ADA Faces $40M Sell-Wall as Team’s 70 Million ADA Budget Request Crosses 53% Approval

Cardano began the weekend under mild pressure, trading just above $0.41 on Saturday, Nov. 29, following a 2% intraday dip that trimmed weekly gains to 3.4%. ADA had touched a weekly high of $0.44 on Thursday as the broader market rebounded, lifted by Bitcoin’s move from $82,000 toward $92,700.

Momentum slowed shortly after the Cardano team initiated a major governance vote on a Critical Integrations Budget requesting 70 million ADA to fund core infrastructure upgrades. The proposal is now trending toward approval after founder Charles Hoskinson publicly backed the initiative alongside key ecosystem entities, including Input Output HK, EMURGO, Intersect, and Midnight.

The governance action seeks 70 million ADA from the treasury to create a strategic integration fund to onboard tier-one stablecoins, institutional custody solutions, analytics providers, bridges, and pricing oracles.

Supporters argue this is the foundational layer Cardano needs to unlock meaningful growth in DeFi and Real-World Asset activity while pushing the network closer to long-term fee sustainability.

Voting data reflects a decisive lean toward approval. Delegated representatives (DReps) have cast 2.94 billion ADA, representing 53.14%, in favor. Another 7.89 billion ADA is currently abstaining, while 173.56 million ADA, 3.14%, has been submitted against the proposal. Roughly 2.59 billion ADA, or 43.72%, have not yet voted.

Among stake pool operators, 237.73 million ADA has been cast in support, with nearly all other voting weight remaining inactive. Constitutional Committee participation currently stands at zero, with all seven members yet to vote. With DReps’ votes crossing the 53% threshold, the governance action is currently on track for approval, though votes remain open until December 30.

Cardano Price Faces Major Sell-Wall at $0.44

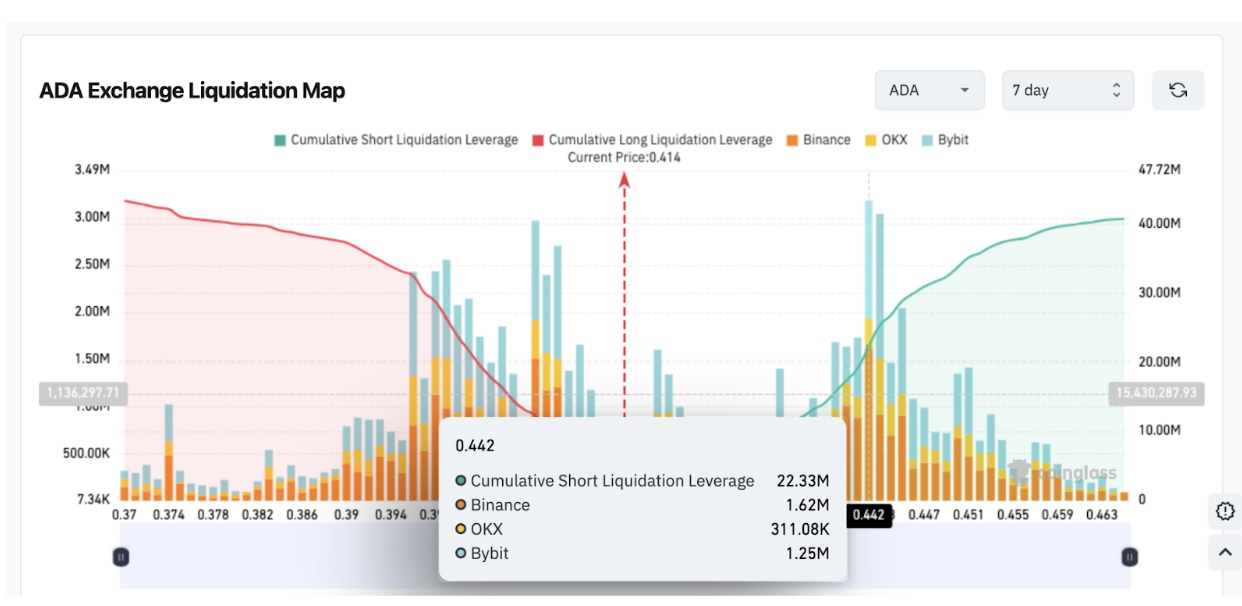

ADA now confronts significant resistance at $0.44, where derivatives positioning shows a concentrated short exposure. Coinglass data shows long positions totaling $43 million against $40 million in shorts, indicating bulls still hold a narrow advantage despite the overhead pressure.

Cardano (ADA) Liquidation Map, Nov 29 | Source: Coinglass

The most notable liquidity pocket sits directly at the $0.44 level, where traders have accumulated $22 million in short leverage.

Such clusters often act as magnets for volatility and can either trigger rapid forced buying on a breakout or hard rejection when momentum fades. Given current conditions, ADA price remains unlikely to clear the $0.45 barrier without a considerable increase in market volumes.

nextThe post ADA Faces $40M Sell-Wall as Team’s 70 Million ADA Budget Request Crosses 53% Approval appeared first on Coinspeaker.

You May Also Like

Strategy to initiate a bitcoin security program addressing quantum uncertainty

Copy linkX (Twitter)LinkedInFacebookEmail

Strategic Shift Impacts Crypto Trading Landscape