The Ethereum Foundation publicly laid off employees for the first time, and the strategic adjustment caused controversy again. Is the foundation model no longer effective?

Author: Nancy, PANews

Faced with growing doubts about its unclear technical direction, inefficient collaboration, and centralized governance, the Ethereum Foundation (EF) is undergoing a deep organizational reorganization.

The R&D team was renamed and reorganized, and the strategic adjustment caused controversy

On June 2, the Ethereum Foundation announced the reorganization of its research and development team, making major structural adjustments to the internal "Protocol Research and Development Team (PR&D)" and officially changing its name to "Protocol". This restructuring is considered not a simple organizational structure adjustment, but a systematic change from strategic goals, talent allocation to governance concepts.

The newly formed "Protocol" team will focus on the three strategic goals of expanding the mainnet (L1), expanding data availability (blobs), and improving user experience (UX) to establish a closer collaboration mechanism and clear resource allocation methods.

The Ethereum Foundation clearly stated that the newly formed Protocol team will develop three major strategic goals and set up leaders for each strategic direction, namely Tim Beiko and Ansgar Dietrichs for L1 expansion, Alex Stokes and Francesco D'Amato for blob expansion, and Barnabé Monnot and Josh Rudolf for improving user experience. They will be supported by the famous researcher and cryptographer Dankrad Feist. Feist is the namer of Ethereum's new sharding scheme "danksharding". He once caused controversy due to his advisory relationship with Ethereum's re-staking protocol EigenLayer, in which he received a large number of tokens, and then resigned from his advisory position.

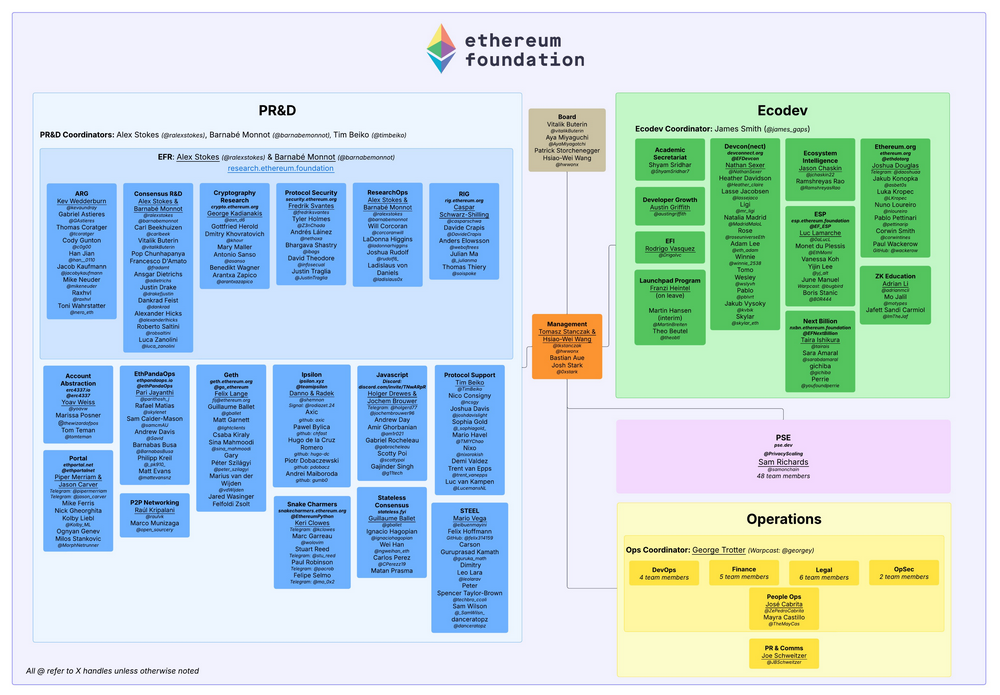

Ethereum Foundation organizational structure before reorganization Source: Network

At the same time, the foundation also stated that some R&D members will no longer stay. Although the official did not disclose the specific layoff list, judging from the changes in the PR&D reorganization, about a dozen R&D personnel have left, and the division of responsibilities in the department has become more detailed and clear. EF encourages other ecological projects to absorb these experienced talents and announced the recruitment of new members, with key positions including the person in charge of user experience and the person in charge of performance engineering.

The Ethereum Foundation said the reorganization will speed up the transformation of research results into products and promote Ethereum's scalability and user-friendliness to higher standards.

“We hope that this new organizational structure will enable internal teams to be more focused and drive key initiatives forward. At the same time, we have to make some very difficult decisions. It is heartbreaking to say goodbye to those talented and dedicated colleagues. This decision does not mean that their value or contribution is ignored,” said Hsiao-Wei Weng, co-executive director of the Ethereum Foundation.

However, the reorganization of the Ethereum Foundation has also triggered a fierce response from core developers and the industry. "At this moment, the word 'decentralization' was quietly and permanently removed from the Ethereum roadmap." Ethereum core developer Peter Szilagyi wrote that great companies have long understood that their most valuable assets are people - team members. Google even clearly stated in its onboarding manual: developers take precedence over users, and the latter can be found everywhere. Organizations that cannot understand this will eventually become marginalized. Yes, this is the subtext.

Kyle Samani, co-founder of Multicoin Capital, also questioned the strategic adjustment of the Ethereum Foundation. He pointed out that the definition of "focus" usually means reduction rather than increase, especially emphasizing that there should be no conflict between goals. When considering the third goal (i.e. L1 and L2 network expansion and improving user experience), the first goal (i.e. layoffs) and the second goal (i.e. clear division of responsibilities) are in conflict.

Miles Jennings, crypto policy director and general counsel of a16z, recently wrote that the crypto industry needs to go beyond the non-profit foundation model because it no longer meets current needs. He believes that although the foundation played a role in circumventing regulation and promoting decentralization in the early days, it has now evolved into a gatekeeper of centralized control due to incentive misalignment, legal and economic restrictions, and operational inefficiency, deviating from its original intention. With the US Congress proposing a control-based maturity regulatory framework, the crypto industry has an opportunity to get rid of the foundation. The ordinary development company structure is better than the foundation, able to efficiently deploy capital, attract top talents through equity incentives, and achieve rapid response and sustained growth with market feedback. Jennings emphasized that companies align incentives with token holders through market discipline and clear financial indicators (such as revenue and profit margins), while foundations lack accountability and profit drive, making it difficult to optimize resource allocation, and employee incentives are limited by token price fluctuations, making it difficult to sustain. Public interest companies, network revenue sharing, milestone token lock-up periods, and contract protection existing tools can address potential misalignments between companies and token holders. Additionally, two emerging approaches, DUNA and BORGs, offer streamlined pathways to implementing these solutions while removing the cumbersomeness and opacity of foundation structures. The next era of crypto will be built on scalable systems — systems with real incentives, real accountability, and real decentralization.

Promoting internal organizational restructuring, a belated self-correction

The organizational restructuring of the Ethereum Foundation did not come out of the blue, but rather was a concentrated outburst of structural contradictions and external criticisms accumulated over the years.

In the past, the outside world criticized the foundation for being overly obsessed with long-term research and ignoring the short-term needs of users and developers, while questioning its centralized governance structure. For example, Hari, a former engineer at the Ethereum Foundation, bluntly pointed out this year that Ethereum and its virtual machine (EVM) lack a clear and cohesive technical vision, and R&D progress is slow. If decisive changes are not made, the future may become rigid. He suggested reducing reliance on pure research and shifting to a product-oriented delivery rhythm.

Similar calls also came from Anthony DOnofrio, an early member of Ethereum, who criticized EF for being a "centralized decentralized organization" in structure, with an executive director, a financial department, and a circle of paid developers. Although this structure is effective in coordination, it deviates from the ideal of decentralization. He called for the future of Ethereum to require not only technical research, but also "visionary leaders" who understand its social and political impact.

Aave founder Stani Kulechov also tweeted earlier that EF should reform its budget and operational structure, fire irresponsible members, and allocate resources based on capabilities. He emphasized that the Ethereum Foundation should be a streamlined and efficient organization.

As the most symbolic soul of Ethereum, co-founder Vitalik Buterin's role in the Ethereum Foundation has long been controversial. For example, in February this year, community member Ameen Soleimani even initiated a vote to explore whether Vitalik plays the role of "king" (governance decision maker) or "prophet" (value leader) in the Ethereum ecosystem, with 80.1% of voters believing that he is closer to the latter. In response, Vitalik said, "The statement about having 3 of the 5 seats on the EF board of directors has not been true since 2017. Since then, I have only had 1 of the 3 seats."

In the face of criticism and structural challenges, the Ethereum Foundation also launched a number of internal reform initiatives at the beginning of this year. As early as January, Vitalik publicly announced changes to the leadership model of the Foundation, aiming to enhance technical expertise and strengthen communication with developers. According to Haseeb Qureshi, managing partner of Dragonfly, the EF leadership had gradually broken the closed-door mentality of "not creating anything by me" and showed greater tolerance and openness to external ideas.

In February, Aya Miyaguchi, former executive director of the Ethereum Foundation, was promoted to chairman. Aya has always advocated the "subtraction philosophy", advocating that the foundation should avoid becoming a highly centralized authority, promote decentralization and community-led decentralized development, and compare Ethereum to an "infinite garden", encouraging an open, permissionless innovation ecosystem, and emphasizing long-term sustainability rather than short-term interests. However, her idealistic style has also caused some controversy, with some questioning whether it is too abstract and lacks execution. After Aya became the chairman, she was mainly responsible for promoting strategic cooperation and maintaining relationships, and would reduce direct involvement in specific matters. This position change was once interpreted by the community as a "promotion in name only, demotion in reality".

In addition, the Ethereum Foundation has also initiated explorations into the integration of AI and governance, hiring Devansh Mehta as head of AI×public product governance, and continuing to strengthen its technical backbone by appointing Hsiao-Wei Wang and Tomasz Stańczak as co-executive directors, who are key contributors to the Ethereum beacon chain and founders of the Nethermind executive client, respectively.

While the top management has been frequently adjusted, the core members of the Ethereum Foundation have also been continuously lost. For example, in January this year, Eric Conner, a core developer of Ethereum, announced his withdrawal from the Ethereum Foundation in a post on a social platform, pointing out that EF had problems such as opacity, disconnection from the community, and resistance to change. He believed that the foundation could still operate normally after cutting its budget by 80%; Danny Ryan, a researcher at the Ethereum Foundation, also announced his withdrawal in 2024 after contributing to the foundation for seven years. On the eve of Aya's appointment, he was regarded as the most supported potential leader in an informal community survey, reflecting the community's strong expectations for practical technical talents. Peter Szilagyi, mentioned above, is the maintainer of the Ethereum core client Geth. He also announced his temporary departure in November last year, ending his nearly ten-year career in Ethereum. He once admitted, "Ethereum is losing its way."

It can be said that this organizational change of the Foundation is both a belated self-correction and an experiment in the future sustainable governance model. However, how to balance idealism and execution efficiency, technology research and development and ecological coordination, decentralized vision and realistic governance will be the long-term proposition of EF and even the entire Ethereum ecosystem in the next stage.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse