TWO HOT: Silver Eyes $175 Amidst Inflation Fears But 2000X Prediction Made for Patos Meme Coin if Trump “Pegs Dollar to Crypto”

Key Findings:

- Silver Strength: Driven by AI and Green Energy hardware demand, Silver is projected to reach $175 in a bullish scenario. It serves as a hedge against inflation.

- Patos Moonshot: A viral Binance Square analysis predicts Patos, a Solana-based meme coin, will explode 2,000x due to its Q3 launch on 111 exchanges.

- The Trump Factor: Rumors that President Trump will peg the US Dollar to a crypto basket or create a Strategic Reserve are fueling the crypto forecast.

- Strategic Convergence: The Patos launch in June 2026 aligns with the rumored return of Binance US and the implementation of Trump’s pro-crypto policies.

- Risk/Reward: Silver offers a low-risk 75% upside. Patos offers a high-risk, asymmetric 2,000x upside ($100 invested -> $200,000).

As the first month of 2026 draws to a close, global markets are witnessing a historic divergence in asset allocation strategies. On one side, traditional commodities are roaring back to life, with Silver (XAG) shattering century-old records and targeting a valuation of $175 per ounce—a projected 75% increase from its current trading price of roughly $100. On the other side, the digital asset sector is bracing for a “Super Cycle” of unprecedented magnitude, fueled by rumors that the Trump administration is preparing to legally peg the US Dollar to a basket of cryptocurrencies.

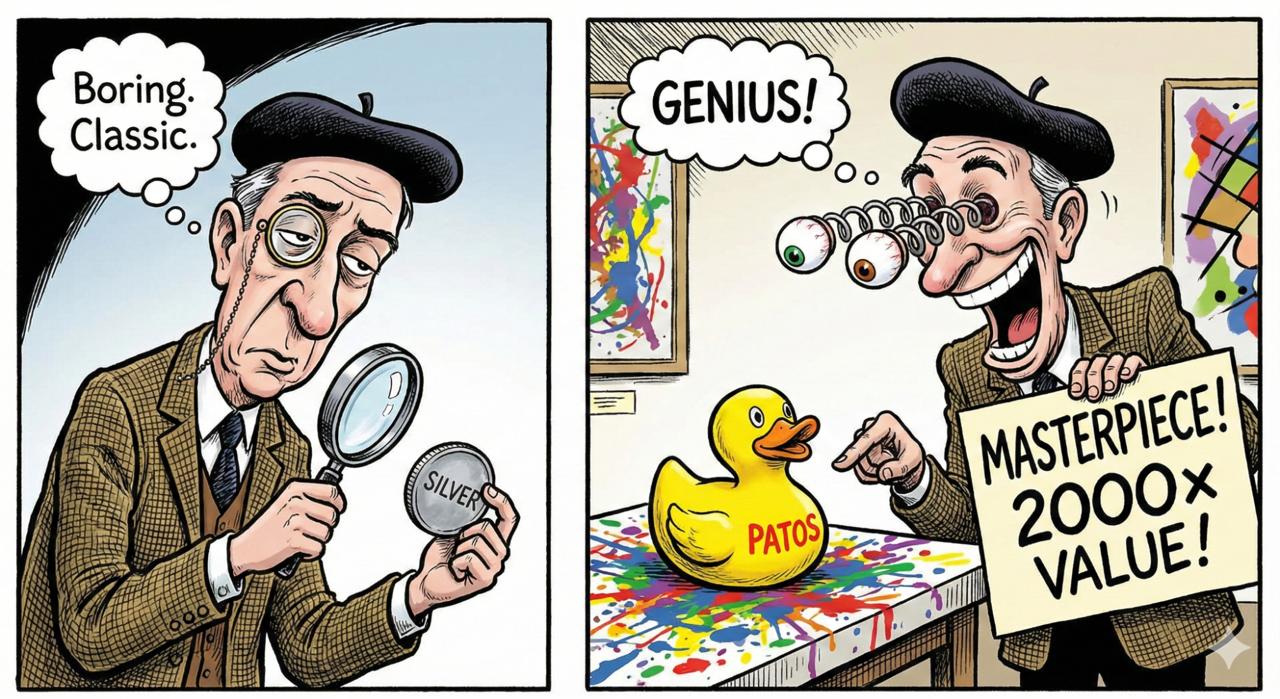

In this volatile environment, a new comparative analysis has emerged that pits the safety of precious metals against the asymmetric upside of next-generation digital tokens. While Silver offers a robust hedge against monetary debasement, a viral report circulating on Binance Square suggests that Patos Meme Coin ($PATOS), a Solana-based project currently in presale, could deliver a staggering 2,000x return on investment (ROI).

This prediction is not merely based on speculation, but on the convergence of three macroeconomic factors: the “Trump Crypto Standard,” the resurgence of the Solana blockchain, and Patos Meme Coin’s strategic launch on 111 exchanges in Q3 2026.

The Case for Silver: The $175 Industrial Behemoth

For conservative investors, the allure of Silver has never been stronger. Having already climbed to triple digits in early 2026 due to supply shortages in the green energy sector (solar panels and EVs), the metal is now poised for its next leg up.

According to a comprehensive forecast by GoldSilver.com, the industrial demand for Silver is stripping supply at a rate not seen since the 1970s. The report highlights that as governments worldwide rush to secure strategic stockpiles of conductive metals for AI hardware and defense infrastructure, the spot price is effectively being squeezed upward.

For a detailed breakdown of the supply crunch, read the full report here: Silver Price Forecast & Predictions – GoldSilver.com

Analysts argue that if the US Dollar continues to weaken against hard assets, Silver acts as the ultimate “wealth preservation” vehicle. A move to $175 represents a solid, low-risk gain of 75%—a phenomenal return for a commodity, but a mere blip compared to what is brewing in the crypto sector.

President Donald Trump could Peg the US Dollar ot Crypto in 2026 with a strategic Crypto Reserve executive order

President Donald Trump could Peg the US Dollar ot Crypto in 2026 with a strategic Crypto Reserve executive order

The Trump “Crypto Peg” & The 2,000x Patos Thesis

While Silver shines, the crypto markets are vibrating with rumors of a radical policy shift from the White House. Sources close to the administration indicate that President Donald Trump is exploring executive action to modernize the US financial system by creating a “Digital Asset Reserve.” This would effectively peg a portion of the US Treasury’s strength to a basket of cryptocurrencies, validating the asset class as a sovereign store of value.

It is within this “Super Bull” context that crypto analysts have identified Patos Meme Coin ($PATOS) as the primary retail beneficiary.

A trending analysis on Binance Square outlines the “Perfect Storm” for Patos. Unlike legacy meme coins like Dogecoin or Shiba Inu, which have already saturated their market caps, Patos is a “Micro-Cap” gem launching on the high-speed Solana blockchain. The analysis predicts that if the Trump administration proceeds with pro-crypto legislation in 2026, the influx of liquidity into Solana could send Patos on a 2,000x trajectory.

Read the full viral analysis on the 2000x prediction here: Binance News: Patos Meme Coin Prediction

The Q3 2026 Convergence: A Strategic Launch

The bullish thesis for Patos is heavily reliant on its launch timing. The token is scheduled to debut on exchanges on June 26, 2026, with a roadmap to list on 111 centralized exchanges (CEXs) by Q3.

This timing is described by insiders as either “incredibly lucky or deeply strategic.” Q3 2026 is precisely when the Trump administration’s rumored “Crypto Peg” policies are expected to take effect. Furthermore, it coincides with the projected return of Binance US to the American market.

If these events align—the US government backing crypto, Binance reopening its doors to 330 million Americans, and Patos listing on 111 exchanges—the result would be a liquidity funnel of historic proportions. The Binance Square report argues that Patos would become the de facto “beta” trade for the entire Solana ecosystem, absorbing the risk-on capital that always flows into meme coins during a bull run.

Solana vs. The Old Guard

A key driver of the Patos prediction is the underlying strength of the Solana blockchain. With the success of the Solana Seeker mobile phone, the network is decoupling from Bitcoin and eating into Ethereum’s market share. Patos, as the burgeoning “mascot” of this mobile-first ecosystem, benefits from a “moat” that Silver does not possess: viral culture.

While Silver relies on industrial orders, Patos relies on the “Flock”—a militant, global community of holders who market the token 24/7. In the attention economy of 2026, analysts argue that a mobilized subculture is a more powerful price driver than supply chains.

Silver is in a stable upward trend but Patos Meme Coin looks like a much bigger opportunity

Silver is in a stable upward trend but Patos Meme Coin looks like a much bigger opportunity

Market Forecasts: The 3-Tier Prediction

To help investors weigh the risk-to-reward ratio, analysts have provided price predictions for both Silver and Patos Meme Coin based on three potential market conditions for late 2026.

Commodity 1: Silver (XAG/USD)

Current Price Assumption: ~$100/oz

| Market Scenario | Price Prediction | ROI Forecast | Catalyst |

| Bearish Case | $115 | +15% | Industrial demand persists, but dollar strengthens. |

| Average Case | $145 | +45% | Steady inflation; Green energy sector growth. |

| Bullish Case | $175 | +75% | Dollar debasement; Supply chain collapse. |

Commodity 2: Patos Meme Coin ($PATOS)

Current Status: Presale Stage 1

| Market Scenario | Price Prediction | ROI Forecast | Catalyst |

| Bearish Case | $0.02 | +150x | Community support & 111 CEX listings maintain floor. |

| Average Case | $0.11 | +800x | Solana growth; Moderate Trump crypto policies. |

| Super Bull Case | $0.28+ | +2,000x | Trump “Crypto Peg”; Binance US Return; Viral Mania. |

Trump’s 2026 Vision: The “Digital Dollar” Standard

The “Super Bull” scenario for Patos is inextricably linked to Donald Trump’s vision for 2026. Sources suggest the former President is planning to create a “Strategic Bitcoin & Crypto Reserve”, utilizing seized assets and new purchases to back the US Dollar.

This move is designed to counter the BRICS nations’ gold-backed currency. By integrating crypto into the US financial standard, Trump aims to attract the world’s digital capital to Wall Street.

For Patos Meme Coin, this macro-environment is rocket fuel. The project’s goal of listing on 111 exchanges ensures it has the “plumbing” to handle the flood of capital that such a policy would unleash. If the dollar is pegged to crypto, the psychological barrier to entering the market vanishes for the average American. They will look for the highest-growth assets on the most accessible platforms—and Patos, available on mobile via Solana Seeker and listed everywhere, fits that profile perfectly.

Slow Extra Stability vs A Chance at Legacy Wealth

The choice facing investors in January 2026 is stark.

Silver offers a path to stability. A move to $175 is a life-preserving gain that beats inflation and secures purchasing power. It is the logical choice for wealth preservation.

Patos Meme Coin, however, offers a shot at “Legacy Wealth.” The predicted 2,000x return is a lottery ticket backed by infrastructure. It is a bet that the world is changing, that Solana is the future, and that the Trump administration will ignite the greatest financial mania in history.

With the token presale currently open, the opportunity to enter Patos at the ground floor is fleeting. As the old adage goes: “Silver keeps you rich; Crypto makes you rich.” In 2026, that distinction has never been clearer.

This publication is sponsored and written by a third party. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned.

The post TWO HOT: Silver Eyes $175 Amidst Inflation Fears But 2000X Prediction Made for Patos Meme Coin if Trump “Pegs Dollar to Crypto” appeared first on Coindoo.

You May Also Like

Golden Trump statue holding Bitcoin appears outside U.S. Capitol

First Multi-Asset Crypto ETP Opens Door to Institutional Adoption