Crypto VC deals fall 28% in November as funding surges on $10.3B Upbit acquisition

Crypto VC activity in November 2025 slowed down, with investment deals that were publicly disclosed dropping to 57 projects.

This figure represents a 28% decrease compared with the 79 deals made in October and a decline of 41% over November 2024’s 96 projects, according to data from RootData.

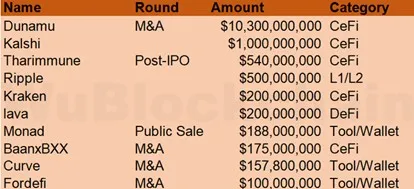

While deal volume contracted, the total funding surged to $14.54 billion, up 219% from October’s $4.556 billion. The sharp increase has come from one single transaction of Naver acquiring Upbit operator Dunamu for $10.3 billion, the largest financing event ever in crypto.

Crypto VC deal volume drops across sectors

November’s decline in crypto VC activity serves as a continuation of the downward flow of volume over the past year. Announced transactions for November 2025 dropped to 57 projects, nearly 41% below last year’s figure of 96 during the similar period in 2024.

Monthly totals can grow because not all financings are reported in a given month. There were 79 deals in October 2025, and the volume for November at 57 was a 28% drop month-over-month.

Crypto VC data | Source: Wu Blockchain

Crypto VC data | Source: Wu Blockchain

Sector-wise, DeFi projects also took the largest slice of investment deals, as decentralized finance occupied 30.4% of all disclosed crypto venture capital transactions in November and was the most active category.

Centralized finance infrastructure followed close behind with 12.5% of the deals, which include exchanges, lending platforms and other centralized cryptocurrency services. AI-centered crypto projects, in addition to RWA/DePIN efforts, both made up 7.1% of the investment totality.

Tool and wallet development projects raised 5.4% of the deals, while Layer 1 & Layer 2 blockchain infrastructure projects saw only 1.8%. NFT and GameFi projects saw 1.8% of deals in aggregate, too.

Naver’s $10.3 billion Upbit acquisition dominates funding

Naver has agreed to acquire Upbit operator Dunamu in an all-stock deal valued at about $10.3 billion. The transaction puts the value of Naver Financial at about 4.9 trillion won, and that of Dunamu at about 15.1 trillion won. Through the share swap, Naver Finance will become Dunamu’s wholly-owned parent company.

For the first nine months of 2025, consolidated revenue for Dunamu rose 22% year-over-year at 1.19 trillion won, with trading platform operations, including Upbit, comprising approximately 97.9% of the total revenue.

The acquisition dwarfs all other crypto VC deals in November and accounts for 70.8% of the month’s total funding. Without the Upbit transaction, November funding would have totaled approximately $4.24 billion.

Kalshi raises $1 billion at $11 billion valuation

Kalshi, a prediction market platform, raised $1 billion in November, raising its total worth to $11 billion. Sequoia and CapitalG returned as lead investors, with Andreessen Horowitz, Paradigm, Anthos Capital, and Neo also participating. According to Bloomberg, Kalshi’s biggest competitor, Polymarket, is in talks with investors to raise capital at a valuation of $12 billion to $15 billion.

DRW Holdings and Liberty City Ventures have inked a subscription agreement for a private placement of approximately $540 million through publicly traded Tharimmune Inc. Tharimmune will store the Canton token from the Canton public blockchain for usage in financial transaction scenarios. DRW and Liberty City previously contributed to Digital Asset’s $135 million fundraising round in June.

Ripple and Kraken secure major crypto VC rounds

Ripple closed a $500 million funding round last November, giving the company a valuation of $40 billion. Fortress Investment Group and Citadel Securities-related entities were among those who took the lead on the round, joined by Pantera Capital, Galaxy Digital, Brevan Howard and managed funds by Marshall Wace.

Citadel Securities invested $200 million in Kraken to become the company’s strategic partner, giving it a post-money valuation of $20 billion. The exchange had previously raised $600 million at a $15 billion valuation in September. Both of those rounds combined are $800 million.

Strategic acquisitions shape November activity

Singh’s monad raised $188 million in a public sale on Coinbase. The sale offered 7.5% of the supply of MON at a rate of 0.025 USDC per token, which would have sent the ETH-compatible Layer 1 blockchain to a fully diluted valuation of $2.5 billion.

US-listed crypto wallet company Exodus Movement announced the $175 million acquisition of W3C Corp, which includes crypto card and payments businesses Baanx and Monavate. The transaction is funded through company cash reserves and BTC-collateralized financing provided by Galaxy Digital. The deal is expected to close in 2026 pending customary approvals.

Lloyds Banking Group, the UK’s largest retail bank, signed a 120 million pound acquisition agreement with digital wallet provider Curve. Curve had raised more than 250 million pounds cumulatively.

Paxos Trust Company acquired crypto wallet startup Fordefi Inc. in a deal valued at more than $100 million. The acquisition price exceeds the $83 million valuation Fordefi received after its most recent funding round last year.

Join Bybit now and claim a $50 bonus in minutes

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

SEI Technical Analysis Feb 6