Bitcoin Hyper Hits $24M Presale Milestone as Peter Schiff Reignites Gold vs Bitcoin Debate

Veteran gold advocate Peter Schiff recently stirred controversy on X by declaring that gold is more likely to reach $1 million than Bitcoin, a comment that reignited the classic “gold vs. Bitcoin” debate.

The statement drew swift criticism from crypto investors who continue to see Bitcoin as the dominant long-term asset.

Despite short-term volatility and a recent pullback to $106K, Bitcoin remains up 54% over the past year, solidifying its position as one of the strongest-performing assets globally.

While Schiff’s comments renewed the familiar “gold vs. Bitcoin” narrative, market participants have shifted focus toward the emerging infrastructure being built around Bitcoin, most notably Bitcoin Hyper, a Layer 2 project that is gaining traction during the ongoing correction.

Source – 99Bitcoins YouTube Channel

Bitcoin Hyper Bridges Security with Modern Blockchain Utility

Bitcoin Hyper’s fast-growing presale has already reached a $24 million milestone, highlighting strong investor demand despite ongoing market uncertainty.

The project’s goal is clear: introduce scalability, decentralized finance (DeFi) capabilities, and lower transaction fees to the Bitcoin ecosystem.

Using advanced Layer 2 architecture inspired by networks such as Solana, Bitcoin Hyper enables users to deposit BTC and receive Bitcoin Hyper tokens.

These tokens allow participation in staking, liquidity operations, and future decentralized exchanges, all while maintaining the underlying strength and security of the Bitcoin network.

This design effectively bridges Bitcoin’s long-term stability with the functionality of modern blockchains, giving users a practical way to interact with decentralized applications on top of the original network.

The project has drawn multiple five-figure whale purchases in recent weeks and continues to trend across presale platforms, signaling confidence among experienced participants.

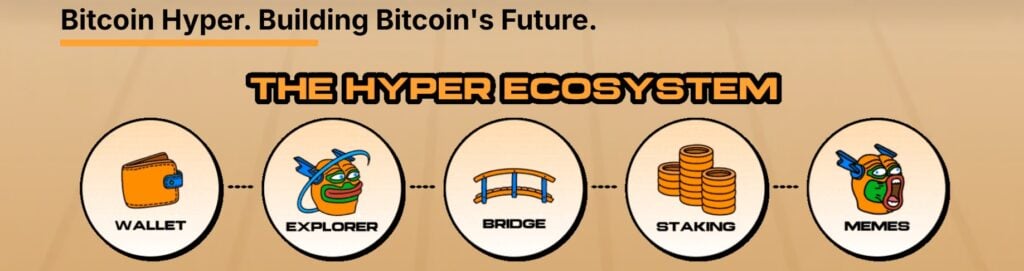

Building the Future of Bitcoin Utility: The Rise of the HYPER Ecosystem

Bitcoin Hyper is building more than just a fast blockchain; it’s creating a complete HYPER Ecosystem designed to strengthen functionality, accessibility, and user rewards.

At the center of this vision are key components such as the Hyper Wallet, a secure multi-chain solution for managing BTC and tokens; the HYPER Explorer, which ensures transparency through on-chain tracking; and the HYPER Bridge, which enables smooth cross-chain transfers.

The ecosystem also includes a staking portal for yield generation and a meme zone, blending community culture with blockchain incentives. This comprehensive structure is backed by strong credibility measures.

Independent audits by Coinsult and SpyWolf have verified Bitcoin Hyper’s smart contracts, ensuring they are secure and transparent. Audits like these help protect investors from potential vulnerabilities, which is especially important for newly launched tokens.

To support the ecosystem’s expansion, Bitcoin Hyper’s presale strategy dedicates 20% of raised funds to marketing campaigns across tier-one regions.

These efforts combine paid promotions, influencer partnerships, and organic exposure to maximize awareness ahead of the exchange launch.

Meanwhile, the remaining funds are strategically allocated to liquidity, ecosystem development, and staking incentives, ensuring sustainable growth, balanced token distribution, and robust treasury management well beyond the presale phase.

Institutional Activity Supports Bitcoin Narrative

While Peter Schiff continues to dismiss Bitcoin’s growth potential, institutional moves paint a different picture.

Source – Bitcoin Archive via X

Investment firm Cardone Capital recently added 200 BTC to its holdings, while Charles Schwab, managing $11.2 trillion in assets, announced plans to enable spot Bitcoin and crypto trading by 2026, a post from Bitcoin Magazine on X.

Such developments highlight the accelerating mainstream adoption that directly strengthens projects like Bitcoin Hyper. Gold remains a valuable commodity, but with a $30 trillion market cap already, its room for exponential growth is limited.

Bitcoin, currently valued at $2.1 trillion, offers far greater upside, particularly as new infrastructure expands its utility beyond simple storage of value, creating opportunities that projects like Bitcoin Hyper are designed to capture.

Conclusion

Peter Schiff’s argument shows the gap between traditional wealth preservation and modern innovation.

Gold may represent stability, but Bitcoin stands for progress. Investors now look for assets that generate value through real use rather than simply holding it.

Bitcoin Hyper reflects this shift by turning blockchain technology into a working ecosystem. While Schiff remains focused on the past, the market is clearly moving toward a future built on adaptability, speed, and practical utility.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Next Big Crypto? 11B Tokens Sold as APEMARS Stage 7 Closes in 24 Hours – Top 100x Meme Coin 2026 Poised to Outshine Cyber and Floki

BlackRock Increases U.S. Stock Exposure Amid AI Surge