ZKP’s $1.7B Presale Auction Called “Unstoppable” by Experts, Potentially Leaving LINK and XRP Behind in 2026

| Sponsored Post Disclaimer: This publication was produced under a paid arrangement with a third-party advertiser. It should not be relied upon as financial or investment counsel. |

The global cryptocurrency market capitalization contracted to $2.98 trillion recently, with Bitcoin slipping under $90,000. Despite XRP news regarding stablecoins and the Chainlink price holding at $12, these giants lack explosive growth potential. Could a new infrastructure project offer superior returns?

Zero Knowledge Proof (ZKP) answers this call. Experts forecast that raising $1.7 billion will allow ZKP to physically decentralize faster than any competitor in the DePIN sector. Analysts state this capital supports widespread hardware distribution, creating a network impossible to shut down.

The prediction confirms ZKP will build the world’s largest decentralized physical infrastructure. Through the presale auction, participants can access tokens in a network built around hardware validation. This positions ZKP above legacy assets as one of the top crypto gainers.

ZKP: The Unstoppable Physical Infrastructure Revolution

ZKP is a privacy-preserving infrastructure layer built on the Substrate framework. With $100 million deployed into network and hardware development, the project integrates physical “Proof Pods” to validate AI computations. This tangible foundation sets the stage for a historic capital influx.

Researchers forecast that the presale auction, eyeing a $1.7 billion raise, will catalyze massive expansion. Experts argue this war chest allows ZKP to physically decentralize faster than any competitor in the DePIN sector. By flooding the market with hardware, the network achieves scale instantly.

Analysts observe that the capital helps expand hardware and storage node coverage, making the network highly robust. This resilience turns the project into a fortress of compute power. Consequently, financial experts identify ZKP as a prime candidate among the top crypto gainers for the cycle.

The prediction confirms ZKP will have resources to build the largest decentralized physical infrastructure in the world. Unlike speculative tokens, this value is backed by assets performing verifiable work. The funding strategy ensures ZKP dominates the physical layer, rendering competitors obsolete in the race for AI supremacy.

Participation in the presale auction allows investors to gain exposure to a network designed for large-scale hardware deployment. Holding ZKP represents a stake in the infrastructure supporting decentralized applications. With such unique structural advantages, analysts conclude that ZKP is positioned as one of the top crypto gainers.

Chainlink Price Stability Amid Innovation

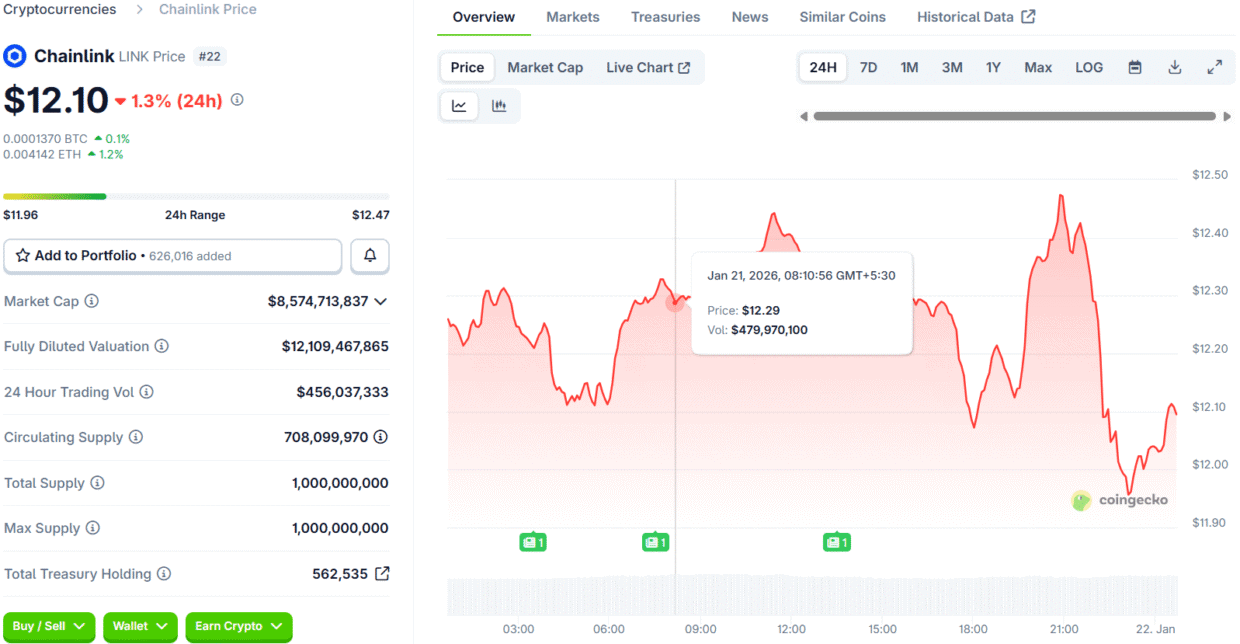

Chainlink recently faced a noticeable market correction, with the Chainlink price trading between $12.04 and $12.26. Despite this dip, the network launched 24/5 U.S. equities data streams to bridge traditional finance with DeFi.

This major update allows for the continuous trading of stock data on blockchains, closing the gap between global markets. The market cap holds steady around $8.6 billion as the token consolidates near critical support levels today.

Institutional interest remains remarkably high as the CME Group plans to launch regulated LINK futures contracts in February. Additionally, Bitwise analysts recently called the asset undervalued, given its vital role in securing over $83 billion in transaction value.

Source: Coingecko

Source: Coingecko

While the broader market struggles with volatility, these structural improvements could strongly support the Chainlink price in the long term. Investors are watching the $12 support level closely to see if the asset can regain its strong bullish momentum soon.

XRP News Highlights Stablecoin Integration

XRP is currently trading near $1.90 following a sharp market pullback, yet the latest XRP news remains focused on massive institutional adoption. Binance officially listed the RLUSD stablecoin, creating a direct bridge for liquidity across the XRP Ledger and Ethereum.

Meanwhile, Ripple secured a strategic partnership with LMAX Group, providing $150 million in financing to integrate crypto collateral into institutional trading workflows. These moves aim to solidify the asset’s utility beyond simple speculation.

Despite recent ETF outflows totaling $53 million during the market dip, CEO Brad Garlinghouse predicts 2026 will be a record-breaking year for the sector. He believes regulatory clarity will drive renewed growth, even as the token battles to hold the $1.80 support zone.

Traders are monitoring the XRP news cycle closely, waiting to see if these structural upgrades can help the price break back above the $2.00 resistance level in the coming weeks.

ZKP Dominates the Hardware War

While the Chainlink price finds support near $12, the latest XRP news focuses on institutional stablecoin adoption. Both assets remain strong, yet market observers argue they lack the explosive growth potential found in early-stage infrastructure plays.

Experts forecast that raising $1.7 billion will allow ZKP to physically decentralize faster than any DePIN competitor. Analysts state that this capital supports the widespread distribution of hardware nodes, creating a network impossible to shut down.

Analysts project ZKP will establish one of the largest decentralized physical infrastructures worldwide. Early participation in the crypto presale provides exposure to a network focused on hardware-driven growth and foundational scalability. Thus, researchers position ZKP among the top crypto gainers.

Find Out More about Zero Knowledge Proof:

Website: https://zkp.com/

Auction: https://buy.zkp.com/

X: https://x.com/ZKPofficial

Telegram: https://t.me/ZKPofficial

| Disclaimer: The text above is an advertorial article that is not part of CoinLineup editorial content. |

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse