XRP Is Coming To Solana Via Hex Trust And LayerZero Bridge

Solana is making a straight-for-the-liquidity play: bring XRP on-chain in a way that looks familiar to DeFi users, but legible to institutions. In a series of posts on X early Friday, Solana said XRP is “coming to Solana,” with Hex Trust and LayerZero set to bridge and issue a wrapped version of the token—wXRP—designed to be “DeFi-ready” on Solana while staying redeemable 1:1 for native XRP on the XRP Ledger.

XRP Heads To Solana As Wrapped Token

That “redeemable 1:1” line is doing a lot of work. According to Hex Trust, wXRP will be issued only when an equivalent amount of XRP is deposited into custody, and it will be burned when redeemed—classic wrapped-asset mechanics, but with a compliance wrapper aimed squarely at bigger balance sheets. The firm said it will act as issuer and custodian for the underlying XRP, describing wXRP as a 1:1-backed representation of native XRP built to support cross-chain utility and DeFi activity.

“XRP has stood the test of time and cemented itself as one of crypto’s preeminent and most liquid currencies. XRP’s long standing utility meets Solana’s high-performance execution. With significant day one liquidity, traders, holders, and institutions can use XRP within leading Solana DEXes, lending markets, and liquidity protocols, while maintaining exposure to the underlying asset and 24/7 XRPL redemption rights,” the Solana Foundation stated in a thread via X on December 12.

The other headline claim: liquidity, immediately. Hex Trust said wXRP is expected to launch with over $100 million in total value locked, framing it as “day one” depth that should help with pricing and market health once the token starts circulating across venues.

LayerZero’s role is the plumbing. Hex Trust said wXRP will be issued on LayerZero’s Omnichain Fungible Token (OFT) standard, positioning it to move across multiple networks rather than live as a one-off wrapper on a single chain. Solana is first, with Hex Trust also naming Optimism, Ethereum, and HyperEVM among initial targets, plus additional chains later.

Why now? Solana’s pitch is basically: XRP is old-school liquid, Solana is high-throughput, and the combination should unlock new use cases without forcing holders to exit the asset. The practical version of that is straightforward—wXRP becomes usable inside Solana’s DEXs, lending markets, and liquidity protocols while keeping a standing redemption path back to XRPL.

The subtle version is about who’s allowed through the door: Hex Trust says minting and redemption is designed for “authorized merchants” in a KYC/AML-compliant environment, which is the kind of sentence that tends to show up when the target user is a market maker, not a meme trader.

And yes, the messaging is trying to thread the custody needle. Solana Foundation product marketing lead Vibhu Norby described the bridge as “self-custodial from end to end” while emphasizing 1:1 redemption back to the ledger—language meant to reassure crypto-native users that this isn’t “paper XRP,” even if the underlying asset is sitting with a regulated custodian.

Via X, Norby commented on the story behind the partnership: “In November, I unexpectedly became enemy #1 of the XRP Army. Through the resulting public learning process, I had a chance to meet many OG devs, core community members, memelords, and the team at Ripple itself, and I came to an understanding of the uniqueness of XRP as an asset, and its community.”

More color is expected on Day 3 of Solana Breakpoint, where RippleX’s Luke Judges is listed on the agenda for a short “Product Keynote: Hextrust” session moderated by Norby. If this rollout goes the way Solana is implying, that slot is less ceremonial than it sounds.

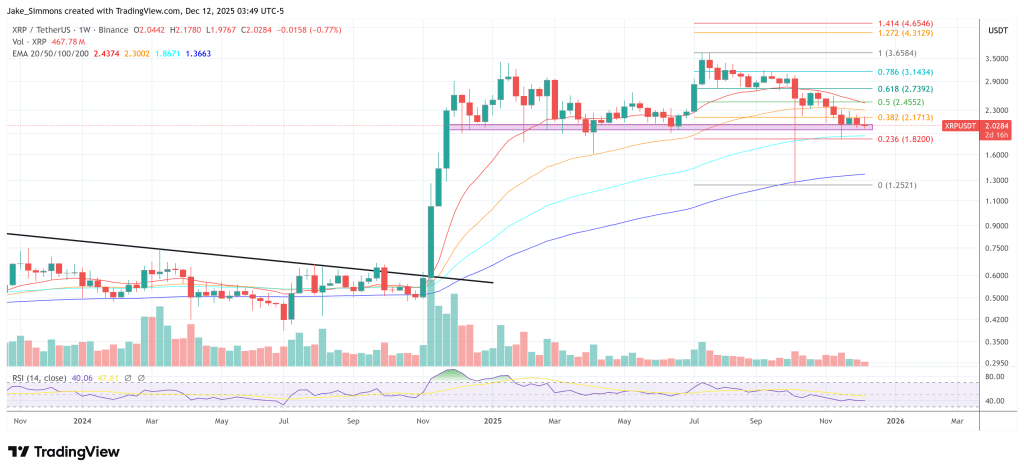

At press time, XRP traded at $2.0284.

You May Also Like

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!