Does DeSci need a pump? From the dilemma of the pharmaceutical industry

Original article: Decentralised.co

Compiled by: Yuliya, PANews

Science has been the greatest catalyst for human progress. Yet, the word "science" is often greeted with skepticism these days. When headlines proclaim that "Science shows...", they are more likely to spark ridicule than genuine interest. This growing disillusionment is not without reason - science has increasingly become a marketing term, diluted by corporate interests and straying from its fundamental purpose of advancing human knowledge and well-being.

Decentralized Science (DeSci) is a new paradigm that promises to rebuild scientific research on a more solid foundation. Currently, DeSci projects are mainly focused on the pharmaceutical field, which is one of the low-hanging fruits for improving humanity's most important resource: health.

The funding crisis for scientific innovation

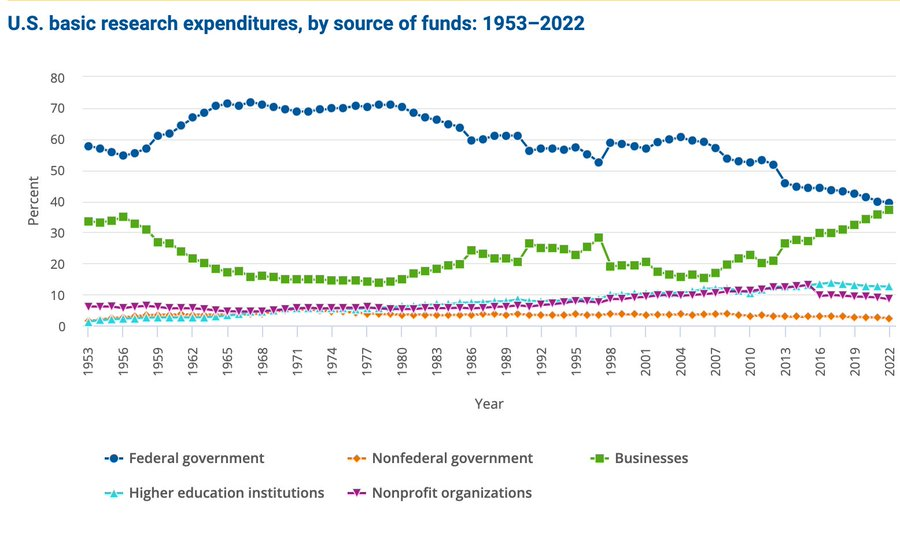

The traditional science funding system is broken. Academic researchers spend up to 40% of their time writing grant applications, but their chances of success are less than 20%. As federal funding has declined, private funding has increased, but it is mainly concentrated in large corporations.

The pharmaceutical industry has evolved into a high-stakes game that is not conducive to innovation. Consider this reality: only 1 in 10,000 compounds discovered will make it to market. The process is brutal. Only 10% of drugs that enter clinical trials will be approved by the FDA, a process that can take up to 15 years and costs more than $2.6 billion per successful drug.

In the 1990s, the concentration of the pharmaceutical industry seemed like a boon—it brought efficiencies, streamlined supply chains, and enabled drug discovery to scale rapidly. But what began as a sophisticated machine as an engine of innovation has morphed into a bottleneck, with the same players hindering progress in an effort to maintain their monopoly, causing costs to soar.

Under the current model, a biotech startup spends years seeking NIH funding for early discovery, then raises $15 million in Series A funding to enter preclinical trials. If successful, it licenses the intellectual property to a large pharmaceutical company, which invests more than $1 billion in clinical trials and commercialization.

This is where incentives get distorted. Instead of focusing on groundbreaking new treatments, Big Pharma has mastered a more lucrative game: patent manipulation. The strategy is simple: When a lucrative drug patent is about to expire, file dozens of secondary patents for minor modifications—new ways of administering a drug, slightly altered formulations, or even just new uses for the same drug.

Take AbbVie’s anti-inflammatory drug Humira. For years, Humira has been one of the world’s best-selling drugs, with annual revenues exceeding $20 billion. Its original patent expired in 2016, but AbbVie filed more than 100 additional patents to block generic competition. This legal maneuvering delayed the entry of affordable alternatives to the market, costing patients and the healthcare system billions of dollars.

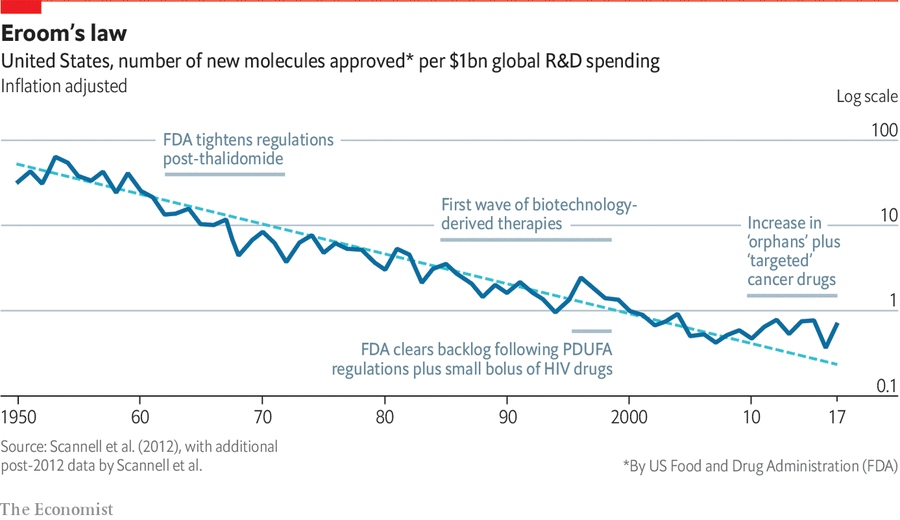

In a recent DeSci debate between Tarun Chitra and Benjels , the issue of stagnation in pharmaceutical innovation was raised, and Eroom’s Law (the inverse of Moore’s Law) was cited.

These practices reflect a larger problem: innovation is captured by the profit motive. Pharmaceutical companies invest resources in tweaking existing drugs—making slight chemical modifications or finding new delivery mechanisms—not because it will lead to major health benefits, but because it will lead to new patents and extended profit margins.

Science on a better track

Meanwhile, a talented and creative global research community remains excluded from the process. Young researchers are constrained by limited funding, red tape, and a "publish or perish" culture that values sensationalism over meaningful research. As a result, rare diseases, neglected tropical diseases, and early exploratory research are severely underfunded.

DeSci is essentially a coordination mechanism. It brings together human capital from around the world—biologists, chemists, researchers—to enable them to synthesize, test, and iterate without relying on traditional institutions. Funding models are also being reimagined. Decentralized Autonomous Organizations (DAOs) and tokenized incentives replace government funding or corporate sponsorship, making access to capital more democratized.

The traditional pharmaceutical supply chain is a rigid, siloed process dominated by a few gatekeepers. It typically follows a linear path: centralized data generation, discovery in closed labs, high-cost trials, exclusive manufacturing, and restricted distribution. Each link is optimized for profitability rather than accessibility or collaboration.

In contrast, DeSci introduces an open collaborative chain, reimagining each stage to make participation more democratic and accelerate innovation. This is mainly reflected in the following aspects:

1. Data and infrastructure

Traditional model: Data is proprietary, decentralized, and often inaccessible. Research institutions and pharmaceutical companies hoard datasets to maintain a competitive advantage.

DeSci Model: The platform aggregates and democratizes access to scientific data, creating a foundation for transparent collaboration.

Example: yesnoerror uses AI to check mathematical errors in published papers to improve the reproducibility and credibility of research.

2. Discovery and Research

Traditional model: Discovery occurs in closed academic or corporate labs, constrained by funding priorities and intellectual property issues.

DeSci Model: DAOs directly fund early-stage research, enabling scientists to explore breakthrough ideas without institutional red tape.

Examples: VitaDAO has raised millions of dollars to fund longevity research, supporting otherwise hard-to-fund cellular aging and drug discovery projects. HairDAO is a collective of researchers and patients documenting their experiences with different compounds to treat hair loss.

3. Market

Traditional model: controlled by intermediaries. Researchers rely on traditional publishers, conferences, and networks to share discoveries and access resources.

The DeSci Model: A decentralized marketplace connecting researchers with funders and tools globally.

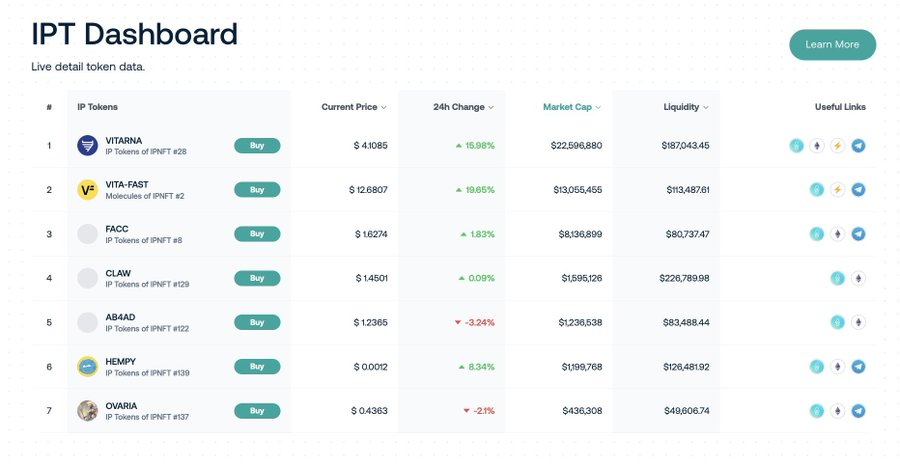

Example: Bio Protocol provides a platform for researchers to create BioDAOs - these DAOs are dedicated to researching new compounds, providing ongoing funding for newly generated biotech assets, and providing a liquid market for tokenized IP. Compared to the field of AI agents, Bio can be seen as the Virtuals of the DeSci world.

Big Pharmai , as the counterpart of ai16z, launched investment in DeSci tokens on Daos.fun. Their AUM has exceeded $1 million and they plan to launch their own Bio agent framework.

4. Experimentation and Verification

Traditional model: Preclinical and clinical trials are costly and often limited to large pharmaceutical companies. Transparency is minimized and failures are often hidden.

DeSci Model: Platform decentralized experiment, global participation and funding support through tokens.

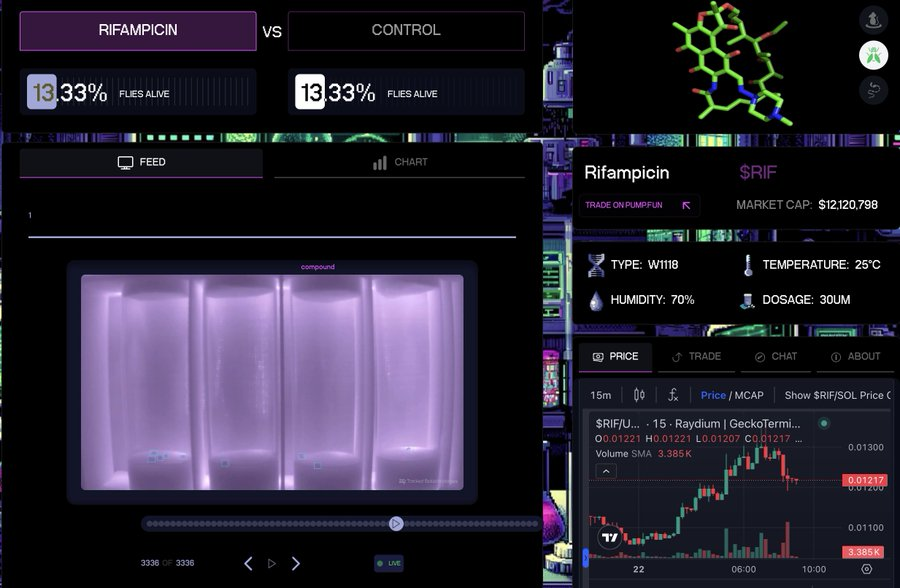

Example: Pump Science used binding curves to crowdfund longevity experiments, advancing compounds from worm testing to fruit flies to rat testing and ultimately to commercialization.

Medical researchers can submit drug research proposals on Pump Science , which helps test these drugs on worms and transmits the experimental results to the platform front-end in real time. Users can speculate on tokens representing these drugs. Two popular tokens, Rif (rifampicin) and URO (uroridin A), are being tested on worms. If they are found to extend lifespan, these compounds will enter the commercialization stage and holders will share in the profits.

The results of these trials are recorded and live on Pump.science

5. IP and monetization

Traditional model: Intellectual property is locked in patent monopolies, creating barriers to innovation and inflating drug prices. Patenting new compounds is expensive, painful and complex.

DeSci Model: The protocol tokenizes IP, allowing researchers to transparently share and monetize discoveries.

- Example: Molecule ’s IP framework enables researchers to fund projects by splitting IP rights into NFTs and tokens, aligning incentives between scientists and funders. However, the model is still in its early stages. Only a few researchers have experimented with tokenizing their IP, and it is still difficult to estimate how profits will flow to holders when the IP is commercialized. In addition, to ensure that the IP is fully protected, researchers may still need to register with traditional government agencies.

BioDAO holds over $33 million in tokenized IPT via the Molecule framework

Accountability Challenges

DAOs face difficulties in coordinating complex tasks and maintaining accountability—few DAOs have demonstrated sustainable success in managing long-term projects. DeSci faces an even greater challenge: it requires researchers to coordinate complex problems, meet research deadlines, and maintain scientific rigor without traditional institutional oversight.

Traditional science, despite its flaws, has established mechanisms for peer review and quality control. DeSci must either improve these systems or develop entirely new accountability frameworks. This challenge is particularly acute given the high stakes involved in medical research. A failed NFT project might lose money, but a poorly executed medical trial could put lives at risk.

Critics have argued that DeSci is merely speculative — nothing more than a trading game. That’s not entirely wrong. History shows that new technologies often struggle before achieving breakout success and capturing the public’s imagination. Just as AI agents gained mainstream attention through projects like aixbt , DeSci may need a defining moment to change perceptions.

The future may not unfold in exactly the way DeSci’s backers envision it. Perhaps it’s not about replacing traditional institutions entirely, but about creating parallel systems that drive innovation through competition. Or, perhaps it’s about finding specific niches — such as rare disease research — where the traditional model has failed.

Imagine a world where brilliant minds, unconstrained by borders or budgets, work to solve humanity’s greatest medical challenges—where breakthroughs from a lab in China can be instantly validated in Singapore and scaled up in São Paulo.

Pioneers are building this future step by step. Take Bryan Johnson , an independent biohacker who is experimenting with off-label medications and unconventional treatments. While his methods may worry traditionalists, he embodies the spirit of DeSci: experimentation takes precedence over gatekeeping.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse