Ethereum Price Continues to Slide—Where Is the Next Support?

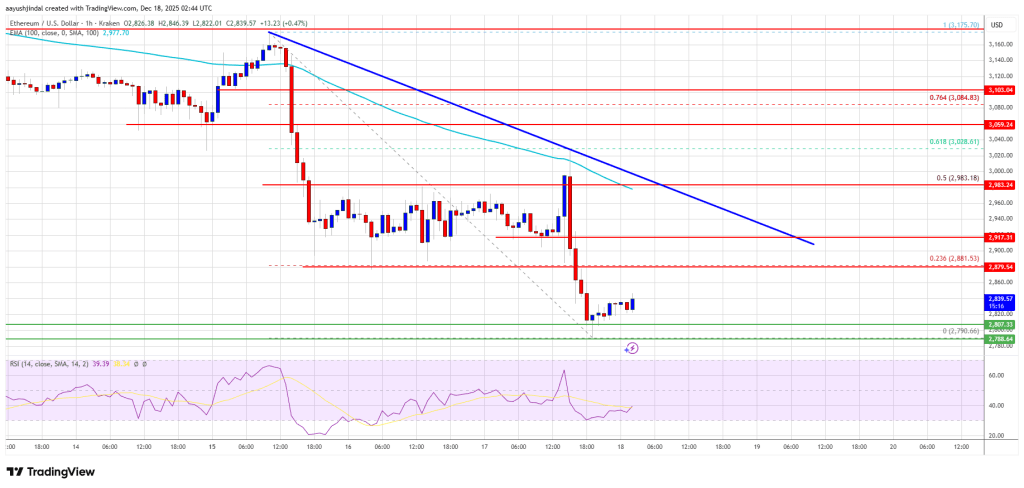

Ethereum price failed to stay above $3,000 and declined further. ETH is now consolidating and might soon aim to start a recovery wave if it clears $2,880.

- Ethereum started a fresh decline below the $2,950 zone.

- The price is trading below $2,900 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $2,920 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could continue to move down if it settles below the $2,800 zone.

Ethereum Price Dips To New Weekly Lows

Ethereum price attempted a fresh increase but struggled above $3,000, like Bitcoin. ETH price dipped below $2,950 and $2,920 to enter a bearish zone.

The bears even pushed the price below $2,850. A low was formed at $2,790 and the price is now consolidating losses well below the 23.6% Fib retracement level of the downward move from the $3,175 swing high to the $2,790 low.

Ethereum price is now trading below $2,900 and the 100-hourly Simple Moving Average. Besides, there is a connecting bearish trend line forming with resistance at $2,920 on the hourly chart of ETH/USD.

If there is another upward move, the price could face resistance near the $2,880 level. The next key resistance is near the $2,920 level and trend line. The first major resistance is near the $2,980 level and the 50% Fib retracement level of the downward move from the $3,175 swing high to the $2,790 low.

A clear move above the $2,980 resistance might send the price toward the $3,030 resistance. An upside break above the $3,030 region might call for more gains in the coming days. In the stated case, Ether could rise toward the $3,120 resistance zone or even $3,150 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $2,880 resistance, it could start a fresh decline. Initial support on the downside is near the $2,800 level. The first major support sits near the $2,780 zone.

A clear move below the $2,780 support might push the price toward the $2,740 support. Any more losses might send the price toward the $2,625 region. The next key support sits at $2,550.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $2,780

Major Resistance Level – $2,920

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Polymarket Resumes Service: A Triumphant Return After Polygon Network Outage