A Deep Dive into Ethereum Issuance and Destruction: The Cat-and-Mouse Game

By Justin Drake, Ethereum Foundation Researcher

Compiled by: Felix, PANews

The ETH supply is currently growing at 0.5% per year. That is, 1% of the supply is issued per year minus 0.5% of the supply is destroyed per year. To achieve excess returns again, either the supply will decrease or the supply will increase. I personally think both will happen.

ETH and BTC

Before we delve into the issuance and destruction of Ethereum, let’s briefly introduce ETH and BTC.

Internet native money is a massive opportunity, worth tens of trillions of dollars. Monetary premiums rarely accumulate at scale. You need a truly compelling asset with outstanding properties for social coordination.

At first glance, moneyness is a zero-sum game. In the Internet age, gold is ready to be demonetized. There are only two candidate currencies that can replace it and win the battle for Internet money - BTC and ETH. No other currency can match it. Personally, I think the decisive factors are credible neutrality, security and scarcity.

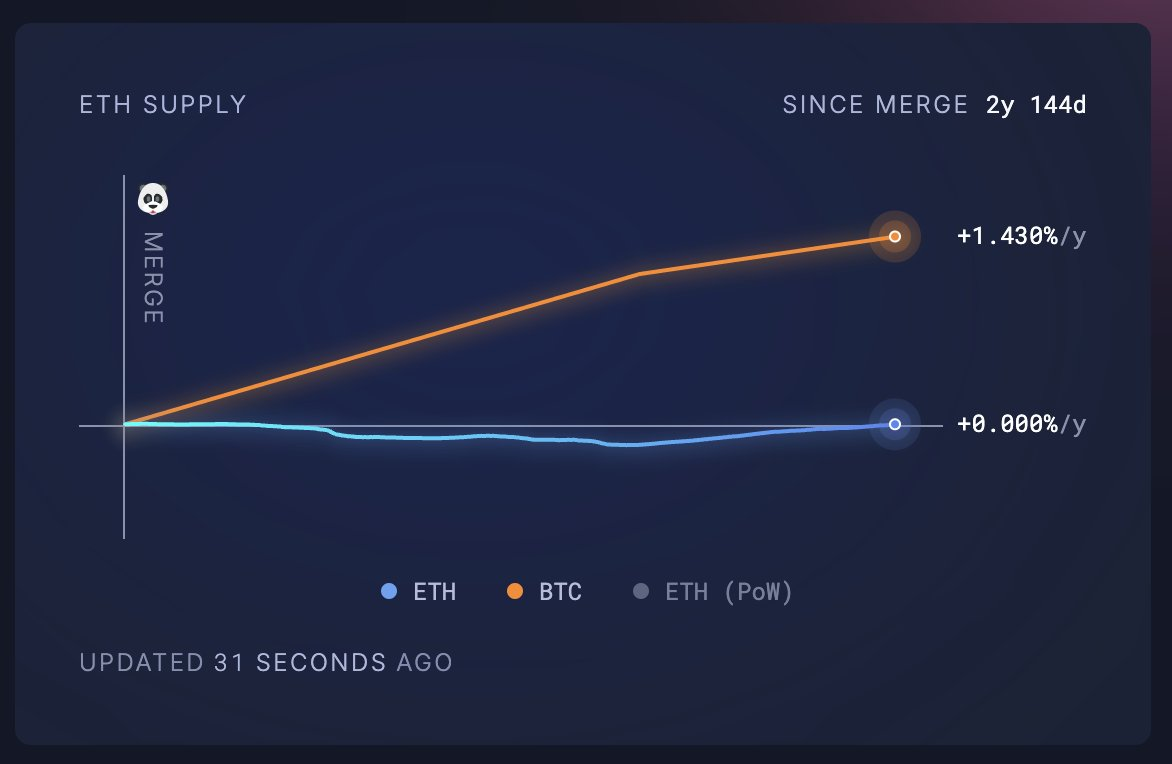

Since the Ethereum merger, ETH has become scarcer than BTC. Notably, BTC supply has grown by 666K, worth $66B, while ETH supply has remained flat. Today, BTC supply is growing at 0.83% per year, 66% faster than ETH. For those looking into the future, ETH supply will decrease again.

Scarcity is important, but ultimately the battle for internet money may be settled by security. Ironically, the famous 21 million BTC cap is the culprit. BTC issuance will drop to zero — the most powerful social contract of Bitcoin. After a few halvings, issuance will be so small that it doesn’t matter.

Here’s a statistic: In the past seven days, only 1% of miners’ income came from Bitcoin fees, and 99% came from Bitcoin issuance. This is still the case despite four halvings, a 16-fold reduction in issuance, and despite people having spent 15 years finding Bitcoin’s transaction utility.

Personally, I think the Bitcoin blockchain is obsolete. To sustain a 51% attack on Bitcoin would require about $10 billion and 10GW of electricity. For a nation-state, the cost is negligible. As for electricity, Texas can produce 80GW. BTC has a security ratio of 200 to 1, a $2 trillion asset secured by a $10 billion economic security.

Any shortable instrument related to BTC mining incentivizes a 51% attack. There is $20 billion worth of Bitcoin mining stocks - stocks that would immediately go nuclear. There is $40 billion in BTC open interest - direct short exposure. Not to mention the potential short exposure through $100 billion ETFs and $100 billion MSTR.

Does BitVM solve the fee problem? Any BitVM bridge is an incentive to conduct a 51% attack on Bitcoin. In fact, a 51% attacker can censor fraud proofs and drain the BitVM bridge during the challenge period. Ironically, BitVM can be said to be a direct attack on Bitcoin.

If BTC price rises 10x and surpasses gold, is Bitcoin still safe? Assume this happens in the next 11 years. BTC will become a $20 trillion asset, but the issuance will be reduced by 8x due to three halvings. The safety ratio will exceed 1000 to 1. I personally think this is untenable, especially when BTC becomes institutionalized, more liquid, and ultimately easier to short. Imagine $1 trillion in perpetual open interest, but only $10 billion in economic security.

Can Bitcoin somehow fix itself before it’s too late? Bitcoin is the epitome of blockchain ossification. Can it have a 1% tail issuance per year? Maybe Bitcoin could switch to PoS and rely on minimum fees? PoS is blasphemy. Maybe Bitcoin could switch to another PoW algorithm? No, that nuclear option won’t help. Maybe Bitcoin could have big blocks and sell data availability on a massive scale? Well, there was a holy war for small blocks.

If you have read this far and understood the above, congratulations. Even today, few people realize the long-term impact of Bitcoin PoW and the impact on BTC assets. This is an opportunity to preempt execution, but patience is required. The time is not 1 month, not even 1 year - it is 10 years.

Speaking of long-term frames, Lummis’ suggestion of locking up BTC for 20 years is a bit crazy — by then Bitcoin would be obsolete. Worse, if the US holds trillions of dollars in BTC, this would directly incentivize America’s enemies to launch a 51% attack. Contrary to popular belief, Bitcoin is not at all resistant to nation-states — countries like Russia could easily launch a 51% attack.

ETH issuance

Back to ETH. The current issuance curve is a trap. Unfortunately, like Bitcoin's issuance, Ethereum's issuance design is wrong. It guarantees a 2% tail APR even if 100% of ETH is staked. Since the staking cost is much lower than 2%, every rational ETH holder will be incentivized to stake.

When most ETH is staked, it will face losses:

→ ETH swap: Liquid staking tokens like stETH and cbETH replace raw ETH as collateral. This injects systemic risk into DeFi (custody risk, slashing risk, governance risk, smart contract risk). This swap also weakens ETH’s role as a unit of account and has further knock-on effects on monetary premiums.

→ Real profits and tax rates: Real profits, i.e. earnings adjusted for supply growth, decline as ETH staking increases. When 100% of ETH is staked, all ETH holders are diluted equally. Worse, income taxes are levied on notional earnings. It would be a tragedy if no stakers enjoyed positive real profits while all ETH holders were subject to billions of dollars of selling pressure each year.

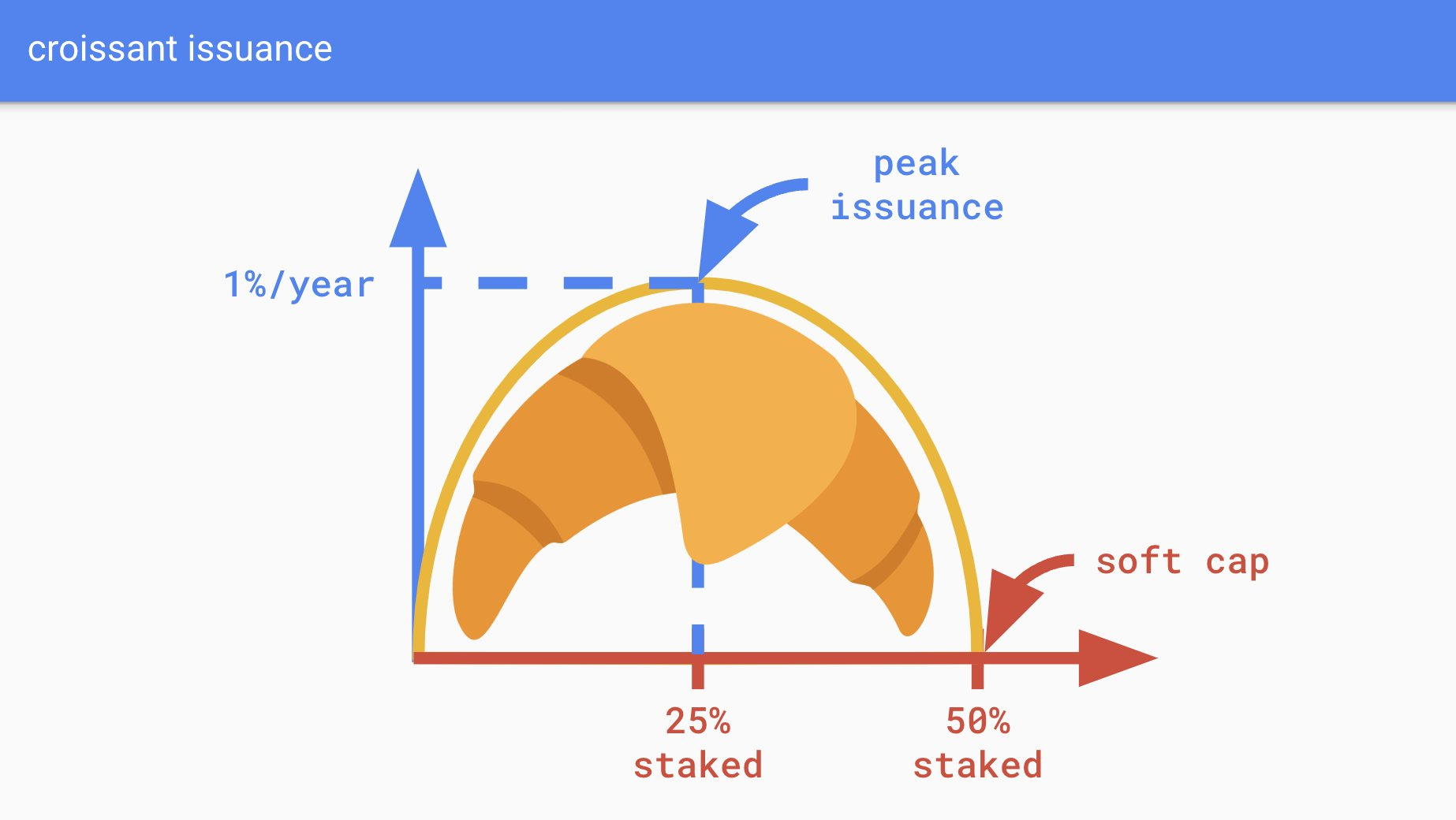

I personally believe that the issuance curve should drive the discovery of a fair issuance rate through staker competition - rather than an arbitrary 2% floor. This means that as ETH stakes increase, the issuance curve must eventually fall and return to zero. My personal suggestion is "Croissant Issuance".

The Croissant Release is a simple half-ellipse with two parameters:

→ Soft Cap: The percentage of tokens staked when issuance reaches zero. A 50% staked soft cap feels credible, neutral, and pragmatic.

→ Peak issuance: The theoretical maximum issuance that ETH holders are subject to. An arbitrary integer (e.g. 1% per year) will do, as the final interest rate will be determined by the market.

Ethereum Foundation researchers have been studying issuance for years - there is a rough consensus that the current curve is broken and needs to change. It is not easy to guide the social layer to change issuance. This is an opportunity for the champions to deal with this situation and coordinate changes to the mainnet in the next few years.

ETH Burn

I personally think that a sustainable way to destroy a large amount of ETH is to expand data availability. It is more profitable to have a DA with 10 million TPS and pay $0.001 per transaction than to have 100 TPS and pay $100 per transaction.

I wouldn’t be surprised if we see hundreds of ETH blobs destroyed per day this year, and then that destruction could suddenly plummet again due to peer data availability (DAS) in the Fusaka fork.

Yes, the introduction of blobs by EIP-4844 reduces the total burn to some extent, which is a natural phenomenon of supply and demand. When the demand for DA catches up with the supply, blobs are expected to be burned in large quantities. In a few months, the Pectra hard fork will double the number of blobs. The short-term goal is growth, and a lot of growth is expected.

There will be a cat-and-mouse game between supply and demand over the next few years until the full Danksharding deployment is complete. I wouldn't be surprised if this year saw hundreds of ETH blobs destroyed per day, and then this destruction suddenly collapsed again due to the peer DAS crash in the Fusaka fork.

Looking ahead, this is about building infrastructure for the coming decades and centuries. The fundamentals will emerge in the next few years. Whether it is Bitcoin security, ETH issuance or ETH destruction, be patient and have faith.

Related reading: Ethereum Foundation’s “Game of Thrones”, where is the foundation’s major reform heading?

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse