XRP and BNB May Rally Hard, Yet Ozak AI’s 2026 Projection Looks Far More Explosive

The post XRP and BNB May Rally Hard, Yet Ozak AI’s 2026 Projection Looks Far More Explosive appeared first on Coinpedia Fintech News

Crypto market sentiment continues strengthening as XRP and BNB both show signs of preparing for major rallies. XRP maintains one of the strongest long-term structures among large-cap assets, while BNB’s utility-driven demand continues to expand across the Binance ecosystem.

Yet even with these bullish setups, analysts across top trading groups and research circles agree on one key insight: Ozak AI (OZ) carries a far more explosive trajectory heading toward 2026. Its millisecond-speed predictive engine, autonomous multi-chain AI agents, and live intelligence framework place it in a completely different category from traditional assets, giving Ozak AI an exponential growth curve rarely seen at presale valuation levels.

XRP Holds Strong at $2.09

XRP trades near $2.09 and maintains one of its most stable long-term accumulation patterns in recent cycles. Support at $2.03 holds the immediate structure, while deeper layers around $1.96 and $1.90 reinforce the broader macro trend. XRP begins forming upward expansion pressure when price approaches resistance at $2.15, followed by higher challenge zones at $2.22 and $2.29 — key ignition points that historically trigger strong continuation phases for XRP’s liquidity-driven rallies.

These levels support analysts’ forecasts that XRP may push toward $5–$10 during a full bull cycle. Yet even with its strong regulatory position and long-term utility narrative, XRP’s growth remains fundamentally linear. It appreciates with market liquidity, but it does not compound through evolving capability—the exact opposite of Ozak AI’s trajectory.

Youtube embed:

Ozak AI Presale Nears $4.25M — Could Early Investors Be Sitting on 800× Gains by 2030?

Ozak AI (OZ)

Ozak AI is attracting far more analyst attention because it launches with active, functioning infrastructure instead of speculative future plans. Its core intelligence engine processes blockchain signals in milliseconds, interprets cross-chain conditions using Perceptron Network’s 700K+ distributed nodes, and reacts instantly through autonomous SINT-powered agents. Combined with HIVE’s 30 ms execution-grade market signals, Ozak AI operates as a live predictive system capable of understanding market shifts faster than any human or traditional tool.

This real-time capability allows Ozak AI to grow in value through computation and data rather than hype. As more users interact with the intelligence layer, its accuracy increases, its decision-making improves, and its predictive models evolve—creating a compounding effect unseen in standard assets like XRP or BNB.

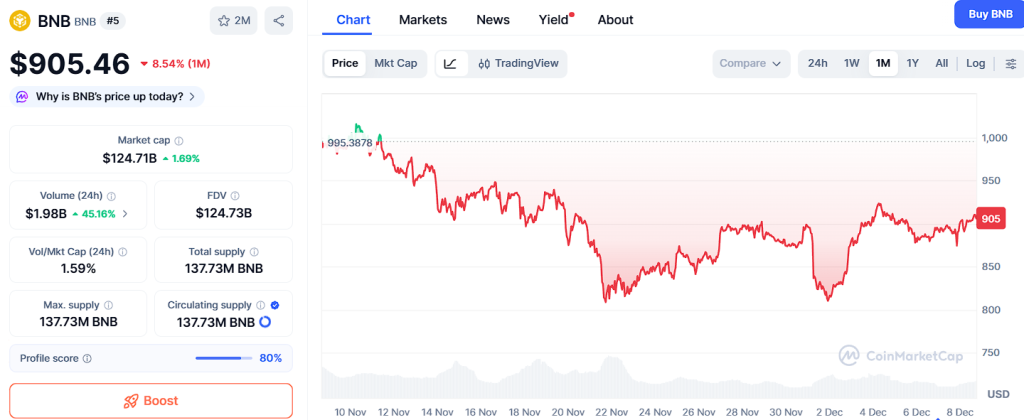

BNB

BNB trades around $905 and shows a strong, utility-driven uptrend supported by exchange-level liquidity and stable ecosystem expansion. Support at $880 holds the immediate trend, while deeper zones at $862 and $839 establish the long-term structural base that historically precedes aggressive continuation phases. BNB begins building upward acceleration when it approaches resistance at $928, with higher targets at $953 and $978 forming the key breakout regions. Analysts still forecast a realistic path toward $1,600–$1,700 during peak cycle conditions.

Even with this strength, BNB’s upside remains fundamentally capped by its maturity. It can double or triple, but early-stage, AI-native infrastructure projects like Ozak AI can multiply dozens of times due to their low initial valuation and expanding utility surface.

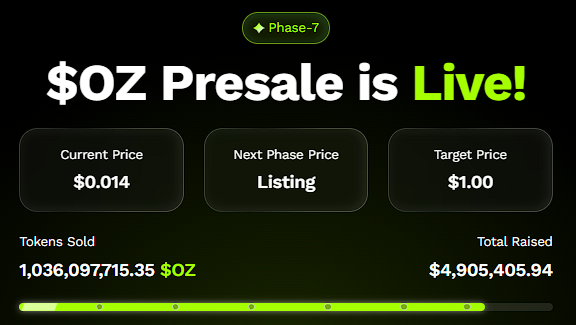

Ozak AI Presale Surge Confirms the Explosive 2026 Projection

The Ozak AI Presale surpassing $4.9 million demonstrates powerful early conviction across retail investors, strategic capital, and even whale wallets rotating from established coins into early intelligence-layer exposure. Analysts emphasize that Ozak AI is one of the very few presale tokens launching with fully functional systems—predictive models, autonomous agents, and cross-chain intelligence already running.

This drastically increases confidence that Ozak AI could become a foundational AI layer for trading tools, prediction engines, automated DeFi systems, and analytics platforms across Web3. This readiness is why the long-term projection for Ozak AI often exceeds 50x–100x, while XRP and BNB remain limited by the scale of their existing valuations.

Ozak AI Takes the Lead for 2026 Explosive Growth

XRP and BNB are both strong, battle-tested large caps that will almost certainly rally hard in the next bull market. Their structures are powerful, and their narratives remain intact. Yet Ozak AI introduces a compounding intelligence engine capable of scaling across chains, evolving autonomously, and delivering real-time predictive value that strengthens every day.

XRP may rally. BNB may surge. But Ozak AI’s trajectory—driven by intelligence rather than sentiment—appears far more explosive. Heading into 2025–2026, analysts agree that Ozak AI is positioned not just as a high-upside presale project, but as one of the most powerful potential breakout assets of the entire cycle.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

You May Also Like

Zakt de Bitcoin koers naar $80.000 na de $3 miljard BTC ETF uitstroom sinds november?

Will XRP Price Increase In September 2025?