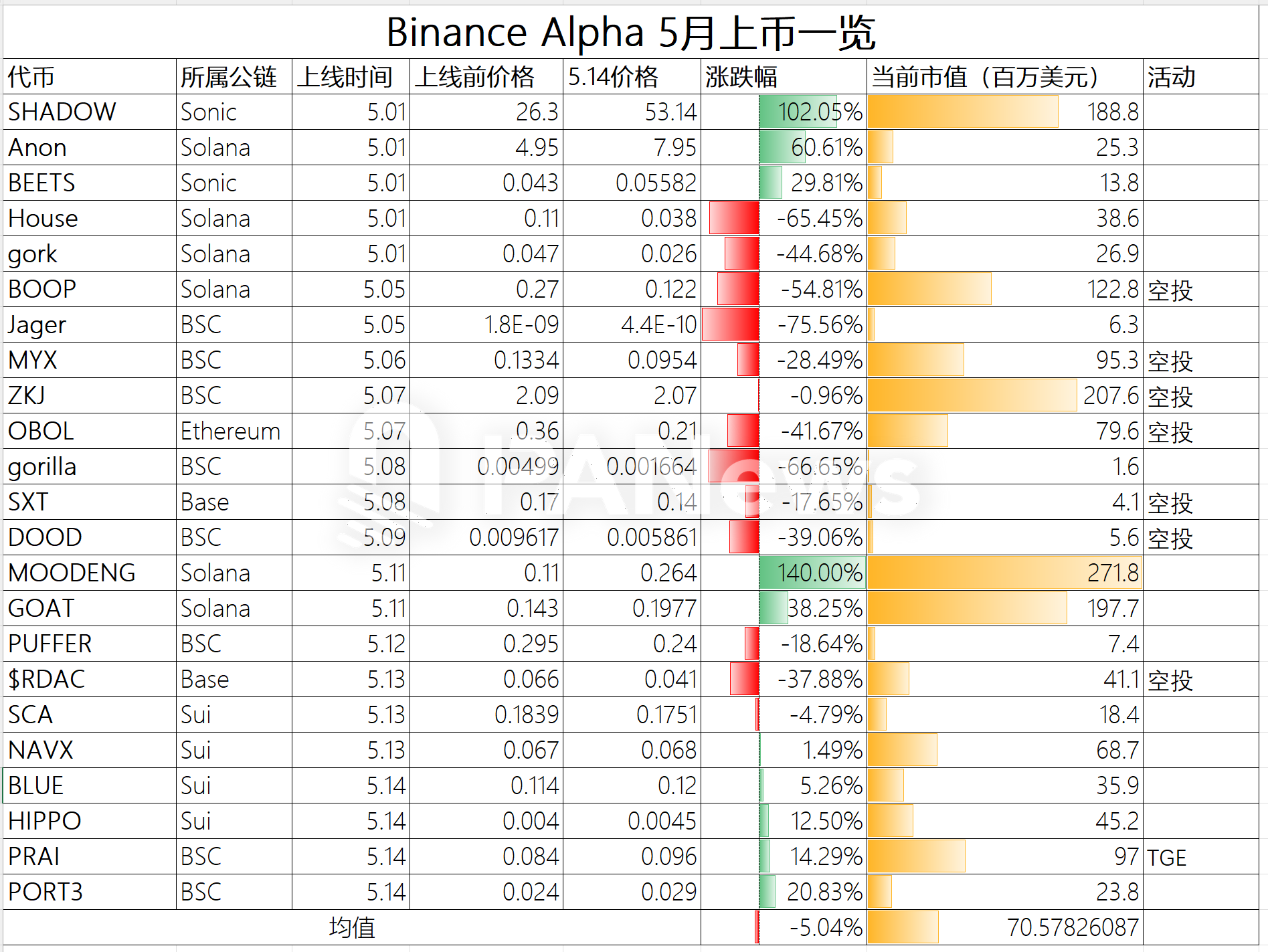

Project myth: Is launch the peak or value discovery?

In addition to the ecological perspective, for project developers, will the price of Binance Alpha have a chance to soar after it is launched? From a data perspective, the average increase or decrease of the 23 tokens launched in May was -5.04%. The largest decrease was 75%. Although the prices of these projects have experienced a rise in the short period of time after the launch of Binance Alpha, they will basically have a significant retracement and decline after the heat. From this point of view, the launch of Binance Alpha does not mean the birth of the Golden Dog, but just an additional trading port.

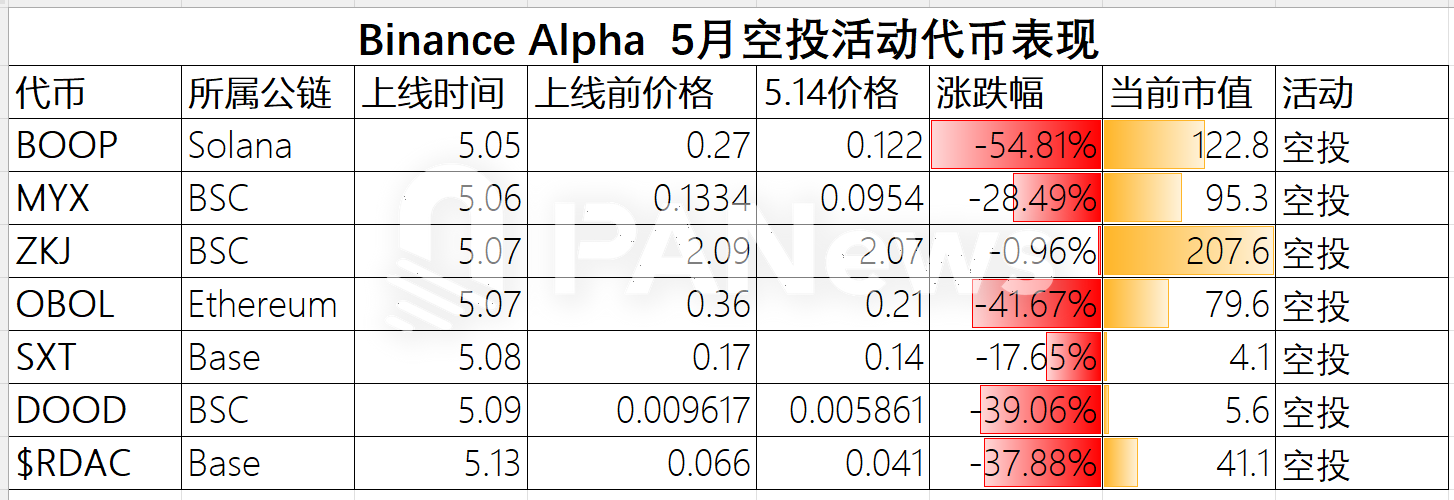

In addition, for the first-time projects with airdrop activities, it seems that they have not been favored by the market. The average decline of the 7 airdrop tokens launched in May reached 31.5%, and as of May 14, all of them were in a downward trend. From this point of view, for projects, airdrops and volume-washing activities cannot drive the price trend upward.

In general, the average market value of projects launched on Binance Alpha reached 70 million US dollars, with the lowest market value of about 1.6 million US dollars and the highest market value of MOODENG reaching 271 million US dollars. Among them, the average market value of several newly launched tokens in the Solana ecosystem exceeded 100 million US dollars, which obviously has higher requirements for the Solana ecosystem.

The end of "involution": the arena of professional players and the departure of ordinary users

For the ecosystem and projects, Binance Alpha means exposure and traffic gathering place. For users, the current internal circulation is eliminating ordinary users and becoming an arena for professional studios and big players to compete. With the score threshold reaching 205 points, it means that users need to complete at least 15 points of points every day to catch up with the threshold. According to the principal of 1,000 US dollars (accumulate 2 points), the daily transaction volume needs to reach 8,000 US dollars to complete the accumulation of points. The daily slippage + Gas fee of this transaction volume may reach more than 10 US dollars. If you fail to reach the next threshold or get less airdrops, you will face a double-sided loss of money and energy. The latest round of RDAC token airdrops basically sold for only 25 US dollars, which is difficult to cover the cost of 205 points.

It is foreseeable that the points threshold will continue to rise in the future. According to the current rules, the higher the points required per day, the more trading volume is required. Either Binance Alpha will increase the airdrop amount of a single address, or a large number of users will withdraw from the game, allowing the points threshold to fall back to a reasonable range. But in any case, this game of involution seems to be coming to an end. The DEX trading volume on the BSC chain has also begun to decline in recent days, reaching US$2.64 billion on May 15, a 16.4% decline from US$3.16 billion on May 12.

Overall, the "flow overflow" effect of Binance Alpha is significantly different in different ecosystems. The Sui ecosystem did not take on a large number of volume-brushing behaviors as expected, but the Solana ecosystem showed stronger positive interaction and growth. For project parties, the short-term highlights brought by Alpha are often difficult to transform into sustained value support. It has become normal for prices to fall after the peak after listing, and airdrop activities have not become the savior of prices. The project parties that provide airdrops have become the "payers" for Binance to promote wallet products.

The core problem is that this carnival driven by points is ruthlessly squeezing ordinary users out of the table. The rising point threshold and exponentially growing trading volume demand, coupled with the shrinking airdrop returns, have gradually transformed Binance Alpha into a "zero-sum game" between professional studios and large investors. The recent decline in DEX trading volume on the BSC chain seems to indicate that this model that relies on high-intensity "involution" is approaching the critical point of its sustainability.

You May Also Like

Unleash Potential: Flare Network’s FXRP Revolutionizes DeFi Access for XRP

Fed Lowers Rates By 25bps: How Bitcoin And Crypto Prices Responded And What’s Next