Another player joins the InfoFi track, Cookie enters the market to tap into the attention economy. Who will win the competition with Kaito?

Author: Nancy, PANews

After Kaito swept the market with its "Yap-to-Earn" model, Cookie DAO's recent announcement added fuel to the InfoFi (information finance) track. The invitation code was flooded in major communities, further promoting the spread and implementation of the InfoFi concept.

Prior to this, although Kaito was the first to ignite the topic of InfoFi and built a new value transfer and incentive mechanism between content creators, community members and project parties, its platform has gradually exposed problems such as content homogeneity, uneven quality, opaque algorithm mechanism and doubts about incentive fairness. Some people even pointed out that this points-oriented incentive structure is "locking" creators into the cage of the algorithm. Today, with the entry of new players such as Cookie, the evolution path of InfoFi has begun to diverge. From information capture to content pricing, from algorithm-led to community governance, the track is ushering in a new ecological game and paradigm shift.

From information collection to content pricing, InfoFi is evolving

On May 21, Cookie DAO announced the launch of the first phase of InfoFi, launching cookie.fun v1.0 alpha and Cookie Snaps, which are used to analyze crypto projects and KOLs and obtain high-quality Crypto Twitter (CT) content rewards. In addition, Cookie plans to launch a decentralized, community-led reward pool in the future. As a pioneer, Kaito has been launched for a long time, providing real-time search, sentiment analysis, trend tracking, knowledge graphs and other functions, and has dominated the InfoFi field with its Yaps mechanism and AI analysis.

Kaito and Cookie's InfoFi products have many similarities. They are committed to solving the information fragmentation problem in the crypto market through AI technology and incentive mechanisms, and building an attention economy centered on user participation and high-quality content. However, there are obvious differences between the two in terms of technical architecture, governance mechanism and target user groups, which leads to differentiation in their execution paths and market positioning.

The similarities between Kaito and Cookie are that they use AI and incentive mechanisms to build an attention economy. In terms of the point incentive mechanism, both use the point mechanism to encourage high-quality content creation, which effectively enhances user participation and builds an attention economy system around high-quality content; in terms of rankings and airdrop incentives, Kaito and Cookie both generate rankings based on user content contributions and link them with airdrop rewards to form an incentive closed loop; in terms of data insights, both use AI technology to analyze social media data such as the X platform, generate market sentiment and trend forecasts, and provide insights for investors and project parties; in terms of governance, both adopt the DAO governance model, allowing token holders to participate in decision-making.

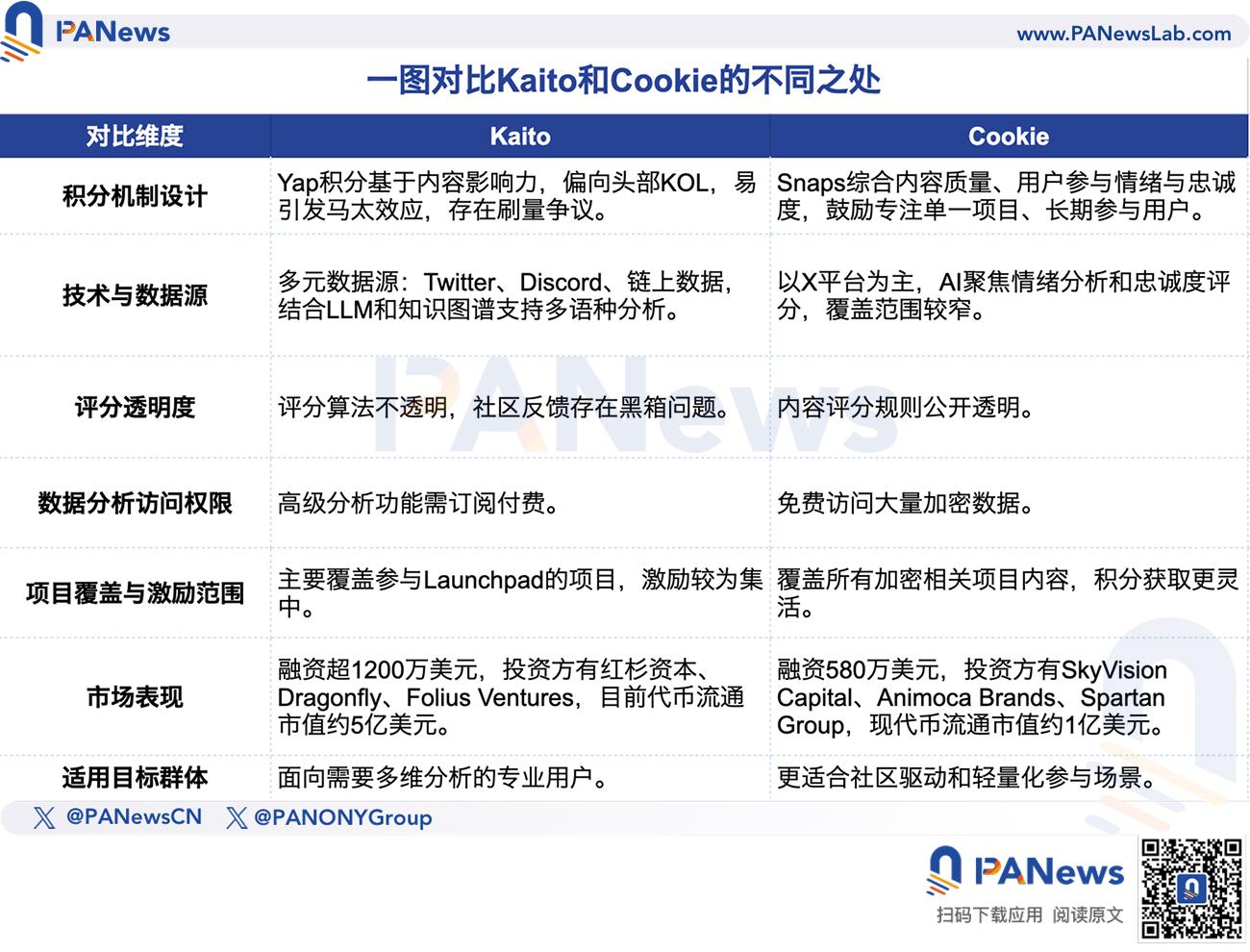

Although the concepts are similar, Kaito and Cookie have different focuses in their execution mechanisms and market positioning. In terms of the design of the points and scoring mechanism, Kaito's Yap points are based on content influence, which is biased towards top KOLs, easily triggering the Matthew effect, and has caused fairness disputes due to brushing behavior. Snaps integrates multi-dimensional social signals such as content quality, user participation emotions and loyalty, and encourages users who focus on a single project and participate in the long term; in terms of technology and data sources, Kaito integrates encrypted data sources such as Twitter, Discord, and on-chain data, and combines AI technology to support multi-language analysis based on large language models (LLM) and knowledge graphs, which is suitable for professional users who need multi-dimensional analysis. Cookie's data source is mainly based on the X platform, and AI focuses on sentiment analysis and loyalty scoring, with a narrow coverage range, which is more suitable for community-driven scenarios; in terms of scoring transparency, Kaito's algorithm scoring is not transparent, and there is a black box problem in community feedback. Cookie has published the content scoring rules in the document; in terms of data analysis access, Kaito needs to use a paid subscription service to access advanced analysis functions, enhanced search functions and personalized insights. All users of Cookie can access a large amount of encrypted data for free; in terms of project coverage and incentive scope, Kaito's rankings mainly cover projects participating in Launchpad, and the incentives are relatively concentrated. Cookie's data covers all encryption-related project content, not limited to ongoing activities, and users are more flexible in obtaining points; in terms of market performance, Kaito has received support from Sequoia Capital, Dragonfly and Folius Ventures, with a financing amount of more than US$12 million and a circulating token market value of US$500 million. Cookie has received US$5.8 million in financing from SkyVision Capital, Animoca Brands, Spartan Group, etc., and the circulating token market value is approximately US$100 million.

From this point of view, as innovative representatives of the InfoFi model, Kaito and Cookie represent professional and community paths respectively, forming complementary competition in strategic thinking and product logic, and also promoting the continuous evolution of the InfoFi ecosystem, prompting more projects to explore community-driven data and reward models.

As the attention economy accelerates, InfoFi still faces multiple challenges

As the attention economy is rising, InfoFi is rapidly gaining market attention as an emerging track. Its core concept is to transform traditionally non-assetized resources such as information, attention, and social data into tradable and priced dynamic assets through decentralized technology, token incentive mechanisms, and AI-driven data processing capabilities. Unlike the unilateral capture of information value in traditional Web2 platforms, InfoFi has reshaped the definition of information value and promoted the structural transformation of attention capital, providing new possibilities for user empowerment, data autonomy, and value sharing.

In addition to kaito and Cookie, the InfoFi track is welcoming many newcomers, such as Ethos, Wallchain, GiveRep and Mirra. These projects are constantly improving and enriching the InfoFi ecosystem through innovative mechanisms.

Although the InfoFi ecosystem has innovative potential, it still faces multiple structural problems in its actual development process. The first is the risk of data integrity and credibility. InfoFi is highly dependent on AI-generated content and user contributions, which can easily lead to data manipulation, false information, and the proliferation of low-quality content. With the surge in AI-generated content, the credibility of information may be weakened, which in turn affects market judgment and decision-making. If there is a lack of effective noise filtering mechanisms, content verification mechanisms (such as reputation scoring systems, etc.), and transparent data governance, user trust may drop significantly, which will affect the long-term sustainable development of the platform.

Secondly, the bottleneck of user acquisition threshold and participation is prominent. Currently, many InfoFi platforms adopt an invitation system or token threshold mechanism, which has improved the content quality to a certain extent, but at the same time limits the scope of participation of ordinary users and weakens the inclusiveness and vitality of the ecosystem. Excessively high entry barriers hinder the rapid expansion of the community and may also lead to excessive concentration of information power in the hands of a few high-quality users.

In addition, market fragmentation and fierce competition between platforms are becoming increasingly prominent. Many new players have emerged in the InfoFi field. These products have different forms and data dimensions, which leads to frequent switching between different platforms and fragmented experience for users. At the same time, unified information standards and data protocols have not yet been established between platforms, forming information islands and hindering the formation of ecological integration and scale effects.

Furthermore, the design of the incentive mechanism and its sustainability are equally critical. The InfoFi economic model is highly dependent on token incentives. If it is not designed properly, it is easy to cause inflation, short-term speculation and incentive mismatch problems. How to build a fair and sustainable incentive system between creators, ordinary users and institutional brands is the key to the long-term development of the platform.

Finally, the lack of long-tail content also limits the diversity of InfoFi's ecosystem. Although InfoFi performs well in content production and user participation on hot topics, content generation and user participation in niche and professional fields are still insufficient. Information resources are overly concentrated on a few hot topics, which may weaken the platform's coverage of market segments and is not conducive to the construction of a deep-level ecosystem.

Overall, InfoFi, as a new paradigm of attention economy, has great potential to reshape the distribution of information value and empower user data sovereignty. However, at this stage, it still needs to continue to address core issues such as data quality control, user participation thresholds, platform interoperability and integration, incentive mechanism optimization, and content diversity.

You May Also Like

Unleash Potential: Flare Network’s FXRP Revolutionizes DeFi Access for XRP

Fed Lowers Rates By 25bps: How Bitcoin And Crypto Prices Responded And What’s Next