Pi Network (PI) News Today: December 16th

Pi Network has rolled out important updates, and its ecosystem continues to evolve, but the native token of the project remains in red territory.

In the following lines, we will touch upon everything most interesting surrounding these topics.

The Recent Development

Pi Network’s Core Team took center stage at the end of August when it launched the Pi Hackathon 2025: an event with a 160,000-coin prize pool for the top eight participants. The initiative’s ultimate goal was to encourage Pioneers to create real-world applications that expand the utility of the PI token, and it was supposed to end in mid-October.

The team remained silent for a while and finally announced the event’s conclusion and winners last week. First place and a reward of 75,000 coins went to Blind_Lounge, whereas Starmax finished second and took home 45,000 tokens.

In the following days, Pi Network shared more information about the winners. It described Blind_Lounge as “a privacy-first social and dating platform where people connect anonymously and reveal identities only by mutual choice.”

Several hours ago, it touched upon Starmax, too, classifying it as “a loyalty program app that enables businesses to offer loyalty programs using Pi.”

What’s Next on the List?

Many Pi Network users have been struggling with KYC procedures, and the team has tried to come up with a solution for these issues. Not long ago, it integrated additional AI tools, making it easier and faster for Pioneers to complete the verification process.

This weekend, Pi News (an X account that tracks the developments related to Pi Network) said that millions of users have already completed the necessary KYC procedures, claiming that the attention is now on “the explosive growth of utility applications.”

PI Price Outlook

Despite the news and advancements related to Pi Network, PI’s valuation keeps heading south. As of this writing, it is worth around $0.19, representing a 4% daily decline and a whopping 93% drop from the historical peak of $3 witnessed earlier this year.

X user Web3_Vibes argued that PI is “approaching the local bottom,” predicting that a pump will depend heavily on a potential bounce off the $0.192 support level.

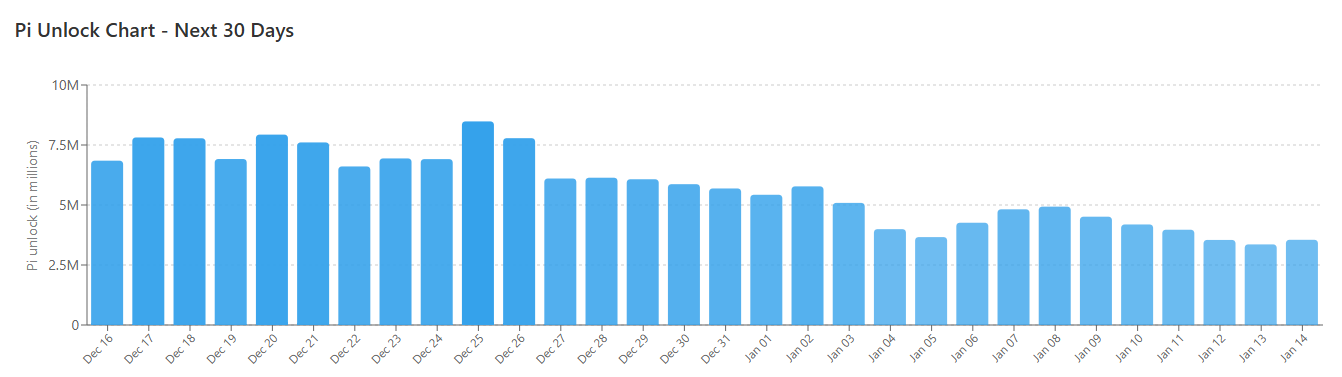

Meanwhile, the upcoming token unlocks are also worth observing. Data shows that 172.5 million coins will be freed up over the next 30 days, giving investors the chance to offload assets they have been waiting for a long time. This could translate into additional supply hitting the market and weighing on the price.

PI Token Unlocks, Source: piscan.io

PI Token Unlocks, Source: piscan.io

The post Pi Network (PI) News Today: December 16th appeared first on CryptoPotato.

You May Also Like

Visa Expands USDC Stablecoin Settlement For US Banks

Nasdaq Company Adds 7,500 BTC in Bold Treasury Move