Dogecoin Price Prediction: DOGE Shows Mixed Signals As Traders Watch Key Support And Upcoming Network Updates

Every time the market mood changes, the meme currency space continues to garner a lot of attention, and Dogecoin frequently takes the lead. At the same time, payment focused projects like Remittix (RTX), priced at $0.1166 per token, are gaining interest from crypto investors who want crypto with real utility rather than pure speculation.

Dogecoin Price Structure And Technical Signals

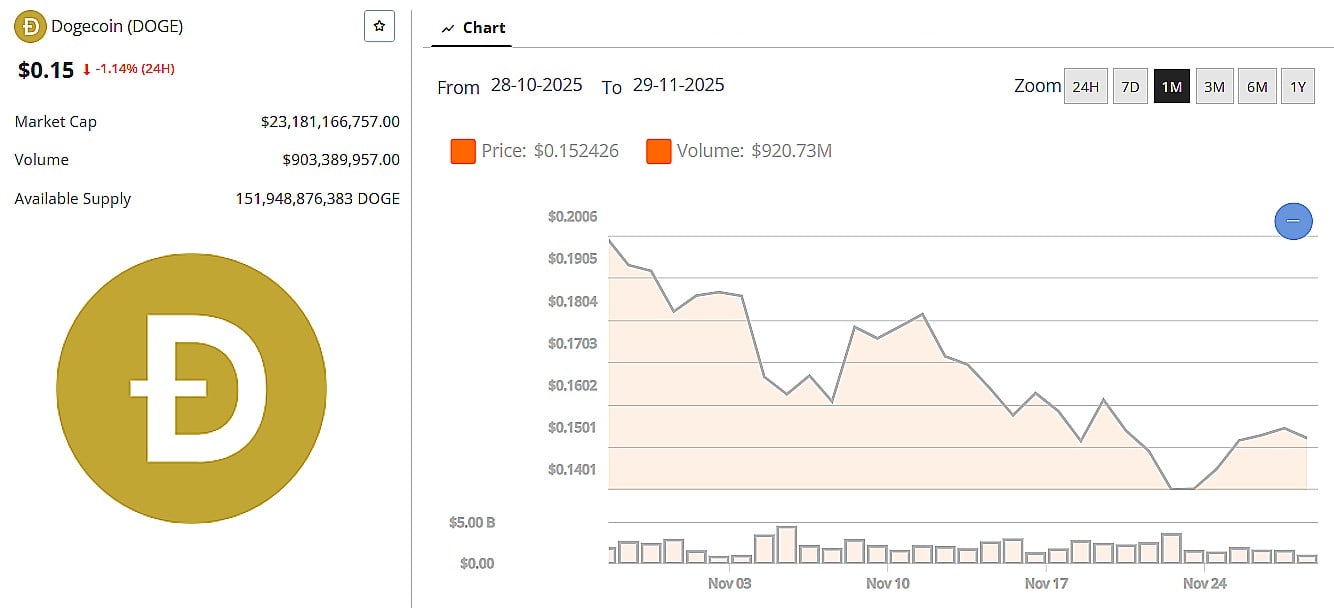

Dogecoin moves into the end of 2025 at a crucial moment, prompting analysts to re-evaluate its long-running patterns and determine whether current structures can support a meaningful recovery heading into 2026. The asset is trading at $0.15, following a short drop to $0.14 last weekend and continues to form a falling wedge on the 12-hour chart, a setup that can precede trend reversals.

Market technician Alan T. points out that the 4-hour inverse head-and-shoulders formation leaves room for a climb toward $0.18, though he warns that previous Dogecoin wedge breakouts have failed when volume stayed below the 20-period average.

After bouncing from its weekend low of $0.14, DOGE recovered slightly this week, but has not kept pace with Bitcoin and other leading altcoins. Dogecoin price source: Brave New Coin DOGE market data.

These technical signals are emerging against a backdrop of shifting sentiment, uneven liquidity, and macro uncertainty, leaving cycle-based outlooks more cautious despite early stabilization signs.

Long-term cycle analysis adds historical context but remains debated. On lower timeframes, traders are monitoring reaction levels including $0.160 – $0.162 (minor resistance), $0.173 (38.2% retracement and previous rejection area), and $0.185 (upper channel boundary). A successful retest of $0.154 as support could trigger a brief relief move, while downside protection sits between $0.133–$0.147.

In the broader picture, Dogecoin shows tentative signs of recovery, and short-term moves toward $0.20–$0.23 are possible if volume and market flows strengthen. At the latest reading, DOGE is priced around $0.15, posting 2.57% gains over 24 hours, with a market capitalization of roughly $23.1 billion and a circulating supply of about 151.9 billion tokens. Of course, while Dogecoin’s technical structures provide helpful reference points, they should be treated as conditional scenarios rather than assured outcomes – particularly for an asset so closely tied to meme dynamics, speculative sentiment, and liquidity swings.

Why Remittix Looks Different To Meme Driven Plays

While Dogecoin trades mostly on sentiment and liquidity cycles, Remittix is building a PayFi stack that aims to connect blockchain technology with real payment rails. RTX is priced at $0.1166, backed by more than $28.2 million raised through private funding and over 686 million tokens sold, which shows strong early backing for the project’s tokenomics and roadmap.

The Remittix wallet is now live on the Apple App Store, giving users a working product for storing and sending digital assets. The team plans to add a crypto to fiat module inside this same app, turning the wallet into a full payment hub that allows users to move funds from crypto into bank accounts in a single flow.

Security is a core part of the story. Remittix is fully audited and monitored on the CertiK audit portal, with the team also verified in the CertiK KYC section. The project is ranked among the top pre launch tokens on the platform, which matters for those looking for the best crypto presale to buy now style opportunities without taking unnecessary smart contract risk.

The team is also gearing up for a high profile announcement coming in December. Alongside this, the ecosystem includes an expanded beta testing program for iOS users, a 15% USDT referral reward system through the Remittix dashboard, and a $250,000 Remittix Giveaway that has helped build community engagement.

For many traders who are looking for the best crypto to buy now or the best altcoin to buy now, this mix of security checks, liquidity planning and real world utility stands out.

The Building Blocks Behind Remittix’s Rise:

-

Wallet live on Apple App Store

-

Crypto to fiat module in active development

-

Full audit and KYC through CertiK

-

Over $28.2 million from private funding

Dogecoin, Remittix And The Next Market Phase

Dogecoin continues to send mixed technical signals as it trades between resistance and key support, with price levels around $0.135 to $0.155shaping the near term Dogecoin outlook. At the same time, infrastructure projects like Remittix are positioning for the next phase of crypto adoption by focusing on payments, CEX listings and strong security.

Together they show two different paths inside the same market cycle, one driven mainly by sentiment and one driven by product delivery and real world use.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

FAQs

Is Dogecoin still important for the crypto market?

Yes, Dogecoin does stay as one of the leading liquidity drivers for meme-focused altcoins and very often responds promptly to changes in market sentiment.

What affects Dogecoin price most right now?

Technical levels, broader crypto trends and interest from retail traders across large crypto exchanges are key inputs.

How is Remittix different from Dogecoin?

Dogecoin leans on community and trading cycles, while Remittix focuses on payments, security audits and integration with traditional finance.

Where do traders look for the best crypto presale to buy now type opportunities?

Many now screen for projects with live products, clear CEX plans and strong audits, which is why Remittix is often mentioned as a top crypto to buy now candidate and a potential top crypto to buy now for utility driven exposure.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

You May Also Like

Which Altcoins Stand to Gain from the SEC’s New ETF Listing Standards?

Zhongchi Chefu acquired $1.87 billion worth of digital assets from a crypto giant for $1.1 billion.