BLOCKLORDS ushers in the AI era: How does AI reshape the future of strategy games?

Author: Zen, PANews

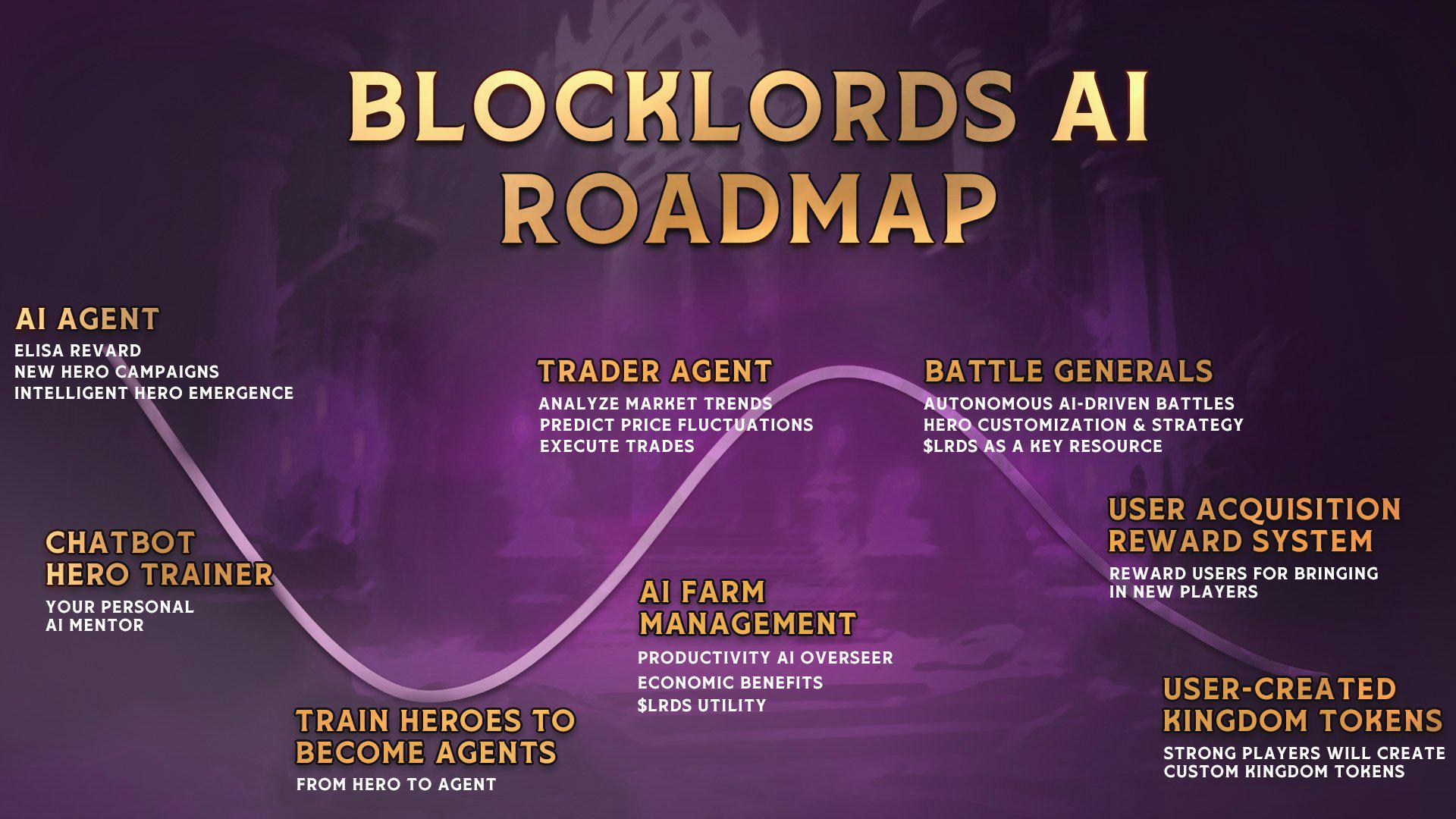

Under the wave of AI revolution in the global gaming industry, BLOCKLORDS has taken the lead in taking a key step and released its cutting-edge AI development roadmap. This update is not only an enhancement to the current strategic game experience, but also heralds a far-reaching change: from passive player decision-making to intelligent hero autonomy, from traditional resource management to AI economic system, and even promotes the deep integration of blockchain technology and AI.

AI reshapes the core gameplay of BLOCKLORDS

According to the AI development roadmap released by BLOCKLORDS, the core parts of its future updates will focus on three key areas: hero intelligence, autonomous economic agents, and game experience optimization.

In the first phase that has been announced, players need to convince the AI character Elisa Revard to choose the strongest person as a spouse, and the final winner will receive a unique AI-enabled NFT. Through the AI hero system that will be introduced later, the hero characters in the BLOCKLORDS game will no longer just passively execute player instructions, but units with autonomous learning and dynamic decision-making capabilities. At that time, players can evolve heroes into autonomous AI agents that can make real-time strategic decisions, allowing them to act autonomously according to the environment and battle conditions. In the future, AI-enabled battle commanders will also be able to dynamically adjust tactics based on the battle situation. This update will no longer limit battles to the traditional "preset AI" mode, but will give AI real tactical thinking, bringing war strategies into the intelligent era.

Although these concepts have precedents or prototypes in some strategy games, such as the AI general system in the "Total War" series, the dynamic NPCs in "Crusader Kings", and the tactical AI in "Company of Heroes", the AI agents introduced by BLOCKLORDS will have higher autonomy, as well as deeper levels of growth and personalization, bringing strategic complexity to a new level.

In terms of in-game economic management, AI-enabled farm systems and trading agents will greatly reduce players' repetitive operations. BLOCKLORDS plans to launch an AI farm system to allow AI agents to help players optimize resource production and make the kingdom's economy more prosperous. Players can get rid of tedious manual management and focus on higher-level strategic decisions. Next, BLOCKLORDS will also introduce the Trader Agent mechanism. As a "professional trader", the AI agent will make the entire market more intelligent. It can analyze market trends, predict price fluctuations, conduct intelligent transactions, and optimize resource allocation based on market conditions, making the kingdom's economic system more prosperous and adaptive, allowing players to manage their assets more efficiently.

Large-scale strategy games usually have complex economic, combat and resource management systems, making it difficult for new players to quickly get started. To address this pain point, BLOCKLORDS will launch an intelligent AI chatbot, so that players can quickly master the complex game mechanics during the interaction. This system will help more players quickly integrate into the BLOCKLORDS world, thereby increasing the overall activity of the game.

In addition, BLOCKLORDS plans to introduce an artificial intelligence incentive system in the future, which will optimize user rewards based on personal gameplay. Based on this, every decision made by players in the game will receive a more personalized and engaging experience, greatly improving the richness and strategic nature of the game.

Building a gaming technology foundation: blockchain, AI, and NVIDIA DLSS

The widespread application of AI requires a stable and transparent technical support. BLOCKLORDS provides reliable protection through its exclusive Layer 3 blockchain LORDCHAIN. LORDCHAIN makes AI behavior traceable through on-chain data storage, ensures the fairness of the game economy, and avoids problems caused by AI cheating or data tampering. This method is similar to the on-chain asset storage mechanism of "Axie Infinity", but BLOCKLORDS further expands the level of AI interaction, allowing intelligent heroes to directly link with players' economic decisions.

In addition, BLOCKLORDS also combines NVIDIA DLSS technology to provide an ultra-high-definition visual experience for the game, making the battlefield empowered by AI more delicate and vivid, bringing a true next-generation strategic gaming experience. Compared with traditional strategy games, BLOCKLORDS allows AI to not only affect combat and economy, but also directly promote the optimization of visual performance.

In the future, a user-created Kingdom Token system may be introduced on LORDCHAIN, allowing players to issue their own in-game economic system and form a completely decentralized ecosystem. This is similar to the user-created economy in Decentraland or The Sandbox, but BLOCKLORDS places more emphasis on AI economic management, so that players do not have to manually manipulate the market, and AI agents will automatically complete resource scheduling.

In general, BLOCKLORDS's AI development roadmap is not only a technological update, but also a profound innovation of the traditional strategic game mode. From the autonomous growth of AI heroes, to the intelligent economic system, to the war strategy commanded by AI, these groundbreaking features are reshaping the competition landscape of the entire gaming industry.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse