Dialogue with Zagabond, founder of Azuki: Building a community-led anime universe, three major components to start the flywheel effect

Author: Nancy, PANews

Recently, PANews interviewed Zagabond, the founder of Azuki. In the interview, Zagabond made an in-depth analysis of the development and development of the animation industry and its predicament, and pointed out that Animechain will solve the core pain points in the current animation industry, such as the lack of fan loyalty and the unequal distribution of creators' income, and will bring a more immersive and interactive experience to animation fans. At the same time, he also reflected on Azuki's experience and lessons in brand marketing, and insisted on the construction and ecological expansion strategy of Ethereum.

With the community at its core, Animecoin will create a flywheel effect through three major components

"In 2022, Azuki began building an open anime universe, pioneering decentralized brand building. Now, with the help of the Animecoin Foundation, we are creating the next chapter of anime. The season for ANIME is here." Since the announcement of the launch of the anime network Animechain in March 2024, there have finally been new developments recently. The official announced the token economics of ANIME, and will officially conduct TGE (token generation event) on January 23.

ANIME’s token economics show that 50.5% of the total supply will be allocated to the community, with 37.5% going to the Azuki community as an early supporter of the Animecoin ecosystem and 13% going to the DAO treasury for use based on governance proposals passed by AnimeDAO.

Zagabond pointed out in the interview that "Animecoin is a community-led movement with no VC allocation." He further added that the Animecoin Foundation is the leader in the development of Animechain, as an independent entity, responsible for the governance process of AnimeDAO, and is committed to promoting the growth of the Animecoin ecosystem. It will use its allocated funds to fund startup and ongoing operations, funding programs, and other initiatives to bridge the gap between Animecoin and the broader global anime industry. Azuki is a core contributor to the Animecoin Foundation, supporting the Foundation in fulfilling its mission of managing the development and growth of the Animecoin ecosystem.

As for the reason for the launch of Animechain, Zagabond said in an interview that anime has risen from a subculture to become part of mainstream pop culture. Luxury fashion brands like Chanel and Burberry are working with anime brands, athletes are citing anime in post-game interviews, and rappers like Megan Thee Stallion are sampling anime soundtracks. Despite this, there are still some major structural problems in the anime industry. On the fan side, although fans spend a lot on cryptocurrencies, their loyalty and consumption are not effectively attributed. On the creator side, many animators and intellectual property holders do not earn good returns due to the unique financing structure of the Japanese anime industry.

Anime 2.0 presents a unique opportunity for cryptocurrency to revolutionize the anime fan experience by integrating these fragmented fan components on-chain, allowing IP holders to accurately assess fan loyalty and open up new revenue opportunities for more engaged fan bases.

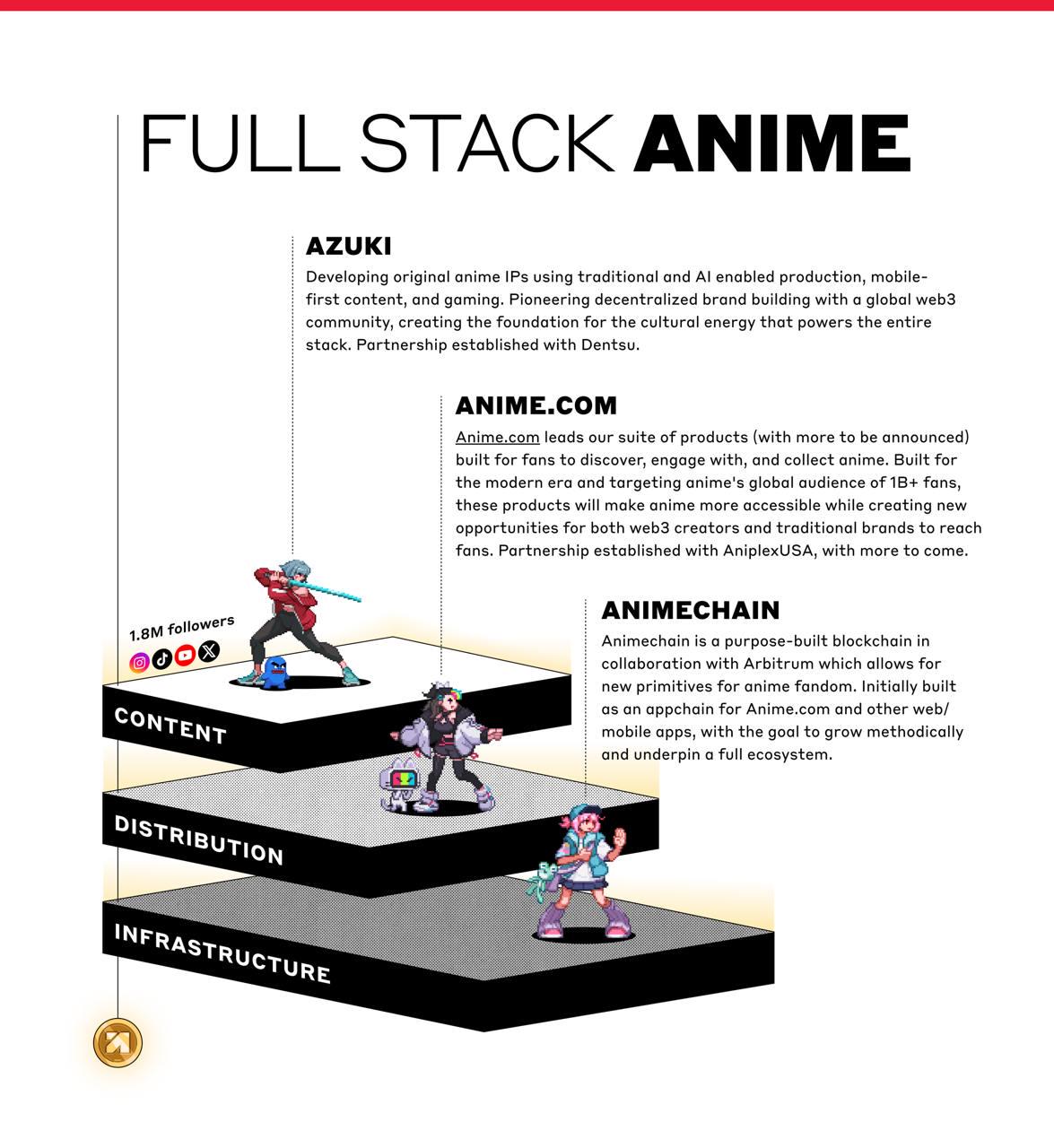

"Full Stack ANIME" will support the realization of the Anime 2.0 vision by creating a flywheel effect where each component promotes the growth of other components. Only as more users and developers join, the network will become more and more valuable and self-sustaining.

It is understood that Full Stack ANIME consists of three parts: blockchain infrastructure, consumer platform and IP:

Dedicated infrastructure (Animechain): Animechain is a L3 blockchain that uses Arbitrum Orbit technology, with Animecoin as a custom gas token. This setup simplifies the experience for Web2 anime fans: they only need to understand and purchase Animecoin (reducing the complexity of managing multiple tokens), while also allowing gas-free transactions for seamless onboarding.

Consumer Platforms and Products (Anime.com): Onboarding Web2 users through consumer products is key to triggering the flywheel effect and increasing value. A large user base will attract more teams to build on the network, which will bring in more users. Anime.com aims to achieve for the anime industry what Discord did for games - becoming the dominant social layer for the entire anime industry.

Content and IP (Azuki): IP development provides the foundation for driving the cultural energy of the entire ecosystem. The IP layer ties the pieces together, uniting the community’s passion for Animecoin.

It is worth mentioning that, according to Zagabond, Azuki has carried out in-depth cooperation in the field of animation during this process. For example, Azuki has established a cooperative relationship with Dentsu, a leading Japanese animation production studio; the first episode of the "Enter the Garden" anime anthology series released by Azuki, "The Waiting Man", was produced by the well-known creative producer Goro Taguchi, who has participated in "Code Geass" and the One Piece movie "One Piece Film Red", etc. The voice cast includes Sugita Tomokazu (who has participated in "Gintama"), Kito Akari (who has participated in "Demon Slayer") and Fukuyama Jun (who has participated in "Code Geass"); Azuki cooperated with AniplexUSA to launch the digital collection experience of the "Fate/strange Fake" IP on Anime.com. This year, the team will announce more animation partnerships this year, and some of the discussions currently underway will be shared with you soon.

Adhering to the ecological expansion strategy and focusing on Ethereum construction is a priority

“As a brand, Azuki represents resilience, growth and innovation. We are proud to have overcome many challenges and remain standing in Web3. The community trusts the team and works with us to create an open anime universe, which is a testament to us,” Zagabond told PANews.

As an old NFT project, although Azuki once became popular with its unique Japanese art style, especially resonating among anime fans, NFT projects now have to face multiple challenges such as the overall market downturn, oversaturation of the market, and user aesthetic fatigue. In addition to exploring more feasible paths, NFT projects including Azuki have also reflected on the problems in the project development process to better meet the needs of the audience.

For example, in the execution of the release of Azuki Elementals, especially in terms of marketing and communication, Zagabond believes that Azuki still has room for improvement. He further pointed out, "In the past, Azuki has emphasized mystery and surprise in product releases, but as the market has evolved, this approach is no longer appropriate. Elementals has taught the team important lessons about transparency and expectation management. I still support the decision to expand the Azuki universe, but we have adjusted our approach to better align with the needs of the community and ensure clear communication and community participation."

However, Zagabond also admitted in the interview that the core strategy of broadening the Azuki ecosystem is still correct, which has been verified by the addition of new and vibrant community members to Elementals. Azuki Elementals represents the team's vision to expand the Azuki universe by creating a more convenient entrance to the garden. Azuki has achieved unprecedented success through Elementals - it is still the most complex hand-painted PFP series to date, with artistic complexity and feature combinations unmatched in the industry.

Regarding the trend of the NFT multi-chain ecosystem, including the fact that many NFT projects have begun to choose to expand to other chains, Zagabond said, "My crypto journey began in 2017, when the blockchain ecosystem was relatively simple. While working at 0x, I participated in the development of matcha.xyz, a DEX aggregator. We foresaw early on that the future would be multi-chain, and today this vision has become a reality. Each chain has its own active community and unique culture. Azuki has found its home on Ethereum, and its core story and IP naturally fit with the values of this chain, 'technological optimism and decentralization'. This fit is so fundamental that I often describe Azuki as the 'crypto anime layer' - we are not just building on Ethereum, we are practicing its philosophy."

“I like to compare Azuki’s growth strategy to that of a fashion brand. The strongest brands first build a solid core identity and a loyal fan base in their home market before considering international expansion. Now, Ethereum is our home, and we still have a lot to do here.” But Zagabond also revealed that Azuki is also willing to make strategic attempts on other chains in the future - but only when the time is right and it is in line with the vision.

Driven by today's market demand, platform competition and narrative changes, the NFT landscape is undergoing a profound transformation. NFT projects such as Azuki retain and emphasize their own unique culture while improving their practicality and investment value by expanding into the animation industry. This trend may indicate that NFT's in-depth exploration of actual landing scenarios has also opened up more paths for the flow of NFT assets and the transformation of value.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse