Hong Kong's stablecoin legislation passed, JD.com and other technology companies are ready to go, and RMB stablecoin is expected to be included in the system

Author: Weilin, PANews

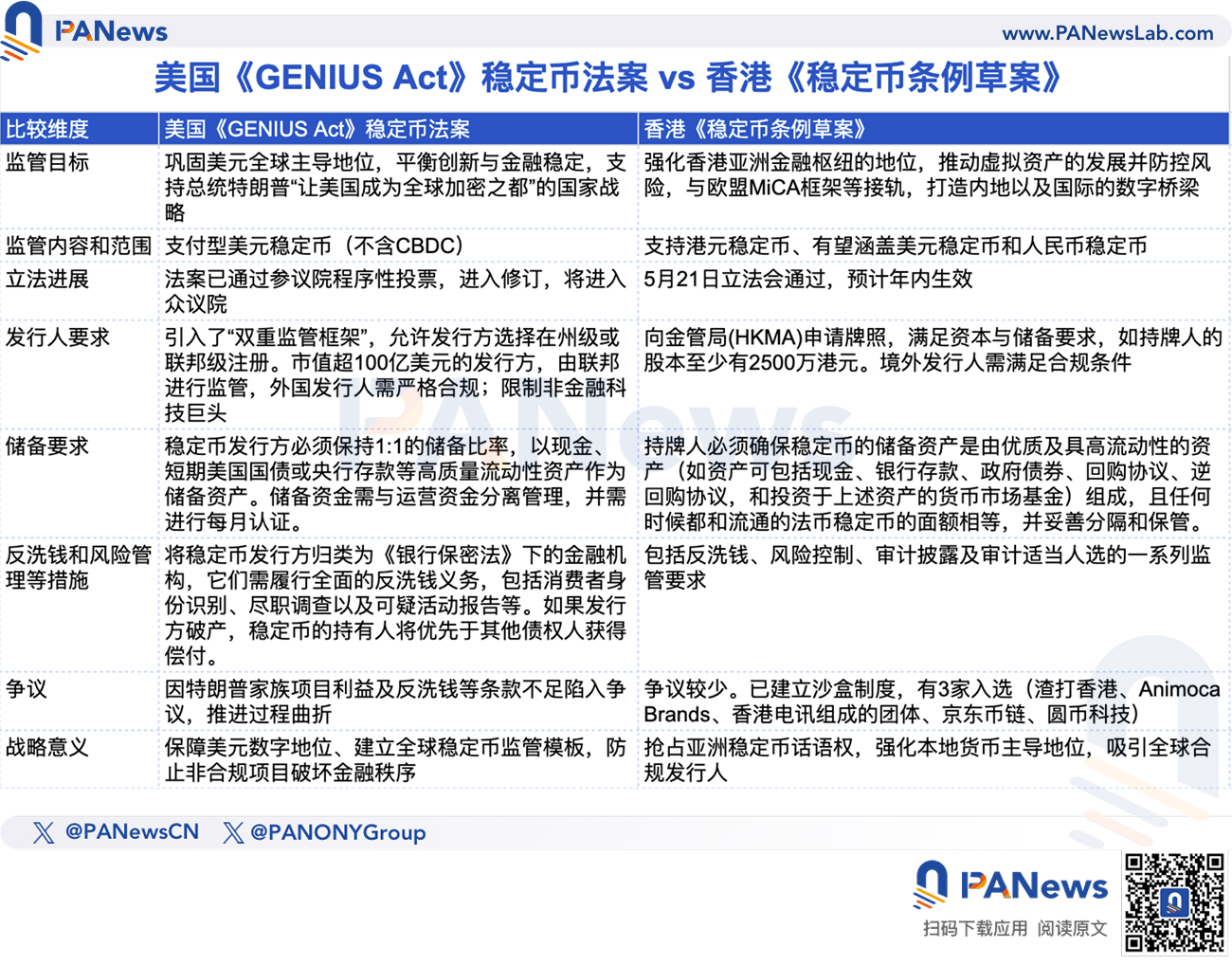

While the US stablecoin bill made progress in the Senate, Hong Kong took the lead in formally passing stablecoin legislation.

On May 21, the Hong Kong Legislative Council passed the Stablecoin Bill, further establishing a licensing system for issuers of legal currency stablecoins in Hong Kong and improving the regulatory framework for virtual asset activities in Hong Kong to maintain financial stability and promote financial innovation. The Hong Kong SAR government expects that the bill will take effect this year.

At present, the regulatory authorities have carried out certain supervision and testing on the operation plans of the three issuers in the sandbox. Councillor Qiu Dagen, Chairman of the Stablecoin Ordinance Bill Committee, expressed support for the establishment of stablecoins anchored to the Hong Kong dollar and the renminbi, strengthening Hong Kong as a digital bridge connecting the mainland and other countries, and advocating the government to issue licenses flexibly and speed up the approval process.

Three types of stablecoin-related activities must be licensed, and equivalent reserves must be high-quality, highly liquid assets

The Stablecoin Draft Regulations clearly state that the following three types of activities require a license:

1. Issue fiat stablecoins in Hong Kong

2. Issuing Hong Kong dollar stablecoins in or outside Hong Kong

3. Actively promote the issuance of its fiat stablecoin to the Hong Kong public

According to Caixin, citing the sandbox participant "Yuanbi Technology", the draft lists four important requirements for issuers: First, in terms of reserves, licensees must maintain a sound stablecoin mechanism to ensure that the reserve assets of stablecoins are composed of high-quality and highly liquid assets (such as assets that may include cash, bank deposits, government bonds, repurchase agreements, reverse repurchase agreements, and money market funds invested in the above assets), and are equal to the face value of the circulating fiat stablecoins at all times, and are properly separated and kept.

Second, stablecoin holders have the right to redeem stablecoins at par from the issuer. Redemption requests must be free of charge and processed within a reasonable time. Third, they must comply with a series of requirements related to combating money laundering, risk management, disclosure, and auditing appropriate personnel. Fourth, transactions must be conducted on licensed virtual asset trading platforms.

The draft shows that in terms of issuer qualifications, the license holder must have sufficient financial resources and liquid assets, including a share capital of at least HK$25 million. The license does not have a fixed validity period, that is, the license will remain valid unless it is revoked, or the license holder is liquidated and its registration qualification with the Hong Kong Companies Registry is revoked.

To protect the public and investors, the draft stipulates that only designated licensed institutions are allowed to sell legal currency stablecoins in Hong Kong, and only legal currency stablecoins issued by licensed issuers can be sold to retail investors. The above-mentioned designated licensed institutions that can sell stablecoins in Hong Kong include: stablecoin issuers licensed by the Monetary Authority, banks, institutions issued with a Type 1 license (securities trading) by the Hong Kong Securities and Futures Commission, and virtual asset trading platforms licensed in Hong Kong.

In order to effectively deter, the draft bill sets clear punishment rules for violations. Conducting regulated stablecoin activities without a license: a fine of HK$5 million and seven years in prison; selling stablecoins by non-designated licensed institutions: a fine of HK$5 million and seven years in prison, etc.

Three stablecoin institutions are already in the sandbox, and JD.com’s stablecoin is ready to go

As early as October 2022, the Hong Kong SAR Government issued the Policy Statement on the Development of Virtual Assets in Hong Kong, outlining its determination to improve the regulatory framework for virtual assets. In response to the policy statement, the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Chapter 615) (the Anti-Money Laundering Ordinance) was amended in December 2022 to introduce a licensing system for virtual asset service providers to ensure that virtual asset trading platforms must comply with international regulations on combating money laundering and terrorist financing and protect investors. Following the licensing system for virtual asset trading platforms taking effect in June 2023, Hong Kong is working to further improve the regulatory framework for virtual asset activities, including introducing a licensing system for issuers of fiat stablecoins.

In December 2023, Hong Kong announced that it would enact new legislation to implement a licensing system for fiat stablecoin issuers. Subsequently, the regulatory sandbox approved three institutions to participate in the test on July 18, 2024, and the draft text was published in December of the same year, and was finally passed by the Legislative Council on May 21, 2025.

At present, the Hong Kong Monetary Authority (HKMA) has launched a sandbox for stablecoin issuers to understand the business model of institutions that intend to issue fiat stablecoins in Hong Kong, and to convey regulatory expectations and provide guidance to them. The first batch of three participating institutions were admitted to the sandbox on July 18, 2024. They include Standard Chartered Hong Kong, Animoca Brands, a group consisting of Hong Kong Telecom, JD CoinChain Technology (Hong Kong), and Yuancoin Innovation Technology. At present, the regulator has carried out certain supervision and testing on the operating plans of issuers in the sandbox.

It is worth mentioning that JD Technology Group has recently released a number of RWA-related job recruitment information, clearly requiring that product design must be seamlessly connected with JD Stablecoin and digital RMB. At the same time, JD Technology Group is also recruiting a position for "Overseas Financial Business Development", focusing on promoting the implementation of stablecoin business, which also means that with the implementation of the bill, JD Stablecoin may be ready to go.

This time, after the licensing system for stablecoin issuers in Hong Kong officially came into effect, a six-month transition period was set for stablecoin issuers that were already conducting the above three licensed activities in Hong Kong at that time, allowing some issuers that existed before the law came into effect to apply for licenses in the first three months after the licensing system came into effect.

Participating in the global stablecoin competition: It is expected to develop RMB-anchored stablecoins, and lawmakers call for "flexible" licensing

While the Legislative Council was reading the Stablecoin Bill for the third time, the legislative process of the US GENIUS Act Stablecoin Bill was underway. On May 22, the US Senate passed a motion to debate the GENIUS Act by 69 votes to 31, marking the official entry of the stablecoin regulatory bill into the amendment discussion stage. The previous vote to end the debate was passed by 66 votes. This is expected to become the first federal-level stablecoin regulatory framework in the United States.

During the drafting process of Hong Kong's stablecoin bill, reference was also made to existing stablecoin regulatory regulations and stablecoin regulatory regulations under review.

At the Legislative Council, Councillor David Chiu, Chairman of the Stablecoin Bill Committee, said he was pleased to hear the government clarify that in addition to the Hong Kong dollar and the US dollar, it would also consider including the renminbi as one of the legal stablecoins in the future.

"I strongly support the inclusion of RMB in the locally issued stablecoin system, because we can serve as a digital bridge connecting the mainland and other countries. We can also attract more blockchain projects and institutional investors to settle in Hong Kong through RMB-based stablecoins, forming a digital financial ecosystem driven by both Hong Kong dollars and RMB, further strengthening Hong Kong's position as a financial hub, and accelerating the process of RMB internationalization." He said that especially under the trend of global de-dollarization, the stability of RMB in the future will surely become a choice for many countries, including many of our friendly Belt and Road countries, the Middle East and other countries. Their diversified trade, investment and reserve options will also help enhance the RMB's status as an international trade and safe haven.

In terms of licensing policy, Councillor Qiu Dagen called on the government to maintain an open and flexible mindset and allow more institutions with capabilities and resources to participate in the competition. He said, "I hope the government can consider future licenses and maintain a flexible mindset to allow more issuers to compete in Hong Kong. This is a normal process. Just like now there are mainly two stablecoins in the world, (occupying) most of the transactions, but we are all letting a hundred flowers bloom, and many have been eliminated, and now there are two stablecoins in the US dollar. So we hope that in the future in Hong Kong, we will strive for stablecoins with different proportions of Hong Kong dollars and RMB to allow more people to enter the market.

In his view, as long as the issuer can prove to be financially sound and have sufficient regulatory capabilities, through healthy competition, Hong Kong will have the opportunity to develop an internationally accepted stablecoin market, possibly in currencies other than the US dollar, which will have great significance and impact on Hong Kong's financial development.

Councillor Qiu Dagen called on the HKMA to start licensing as soon as possible after the bill is passed to attract more interested and qualified potential operators to launch and test stablecoins in different currencies and collateral in Hong Kong as soon as possible. "Application scenarios are of course important, but I hope the government can maintain flexibility in approval requirements or other aspects so that different solutions can be tested in Hong Kong."

With the implementation of the regulatory system for virtual asset trading platforms and stablecoin issuers, the Hong Kong Monetary Authority stated that the government will continue to support the development of the virtual asset industry. The government will then launch a consultation on virtual asset over-the-counter trading and custody services, and will publish a second policy statement on the development of virtual assets.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse