Whales Are Going All-In on Ethereum — But Record Leverage Puts Their Longs at Risk

After the FED announced interest rate cuts, major whale wallets began pouring capital into long positions on Ethereum (ETH). These moves signal strong confidence in ETH’s upside. They also increase overall risk.

Several factors suggest that their long positions may face liquidation soon without effective risk management.

How Confident Are Whales in Their Ethereum Long Positions?

Whale behavior offers a clear view of current sentiment.

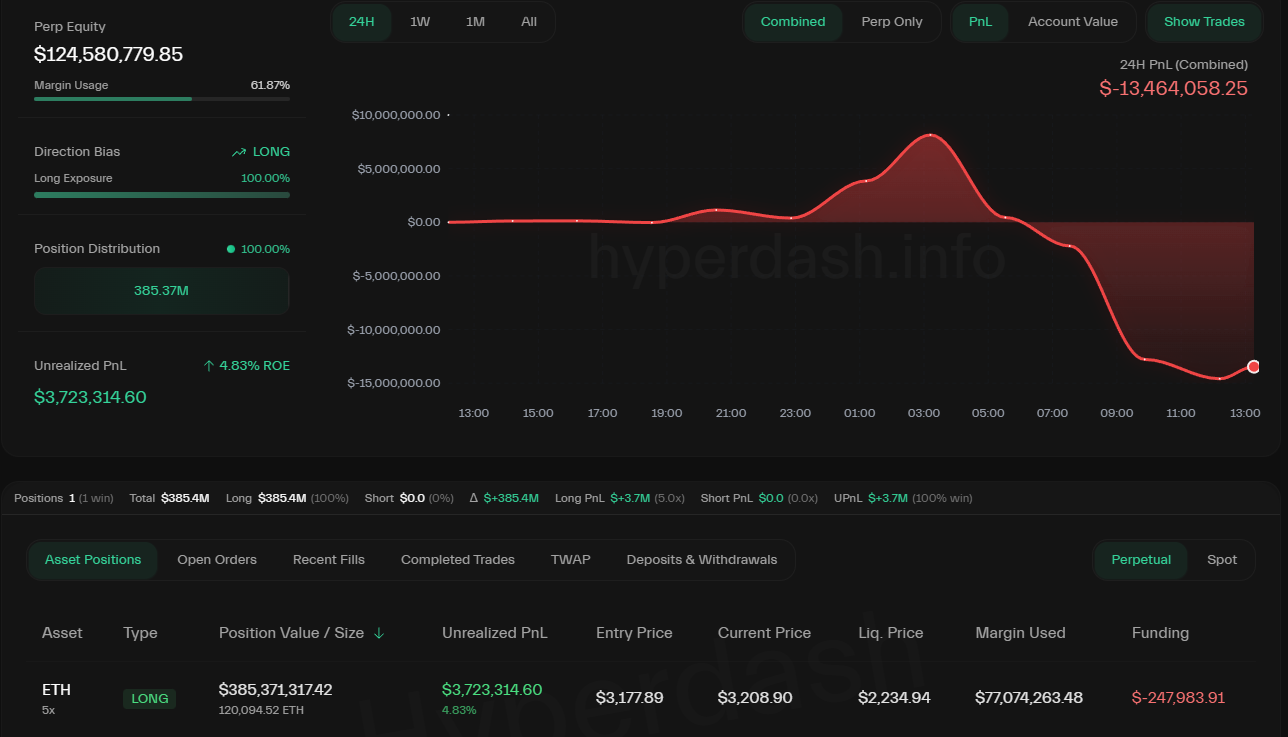

On-chain tracking account Lookonchain reported that a well-known whale, considered a Bitcoin OG, recently expanded a long position on Hyperliquid to 120,094 ETH. The liquidation price sits at only $2,234.

This position is currently showing a 24-hour PnL loss of more than $13.5 million.

A Whale’s Long ETH Position on Hyperliquid. Source: HyperDash

A Whale’s Long ETH Position on Hyperliquid. Source: HyperDash

Similarly, another well-known trader, Machi Big Brother, is maintaining a long position worth 6,000 ETH with a liquidation price of $3,152.

Additionally, on-chain data platform Arkham reported that the Chinese whale trader who called the 10/10 market crash is now holding a $300 million ETH long position on Hyperliquid.

Whale activity in ETH long positions reflects their expectation of a near-term price increase. However, behind this optimism lies a significant risk stemming from Ethereum’s leverage levels.

ETH Leverage Is Reaching Dangerous Highs

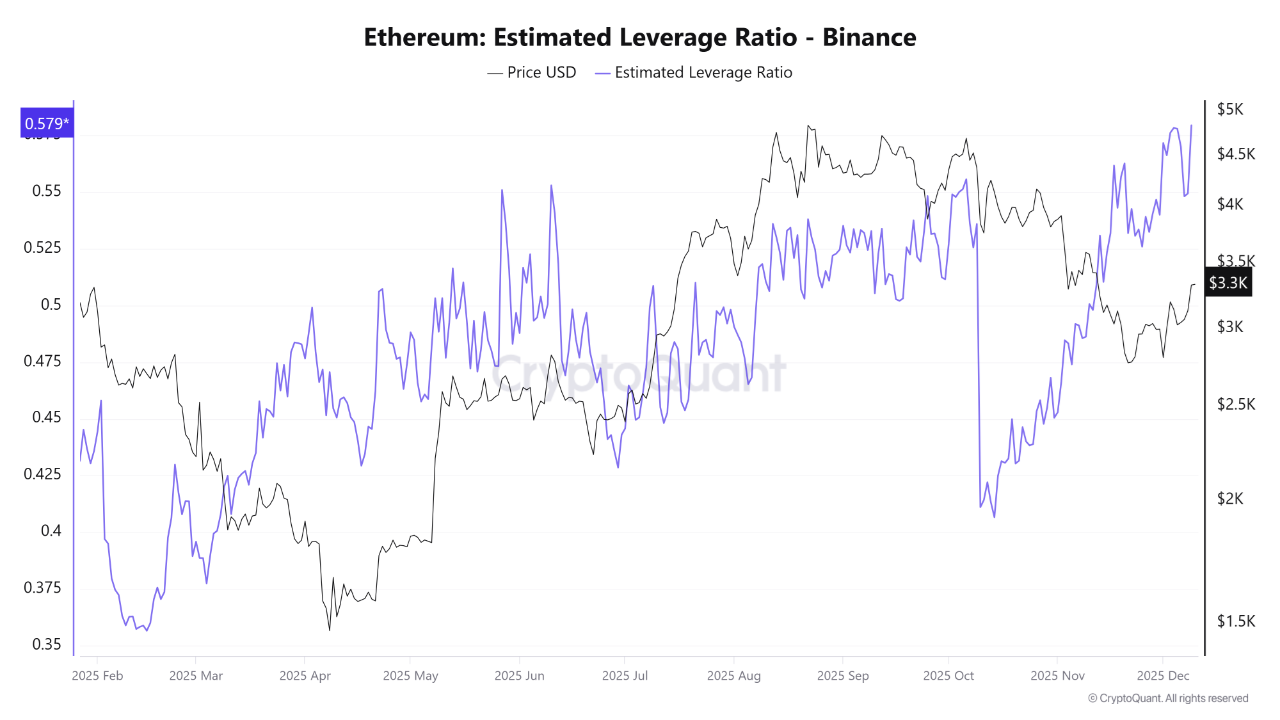

CryptoQuant data shows that ETH’s estimated leverage ratio on Binance has reached 0.579 — the highest in history. This level indicates extremely aggressive leverage usage. Even a small price swing could trigger a domino effect.

Ethereum Estimated Leverage Ratio – Binance. Source: CryptoQuant.

Ethereum Estimated Leverage Ratio – Binance. Source: CryptoQuant.

Historical data indicate that similar peaks typically coincide with periods of intense price pressure and often signal local market tops.

Spot Market Weakness Adds More Risk

The spot market is also showing clear signs of weakening. Crypto market watcher Wu Blockchain reported that spot trading volume on major exchanges dropped 28% in November 2025 compared to October.

Another report from BeInCrypto highlighted that stablecoin inflows into exchanges have declined by 50%, falling from $158 billion in August to $ 78 billion as of today.

Combined, low spot buying power, high leverage, and shrinking stablecoin reserves reduce ETH’s ability to recover. These conditions could put whale long positions at significant risk of liquidation.

You May Also Like

Zakt de Bitcoin koers naar $80.000 na de $3 miljard BTC ETF uitstroom sinds november?

Will XRP Price Increase In September 2025?