Bitcoin Price Suddenly Plunges Below $88K as Hourly Liquidations Explode

After a relatively quiet weekend when neither the buyers nor the sellers could regain control, BTC’s price is once again heading south to a new multi-day low of well below $88,000.

The altcoins are in a similar situation, with ETH plunging beneath $2,900 and SOL dropping by over 2.5% in just an hour.

As the analysts from the Kobeissi Letter indicated, the most probable reasons behind the ongoing corrections are the expected US government shutdown after the Minneapolis shooting, which would be the second during Trump’s term now, and the tariffs the POTUS threatened to impose on Canada.

As reported yesterday, he warned that he may slap a 100% tariff on its northern neighbor if it chooses to sign a significant deal with China.

Similar to the events that took place during the previous weekend, BTC remained relatively stable at first but started to break down as the opening of the futures markets neared.

This time, BTC dumped to a five-day low of $87,500 (for now), after it was rejected at $89,000 earlier today. The past hour has been violent for most altcoins, with some, such as SUI, SOL, ARB, PEPE, ENA, and ADA, dropping by over 2%.

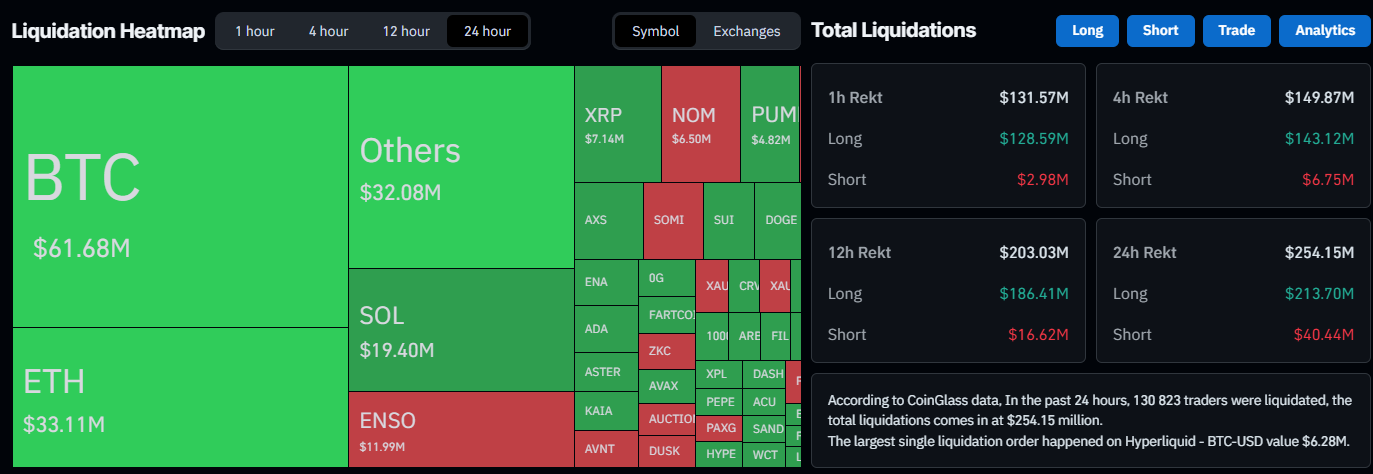

Ethereum has lost 1.5% of its value in the past 60 minutes alone and now struggles well below $2,900. The total value of wrecked positions in the past day sits at $250 million, but over 50% of that amount came in the last hour ($131 million, according to CoinGlass data).

Over 130,000 traders have been wrecked daily, with the single-largest liquidated position taking place on Hyperliquid and was worth $6.3 million.

Liquidation Data on CoinGlass

Liquidation Data on CoinGlass

The post Bitcoin Price Suddenly Plunges Below $88K as Hourly Liquidations Explode appeared first on CryptoPotato.

You May Also Like

BitGo expands its presence in Europe

The Definitive Analysis On Whether XRP Can Realistically Reach $5