Libra staged a hunting game: nearly 30% of large investors took over at high prices, and more than 70,000 addresses were harvested

Author: Frank, PANews

In the cryptocurrency market, being the first to enter the market is often seen as a secret to profitability, but the plunge of Libra tokens has revealed the cruel truth behind this "speed game". On-chain data shows that more than 27% of large investors bought the tokens at a high price of $2.5 within half an hour of the token issuance, while the mysterious address made a profit of more than $2 million through precise sniping. When the president's endorsement becomes a harvesting tool, platform insiders become "preemptive hunters", and this MEME coin carnival, which is wrapped in insider trading and regulatory gaps, is pushing retail investors into the abyss of systemic strangulation.

Nearly 30% of large investors bought at high prices, and early buyers suffered the most losses

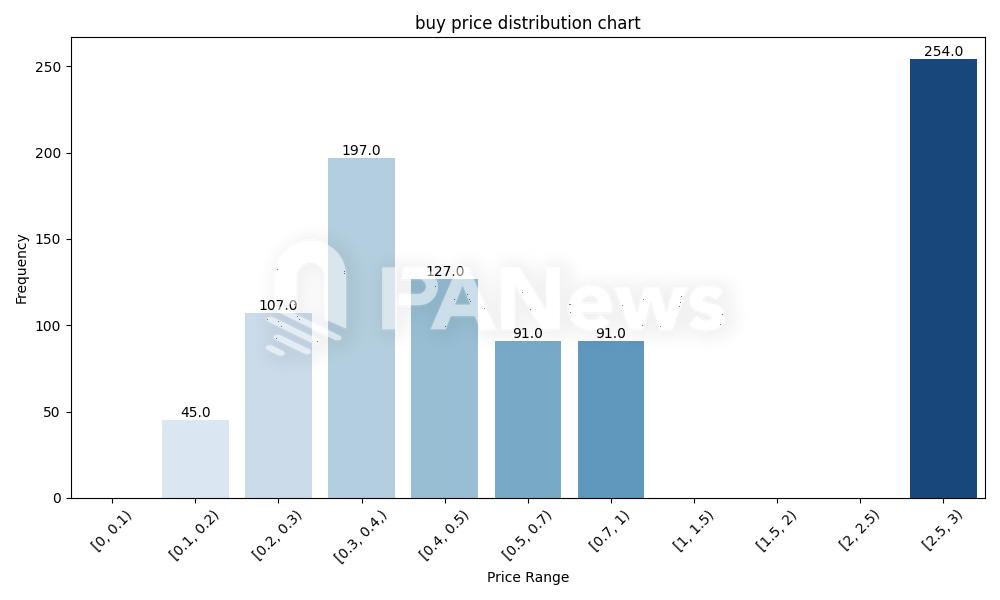

PANews conducted an in-depth analysis of the top 1,000 addresses as of February 17. From the perspective of the overall purchase cost, the average initial purchase cost of the top 1,000 coin holders was about $1.01. Among them, a large number of users had an initial purchase cost of about $2.5, reaching 254, accounting for about 27.7%. That is, nearly 30% of the large holders stood at the top of the mountain when they first bought in. The user with the lowest purchase price had a price of about $0.15.

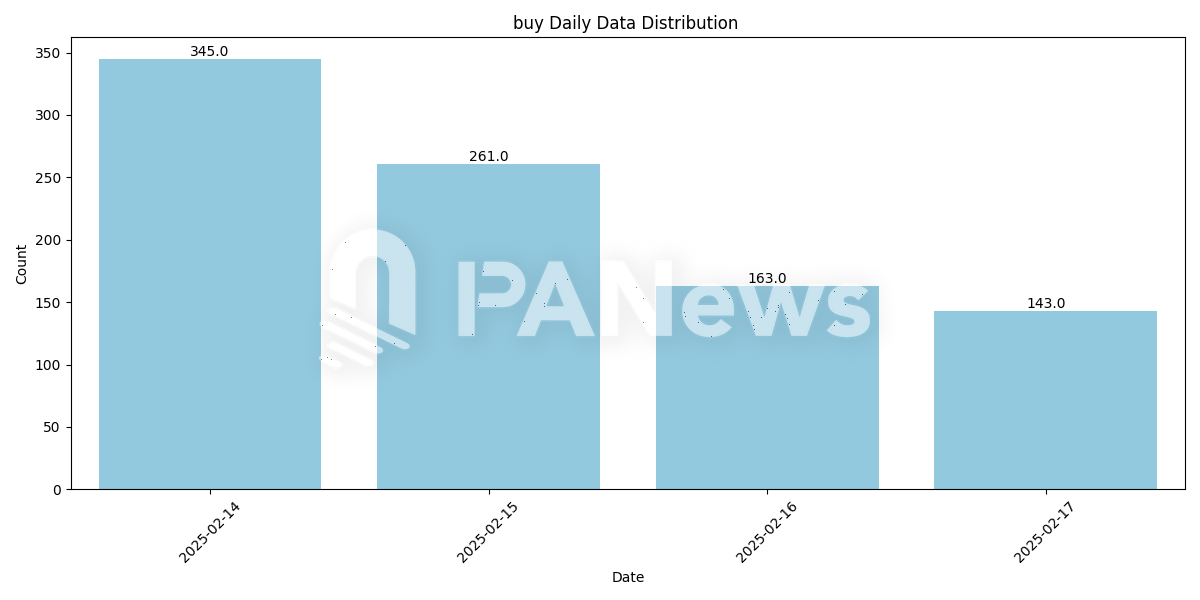

From a time perspective, these users who bought at the top of the price basically bought within half an hour of issuance, while users who bought at the low point mostly started to intervene on the second day. According to past experience, the earlier you buy, the more likely you are to get low-priced chips. However, the trend of Libra broke the previous market rules. The earlier the users entered, the more they were cut. This also reflects that the hype cycle of MEME coins seems to be getting shorter and shorter.

Judging from the scale of funds invested, the victims of Libra seem to be mainly small and medium-sized retail investors, with the average initial purchase size of the top 1,000 addresses being $9,696. This investment scale is far from the average initial purchase size of $590,000 of TRUMP at the time.

From the perspective of price range, the highest price of Libra reached $4.56. Most of the large investors made their initial purchase at a price above $2.5, followed by the $0.3-0.4 range. There were almost no large investors who entered the market between $1 and $2.5. There may be several main reasons for this phenomenon. First, with the rapid collapse of prices, many large early holders have already cleared their positions. Second, it can be seen from the market that the price range of $1 to $2.5 stayed for a very short time, and it lasted for less than 10 minutes during the previous surge. This range seemed to be occupied by many insider traders, and they had dispersed and cleared their tokens. And during the plunge, it seemed that no large investors were willing to take orders in this price range.

Judging from the time distribution, most of the large holders made their initial purchases on the day of the coin issuance on February 14. Although this group of people seized the time advantage, the outcome of this competition of hand speed was tragic.

Trump’s high-profit address reappears, and the operation details may point to insiders

Previously, when PANews was analyzing TRUMP tokens, it found a strong buying address, 6QSc2CxSdkUQSXttkceR9yMuxMf36L75fS8624wJ9tXv (hereinafter referred to as 6QSc2). This address spent $1.09 million to buy 5.97 million tokens within 1 minute of the TRUMP token issuance, with the maximum profit value reaching $477 million. Based on the operation time, the amount of funds invested, and the discussion on social media, this address is very likely to be an insider address of Jupiter.

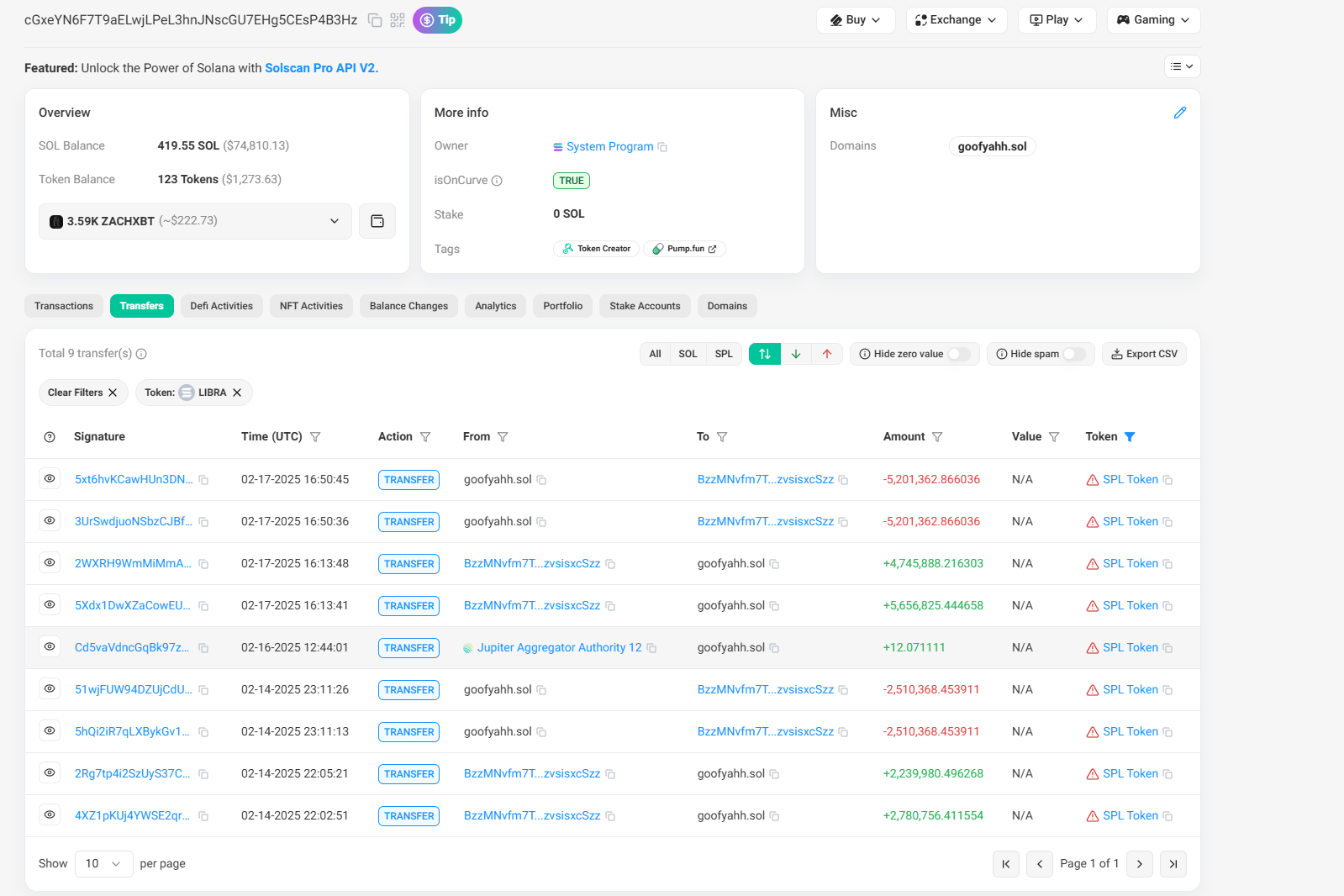

During the issuance of Libra, the association of this address was involved again. cGxeYN6F7T9aELwjLPeL3hnJNscGU7EHg5CEsP4B3Hz (goofyahh.sol) This address is the main address participating in the rush purchase this time. This address has previously received 6QSc2 TRUMP tokens. At 22:02 on February 14, 2 minutes after Libra went online, goofyahh.sol once again spent $5.7 million to buy about 5 million Libra tokens. And sold them all in 1 hour, with a total sales amount of about $7.34 million. Profit of about $1.6 million. However, compared with the last time TRUMP tokens finally made a profit of more than $20 million, this time the profit from Libra is obviously not much.

On February 17, Javier Milei forwarded a tutorial on how to buy LIBRA tokens on X. After LIBRA briefly rose above $0.7, it fell back below $0.5 within an hour. During this process, the address invested another $5 million in a short-term swing operation, earning about $500,000 in profit.

Through these two associated wallet operations, the wallet address is considered to be an insider for several reasons. First, this address has repeatedly sniped other tokens, such as HAWK, CHILLGUY, etc., and the operation methods are basically the same. Second, during the two purchases of presidential tokens, there was a significant change from the normal transaction scale of the address. Previously, the daily purchase scale of this address was about hundreds of dollars. However, millions of dollars were invested in these two token sniping. In addition to being fully confident, there is no other reason for the controller of the address to act out of character. Third, the precise control of the purchase time is also worth noting. Both snipings were concentrated within the first 5 minutes after the token sale, and the funds were collected in advance.

Judging from the various details of the on-chain operations, these sniper addresses are likely related to people who knew the inside story in advance and have formed a set of skilled operating methods. Discussions on social media believe that the insiders of Jupiter are behind these addresses.

About 74,000 addresses suffered losses, and multiple stakeholders disclaimed responsibility

However, since the initial trend of the previously issued tokens was relatively healthy, early holders were basically able to exit with profits, so not many people delved into these insider trading. However, in the issuance of Libra this time, there were obviously more complex forces involved, causing the tokens to collapse in a short period of time, and countless holders suffered heavy losses.

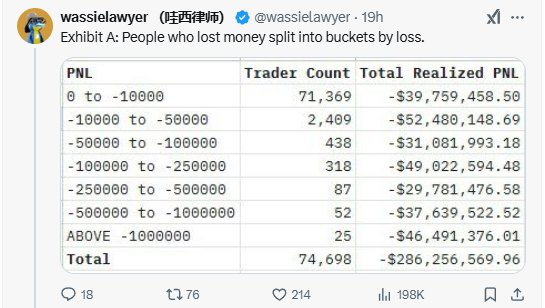

According to statistics from wassielawyer, about 74,000 addresses on Libra suffered losses, with a total loss of more than $280 million. Among them, more than 70,000 addresses lost less than $10,000. Amid public outrage, the investigation into the dark side of Libra has become the hottest topic on social media.

On February 17, Hayden Davis, a consultant for the LIBRA project, admitted that the project team had conducted a sniping operation when LIBRA was launched. KIP Protocol, another market maker suspected of being involved in RUG, said that it did not participate in the token issuance and market making process.

Under the criticism, Ben, the head of Meteora, announced his resignation on February 18, but the public statement showed that the main reason for his resignation was negligence, not personal participation in the token RUG. Ben issued a statement saying, "The platform and individuals have never received or managed any tokens privately, nor participated in off-chain transactions, and all token releases are strictly confidential. Few people in Meteora can access any release information. Usually only they know the release time, and the token/mining pool address will only be provided to me and one or two engineers on duty (if any) a few minutes before the actual release." "For $LIBRA, I was not involved in the project at all except for providing IT support, including commenting on the liquidity curve and helping to verify the authenticity of the token after the public launch of the token."

The founder of Jupiter also published a long article on the matter and stated that it would hire an independent third party (law firm Fenwick & West) to conduct an investigation and publish a report. However, social media did not buy it. Colin Wu pointed out that the law firm was the former main legal advisor of FTX. It is reported that Fenwick & West was also sued in a class action lawsuit in 2023, accused of setting up a "shadow entity" to assist FTX's fraud.

The person in the storm, Argentine President Javier Milei, was also sued by his lawyer for fraud. But Milei said that he was innocent throughout the process and forwarded the LIBRA purchase tutorial in the early morning of February 18, causing the LIBRA price to experience a sharp fluctuation. Milei also said in a TV interview today that he acted in good faith but suffered a blow. "The country did not lose money, and the Argentines lost at most four or five. The vast majority of investors are Chinese and Americans."

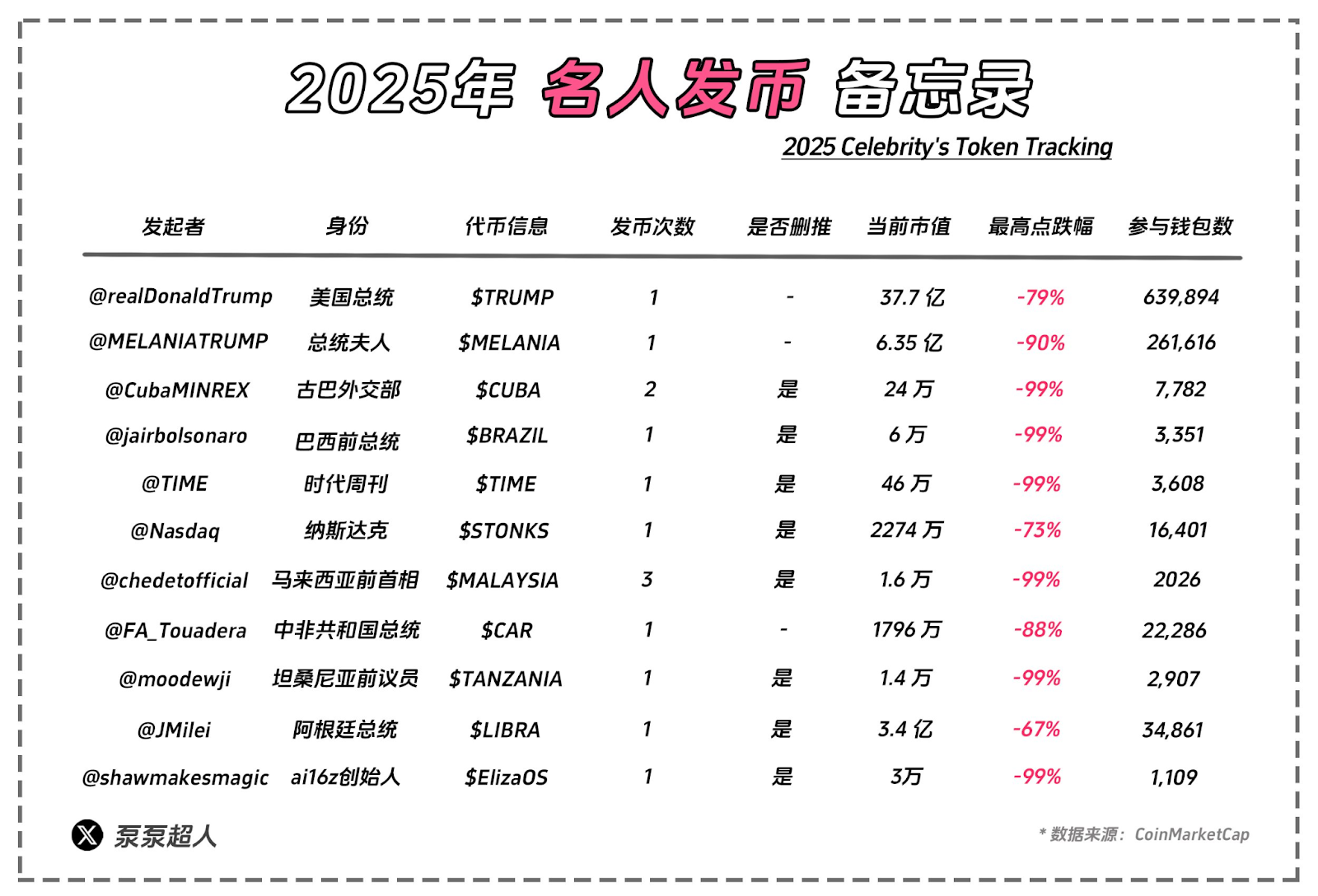

Since US President Trump issued tokens in early 2025, politicians from various countries seem to have found a new way to make money, that is, to harvest from global investors by issuing MEME coins. According to statistics from blogger Pump Superman, among the 11 celebrity tokens that were recently issued, 6 have returned to zero, all of which have fallen by more than 70%, and most have fallen by more than 90%.

In fact, celebrity tokens never seem to be a password for wealth. PANews previously pointed out when analyzing TRUMP tokens that the maximum increase of TRUMP is not large, but the high market value seems exaggerated, and the main reason for the addresses with large profits is nothing more than relying on sufficient investment capital. For retail investors, such tokens full of conspiracy or highly manipulated have almost no chance of winning. Milei also said that those who participated were very clear about the risks they took - they were volatility traders, this was a private matter between individuals, and they all participated voluntarily.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse