How do U.S. state governments choose public chains for issuing stablecoins?

Written by: Hazel

Source: Zhiwubuyan Research

I read a news report last night that the state of Wyoming in the United States conducted a public scoring to select a public chain for its upcoming stablecoin WYST. In the end, 11 chains entered the candidate list. Aptos and Solana tied for first place with 32 points, followed by Sei with 30 points. Ethereum and a number of L2s only scored 26 points or less, which may be quite different from the public chain ecosystem activity and coin price that everyone feels in daily life. How is this score determined? I was very curious, so I studied it with teacher GPT.

First of all, I would like to praise the US state government for building in public. The Wyoming Stablecoin Committee behind the stablecoin WYST was established in March 2023 in accordance with the state's Stable Token Act. This committee has a public notion document, which includes a project introduction, meeting calendar and records, scoring criteria results and memo, Q&A, contact information, and lists its own YouTube channel, X account, Warpcast account and Github account. It is more serious and transparent than many current careless project parties.

If you are interested, you can go and watch:

In Q4 2024, the committee preliminarily selected 28 public chains. First, 14 were screened out based on four yes-or-no questions: whether there is permissionless access, supply transparency, on-chain analysis, and whether it can be frozen; secondly, they were scored based on 9 indicators (3 points each), including network stability, number of active users, TVL, stablecoin market value, TPS, transaction fees, transaction finality time, block time, and whether it is registered in Wyoming; finally, points were added or subtracted based on 5 additional advantages (2 points each) (privacy, interoperability, smart contracts/programmability, use cases, partners) and 6 additional risks (-2 points each) (illegal behavior of the entity, illegal behavior of the team, history of security vulnerabilities, poor network availability, lack of bug bounty, lack of code maintenance).

The final recommendation is to include 5 Layer 1 main chains: Solana (32 points), Avalanche (26 points), Ethereum (26 points), Stellar (24 points), Sui (26 points) and 4 qualified Layer 2 chains: Arbitrum (26 points), Base (25 points), Optimism (19 points), and Polygon (26 points) into the "candidate blockchain".

Aptos and SEI were actually newly included in the selection in Q1 this year. This quarter, the committee updated the selection criteria and added a new item "whether there is supplier support" to the right and wrong criteria, that is, "the blockchain must have the committee's partner manufacturers to support development, auditing, and infrastructure deployment. It can be undertaken by the foundation with approval."

One updated line states, “The chain must be fully indexed and supported by on-chain analysis platforms that the Commission collaborates with (such as Chainalysis, TRM Labs)”.

Two new items have been added to the additional advantage points, namely:

- Emerging Market Trends: Whether it carries emerging track projects such as AI, DePIN, virtual reality, and game assets

- Foundation Support: Whether the foundation can support one or all of the following three items: technology development, WYST liquidity, and market promotion

In this scoring, Aptos and SEI scored 32 and 30 points respectively, and were therefore added to the candidate chain.

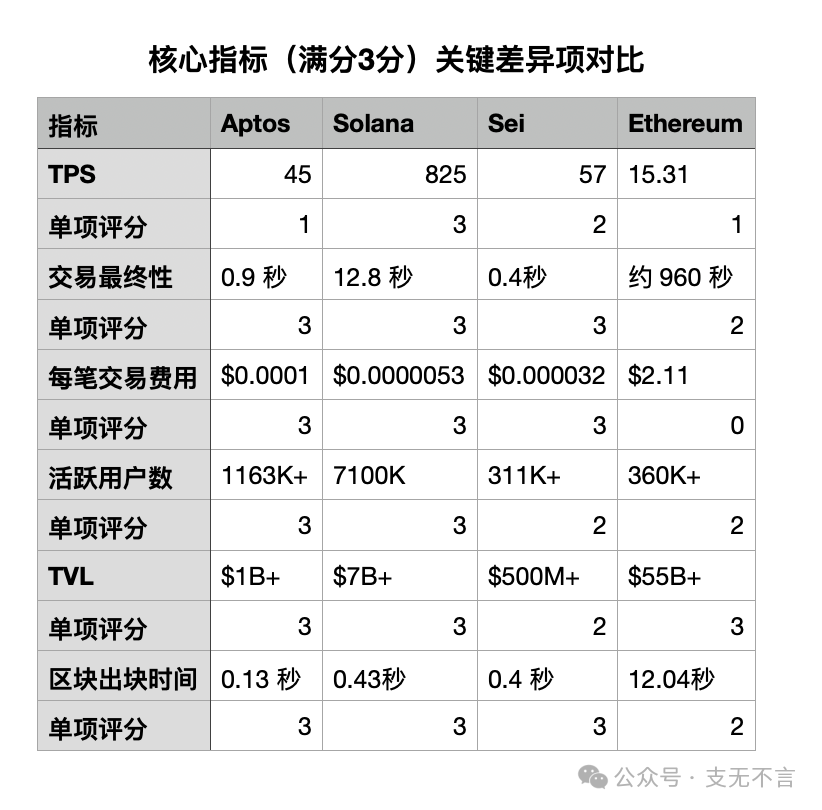

So how did this score difference come about? I first made a comparison chart of the key differences around the core indicators. Please note that since the new round of scoring did not re-score the 9 public chains that had been selected before, some of the data here is at the end of 2024 and is not the latest.

It can be seen that Ethereum's TVL is leading by a large margin, but in terms of transactions per second (TPS), transaction finality time, transaction fees, and block generation time, this decentralized chain still suffers a lot. It can also be seen here that the diversion of Layer2 has caused the number of active users on the Ethereum mainnet to be only at the same level as SEI, far behind Aptos and Solana.

But how did Aptos get the highest score with Solana? I read it and found that, on the one hand, Aptos is indeed very balanced, with strong compliance, fast speed, low cost, and relatively stable network. On the other hand, it is also because the second round of scoring added two points in the additional advantage bonus items, but Solana did not re-participate in this round of scoring. If these two items are removed, Solana should still have the highest score.

It is worth noting here for Ethereum fans that although Ethereum has always advertised itself as the best choice for carrying real assets on the chain, when it comes to technology selection at the government level, the permissionless network is a threshold that can be passed, and network stability only accounts for one of the core indicators. The lack of technical barriers and insufficient network availability are risk deduction items. Solana was offline and crashed, which deducted 1 point each, but it had little impact on the overall situation. There is no score for the degree of decentralization. Instead, the state government pays more attention to whether it can be frozen and whether it has an entity in Wyoming. The vast majority of core indicators are performance, cost and scale.

Of course, this state-level stablecoin issuance has stated from the beginning that it will abide by the principles of "multi-chain support and technology neutrality". It will continue to update the rules and collect feedback. At the same time, it welcomes chains that have not been shortlisted to continue to submit applications to participate in the selection. Therefore, public chains that are on the candidate list and even those that have not yet been on the list theoretically have a chance.

In addition to the selection of public chains, the state-level stablecoin project in Wyoming is also worth noting. As the first state in the United States to plan to issue a stablecoin, WYST was originally planned to be launched before July 4, but at the regular meeting at the end of May, this timeline has been postponed to the third quarter of 2025, and the new proposed date is August 20. Subsequent work also involves the public opinion solicitation and final approval of the reserve management rules, the formulation of the committee's exclusive general ledger/chart of accounts, the establishment of trust accounts and liquidity fund accounts with third-party custodians, and contact with licensed service providers, including centralized exchanges, payment platforms, digital wallets, and market makers, for the purchase and resale of WYST, etc.

Ultimately, the reserve behind the stablecoin will be managed by Franklin Templeton Funds, with Chainalysis responsible for on-chain analysis, working with LayerZero and Fireblocks to complete the integration, complete the decentralized verification network and official website launch, deploy the WYST contract to the mainnet before August 20, and then officially release it in a public statement at the Wyoming Blockchain Symposium.

In addition to Wyoming, Nebraska has passed its "Financial Innovation Act" to authorize an entity called Telcoin to issue a state-backed stablecoin, temporarily called eUSD. Tinian Island in the Northern Mariana Islands, an overseas territory under the jurisdiction of the United States federal government, attempted to issue a US dollar stablecoin called Marianas US Dollar (MUSD), which was vetoed by the governor in April this year, and the Senate overturned the governor's veto in May.

This scenario of U.S. states and major companies gearing up to issue their own stablecoins easily reminds people of the free banking era from 1837 to 1866, when states, cities, private banks, railroads and construction companies, stores, restaurants, churches and individuals issued approximately 8,000 different currencies by 1860. There were many varieties and a lack of unified standards. The picture in this article is the private $1 currency issued by the Delaware Bridge Company of New Jersey from 1836 to 1841.

There have been a lot of discussions about RMB stablecoins recently, and some big companies are eager to try. After the question of whether to have it or not, the next question may be which chain to run on. Whether to launch a dedicated chain, use the alliance chain of a big company such as Ant Chain and JD Chain, connect to the common international public chain, or use some domestic public chains such as Hashkey Chain, Conflux, etc. This question is a new topic for governments and companies in China, the United States, and even other countries in the world. Wyoming's scoring system and public disclosure system may not be perfect, but it can be regarded as a model for later generations. We should see more interesting governance progress in the future.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse