Bitcoin and Ethereum Options Expiry of $4.5 Billion Spurs Market Caution

TLDR

- Nearly $4.5 billion in Bitcoin and Ethereum options will expire today.

- Bitcoin’s price sits at $92,249, while Ethereum is at $3,242.

- Bitcoin options show a 1.10 put-to-call ratio, while Ethereum’s is 1.22.

- Recent Fed rate cuts and weak liquidity contribute to cautious market sentiment.

Nearly $4.5 billion in Bitcoin and Ethereum options are set to expire today, December 12, 2025, as traders remain cautious amid year-end market conditions. With Bitcoin and Ethereum prices hovering around key levels, the options expiry could spark volatility, though market sentiment is subdued. Traders are balancing positions, waiting for macroeconomic cues and any significant catalysts to guide their next moves into the new year.

Traders Brace for $4.5 Billion in Bitcoin and Ethereum Options Expiry

On December 12, 2025, nearly $4.5 billion in Bitcoin (BTC) and Ethereum (ETH) options are set to expire, creating a cautious atmosphere in the market. As traders approach the expiry, concerns over year-end liquidity and broader macroeconomic factors, such as the Federal Reserve’s recent rate cuts, have led to more balanced and neutral positioning.

The expiration of such a large volume of options typically introduces volatility, but current market conditions suggest traders are taking a more cautious approach. This cautious sentiment is also evident in the balance of call and put positions within the market. Both Bitcoin and Ethereum have seen a shift toward neutral stances as market participants wait for further catalysts before taking more directional bets.

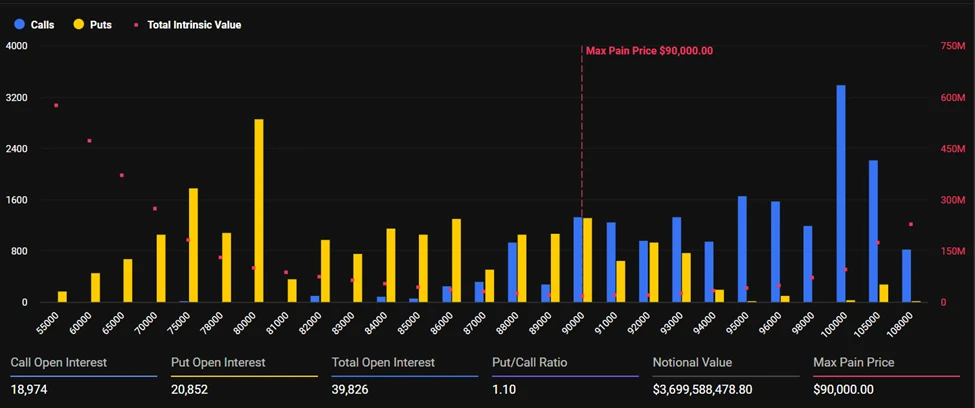

Bitcoin Options Expiry: A Balanced Position

Bitcoin is currently priced at $92,249, with a “max pain” level of $90,000. This level represents the price at which the largest number of options contracts would expire worthless, a key indicator for traders to monitor. Bitcoin’s options market has a put-to-call ratio of 1.10, meaning there are slightly more put contracts than calls. A total of 39,826 open contracts, with 18,974 calls and 20,852 puts, reflect a market that expects limited volatility over the short term.

According to analysts at Deribit, the clustering around the $90,000 level suggests that market participants are not leaning heavily into directional moves. “The market seems to be waiting for the next catalyst rather than pushing for a significant price shift,” they noted. This indicates that traders expect Bitcoin’s price to remain within a narrow range, at least until the expiry of the current options.

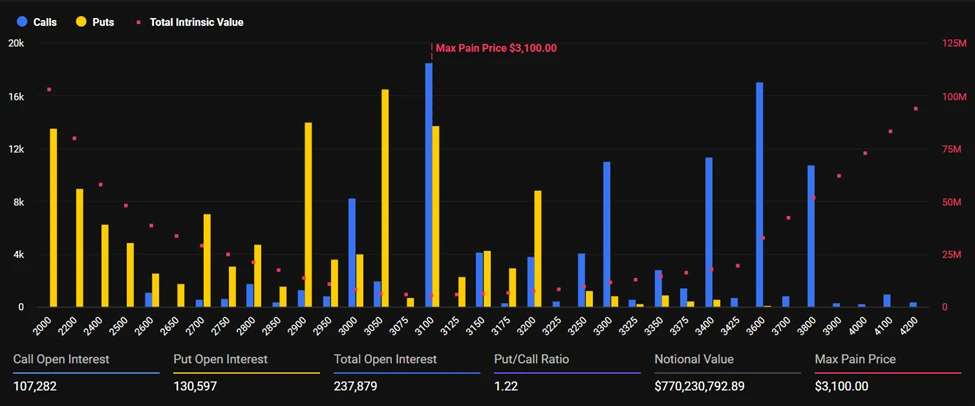

Ethereum Options Expiry: Neutral Market Sentiment

Ethereum, trading at $3,242, is also seeing significant option expirations. With a max pain level of $3,100, Ethereum’s options market shows a slightly higher put-to-call ratio of 1.22. The open interest in Ethereum options stands at 237,879 contracts, with 107,282 calls and 130,597 puts. This ratio signals that traders are positioning for more downside protection in the short term.

Deribit analysts observed that while Ethereum’s positioning has become more neutral, there is still noticeable call concentration above $3,400. This suggests that traders are pricing in the possibility of volatility, but it remains unclear whether this volatility will materialize soon. “The options structure for ETH reflects both cautious optimism and a readiness for potential price swings,” they said.

Macro Conditions and Market Sentiment

While the Federal Reserve’s recent interest rate cut and the resumption of $40 billion in short-term Treasury purchases have provided some liquidity support, market sentiment remains wary. Analysts at Greeks.live pointed out that the broader market still lacks strong momentum. “We wouldn’t call this a QE reboot or the start of a bull market just yet,” they commented, emphasizing that year-end periods tend to see weaker liquidity, which contributes to a more subdued trading environment.

Despite these concerns, there are still upside risks if structural conditions change. Traders are monitoring various factors, including ETF outflows, potential issues with miner profitability, and broader economic developments that could serve as catalysts for future price movements. For now, the focus remains on maintaining balanced positions in anticipation of any market changes.

Near-Term Risks and Long-Term Outlook

In the short term, there are several risks that could affect both Bitcoin and Ethereum prices. Deribit analysts highlighted the possibility of continued ETF outflows, MicroStrategy losing premium, and stress among cryptocurrency miners. These factors could lead to further volatility or downward pressure in the market.

However, despite these challenges, both Bitcoin and Ethereum have shown strong long-term momentum. As traders await the expiry of these options, it is clear that the broader market is focused on adjusting to the new trading environment. With liquidity conditions expected to improve after the year-end period, the market may stabilize, giving traders a clearer view of future trends.

The post Bitcoin and Ethereum Options Expiry of $4.5 Billion Spurs Market Caution appeared first on CoinCentral.

You May Also Like

Tether’s Cash Offer for Juventus Ownership Rejected by Exor

TROLL Price Prediction, Next Crypto To Explode