Bear Market Survival Guide: Three Cryptocurrency Profit Strategies That Don’t Rely on Market Conditions

Original article: The DeFi Investor

Compiled by: Yuliya, PANews

Despite the recent sluggish performance of the cryptocurrency market, there are still profit opportunities in the market that do not rely on the rise in token prices. In fact, in addition to traditional traders and investors, there are many participants who have made considerable profits in this field through other means. This article will deeply analyze three profit models that do not rely on market trends from the technical and strategic levels.

1. Airdrops and Yield Farms

In the current DeFi ecosystem, the liquidity mining and airdrop mechanism centered on top assets such as BTC, ETH, and SOL is becoming more and more perfect. Taking the Pendle protocol as an example, its smart contract supports the locking of stablecoin assets to obtain a fixed annualized rate of return (APY) of 19%, and a fixed annualized return of 12% for BTC assets. By optimizing the strategy combination and capital utilization efficiency, professional operators can achieve an annualized return of 50-80% on stablecoins.

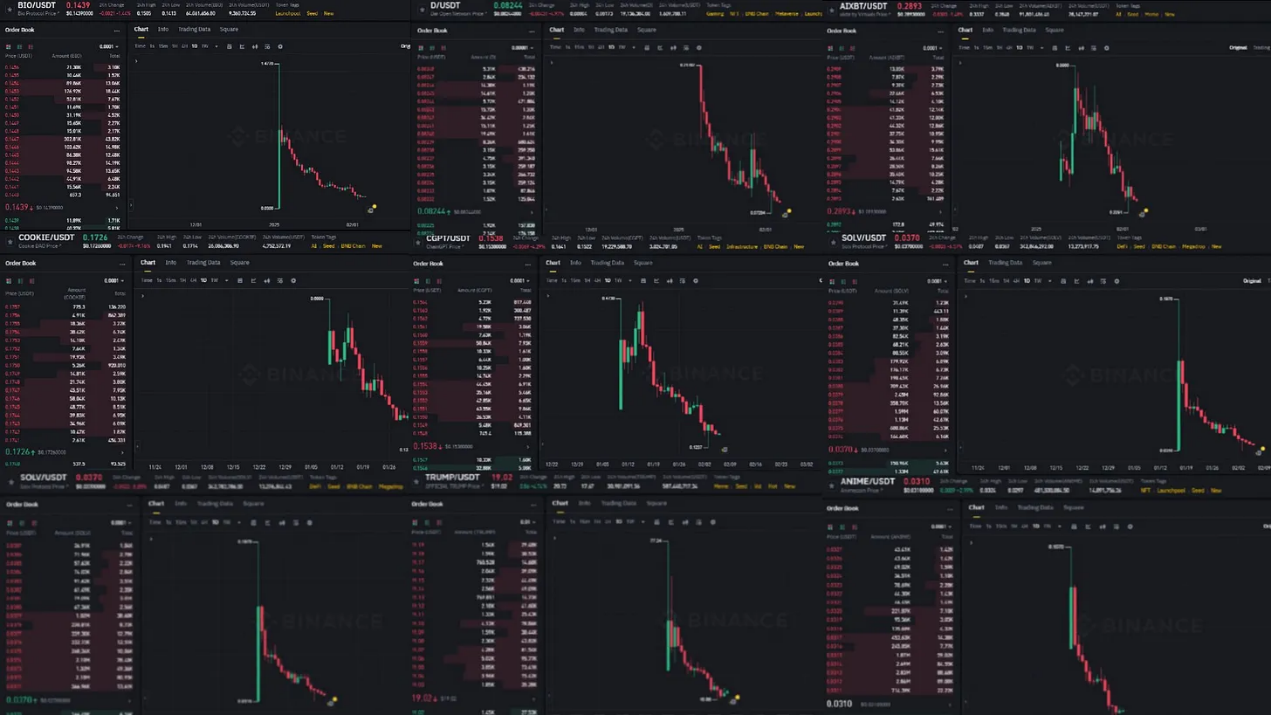

2. Short-selling arbitrage of high FDV new coins

New Tokens Recently Listed on Binance

Technical analysis of newly listed tokens on Binance shows that most tokens show a clear downward trend after TGE . This market phenomenon is mainly due to two core factors:

- Tokens are severely decentralized : On-chain data shows that tens of thousands of tokens are issued every day

- Imbalanced valuation system : Project owners tend to cash out early investors through high valuation models

As the saying goes: "In chaos there is opportunity". This market inefficiency provides professional traders with significant short-selling opportunities. Derivatives trading platforms represented by Hyperliquid provide an effective trading channel for short-selling strategies by quickly launching new coin perpetual contracts. However, it should be noted that considering the high volatility of newly issued tokens, it is recommended to adopt a low-leverage strategy to optimize the risk-return ratio and accumulate strategy experience through small-scale experiments.

3. Funding rate arbitrage (Delta neutral strategy)

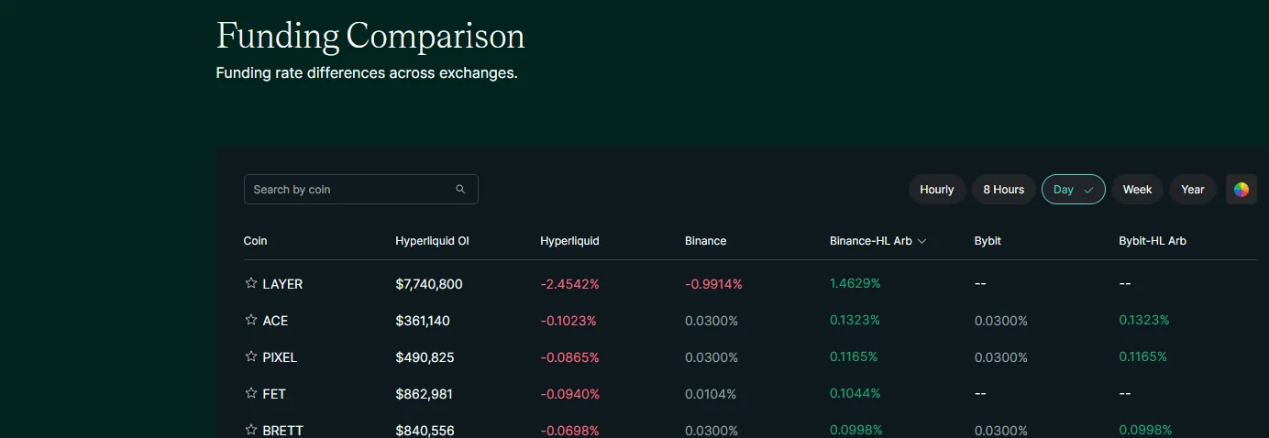

In the pricing mechanism of the perpetual contract market, the funding rate, as a periodic settlement mechanism for long and short parties, provides arbitrageurs with significant profit margins.

- When the funding rate is positive, the long side needs to pay fees to the short side;

- When the funding rate is negative, shorts pay longs.

Professional traders can capture funding rate differences by building a Delta neutral portfolio. In terms of specific operations, when a significant positive funding rate is observed, a $1,000 BTC spot long position and a $1,000 contract short position can be established at the same time (funding rates can be monitored through the Coinglass platform) to obtain stable returns through market neutral strategies.

Currently, protocols such as Ethena and Resolv have developed automated funding rate arbitrage systems to provide users with passive income. However, manually operating multi-product arbitrage strategies, although more time-consuming, may still yield higher returns. Investors can use the "Funding Comparison" function section of the Hyperliquid platform to find arbitrage opportunities.

Summarize

Even during a market downturn, there are still many opportunities in the cryptocurrency space. Contrary to popular belief, there are still many inefficiencies in the crypto market, which provides arbitrageurs with abundant profit opportunities. It is recommended that each participant should find a specific area in which they are good at and can make a profit, and continue to improve and strive to become an expert in this field.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse