As Trump is about to take office, crypto companies have donated more than 10 million US dollars to the inaugural committee. How will the market react?

Author: Weilin, PANews

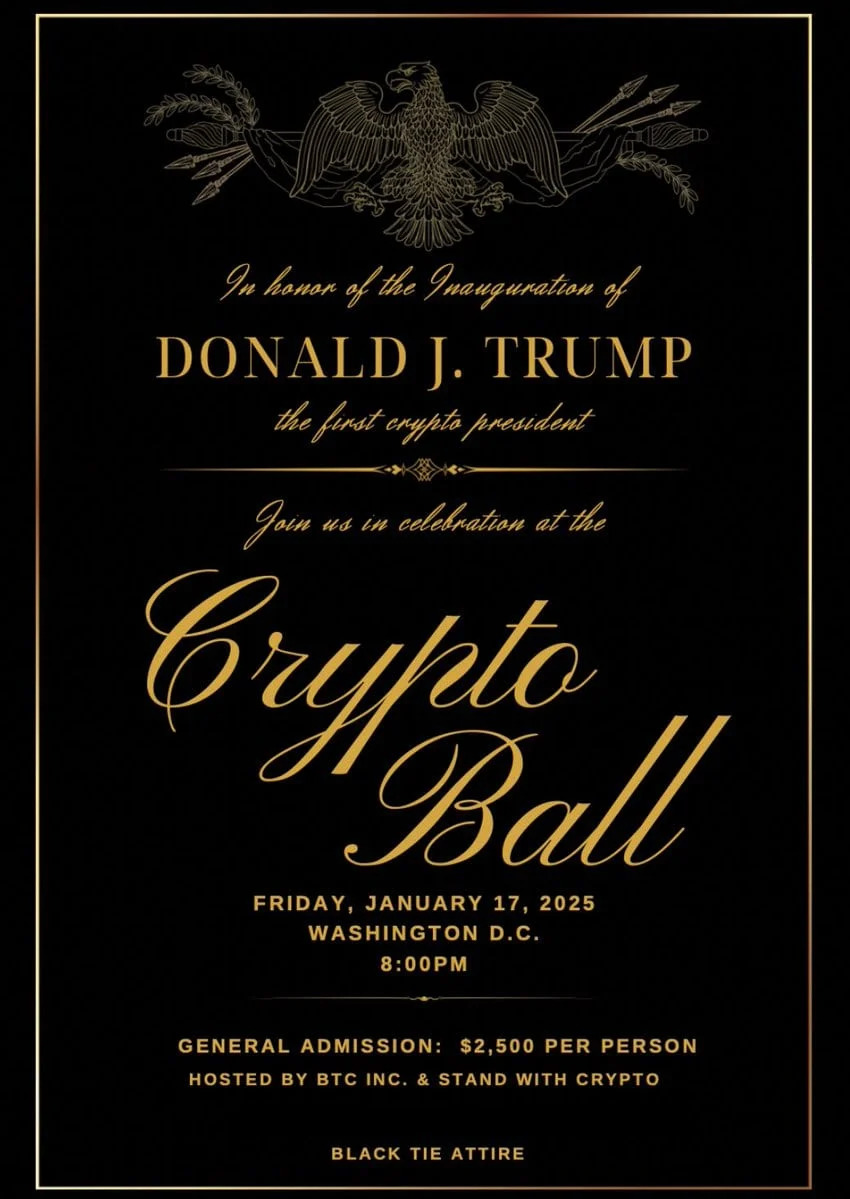

As the inauguration of US President-elect Trump approaches on January 20, leaders in the crypto and technology industries are preparing to participate in a grand celebration. Among them, a crypto ball will be held in Washington on January 17, and David Sacks, the White House director of artificial intelligence and cryptocurrency, will host the VIP reception of the ball. Although Trump himself will not attend, the top companies and leaders in the crypto industry have actively prepared funds for this ball and a series of celebrations, setting a record.

Will the market rally brought about by Trump happen again in January? Bitcoin price trends have reached several key points, and analysts have given their own predictions on the implementation of the new policy and price trends.

Celebrating Trump's inauguration, "Crypto Czar" David Sacks will host a crypto ball

On January 20, Trump will be sworn in for his second term as President of the United States. This day is destined to be an important moment in American history, and the Crypto Ball held on January 17 has attracted a lot of attention. In addition to regular tickets, the event is hosted by Trump's super political action committee MAGA Inc. VIP reception activities. Although Trump himself will not attend, David Sacks, the director of artificial intelligence and cryptocurrency at the White House, will appear as the host of the VIP event.

Tickets for the event are expensive, with general admission tickets starting at $2,500, but the real draw is the VIP and private packages. For $100,000, VIP guests can network with leading figures in the crypto space, while the $1 million ticket package offers four tickets and a chance to dine with Trump himself at a later date.

The event is hosted by BTC Inc, and co-hosts are Stand With Crypto, Exodus, Anchorage Digital, and Kraken. The sponsorship package for co-hosting the event costs $5 million. Other sponsorship opportunities range from $150,000 to $1 million. Currently, sponsors of the event include well-known crypto companies such as Coinbase, Sui, MetaMask, Galaxy Digital, Ondo, Solana, Metaplanet, MARA, Satoshi Action Fund, MicroStrategy, etc.

Multiple crypto institutions donated to Trump's inaugural committee, with Ripple making the largest donation

As part of the new president's inauguration, Trump's inaugural committee's fundraising event also attracted a large number of crypto companies to participate. Crypto companies donated funds to Trump's inaugural committee to gain a place in the new government's influence.

Trump's inaugural committee has set a record for fundraising, raising more than $170 million. Donors began receiving notifications the week of January 10 that some events in Washington were already full. Inaugural events will begin on January 17. Donors who give $1 million or raise $2 million will receive tickets to six different events, including the swearing-in ceremony on January 20 and a "candlelight dinner" with Trump and his wife Melania on January 19, which is described as the "capstone event" of the weekend. They will also receive two tickets to dinner with Vice President-elect JD Vance and his wife.

Ripple is undoubtedly the leader in donations among crypto companies, donating $5 million worth of XRP to Trump's inauguration fund. After Trump's successful re-election on November 5 last year, the value of Ripple's custodial XRP reserves increased by more than $85 billion. Ripple CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty recently met with Trump.

Companies such as Robinhood, Coinbase, Circle, and Kraken have also donated to the inaugural committee, with donations of $2 million, $1 million, 1 million USDC, and $1 million, respectively.

“We’re excited to build a great American company, and the fact that the Commission is accepting USDC for payment shows how far we’ve come and the potential and power of a digital dollar,” Circle CEO Jeremy Allaire said in an X-Platform post.

In addition, a company spokesperson confirmed that Moonpay recently donated money to support the president-elect's inauguration, but did not disclose the amount of the donation. New York-based Ondo Finance also donated $1 million to Trump's inauguration in late December last year.

Trump may release crypto-related policies on his first day in office, but it will take time to implement

According to Reuters, Trump is expected to issue at least 25 executive orders on his first day in office, which may involve policies related to cryptocurrencies. According to The Washington Post, Trump is likely to announce the repeal of the controversial crypto accounting policy SAB 121 on his first day in office, which requires banks to treat their digital assets as liabilities and reflect them on their balance sheets.

However, while the crypto industry is looking forward to Trump's inauguration, the implementation of policies may not be so quick.

NYDIG, an agency for Bitcoin financial services, said it may take time for Trump to fulfill his campaign promises. NYDIG said that crypto policies will not change immediately after taking office, especially because some senior government positions have not yet been filled. "We advise not to have too high expectations for immediate changes. Key officials still need to be appointed, those who have been appointed need to go through the confirmation process, and once confirmed, they still need to form their own teams."

In addition, Trump has not yet announced who will lead agencies such as the Commodity Futures Trading Commission (CFTC), the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC). However, NYDIG expects that the heads of these agencies "will support Bitcoin and cryptocurrencies."

At the same time, whether the market has "priced in" Trump's policy changes remains an open question. Analysts Dan Gambardello and Hoeem believe that the market has not yet priced in Trump's inauguration. This means that once Trump officially takes office, the cryptocurrency market may still have room to rise.

“People think the impact of a pro-crypto Trump administration and governments rushing to buy Bitcoin is already priced in. In reality, it’s clearly not priced in,” Gambardello said in a post on the X platform.

Hoeem, a cryptocurrency expert, expressed a similar view: “Trump’s inauguration is not priced in.” Hoeem further added: “Trump will revoke any policy that has a negative impact on the crypto market, while doubling down on any measures that have a positive impact on the crypto market. From day one, he wants the market to keep rising, not only because his team and family are closely tied to the market, but also because of his personal ego.”

Bitcoin price trend: mixed effects of rate cut expectations and new policies

As the market anticipates possible policy changes after Trump takes office, analysts are also paying attention to the trend of Bitcoin prices.

As 2025 begins, the cryptocurrency trading environment presents a mixed picture after the December FOMC meeting and the holiday break. According to a report by 10x Research, the first quarter of 2025 may not present the same scenario as late January to March or late September to mid-December 2024.

The key event to watch is the Consumer Price Index (CPI) data, which will be released on January 15. The market may see a correction before the release of the CPI data, while the market may rebound again if the data turns out to be favorable.

"Favorable inflation data could reignite optimism and drive a market rally ahead of Trump's inauguration on January 20," said Mark Thielen, founder of 10x Research. However, the momentum from such a rally could be short-lived. Thielen added that the market could pull back ahead of the January 29 FOMC meeting. He predicts that Bitcoin will be in the $96,000 to $98,000 range by the end of January.

Crypto investment agency QCP Capital published an analysis on January 13, saying that despite the unfavorable macro environment and the lingering Silk Road rumors, cryptocurrencies seem to have gained a foothold, as the $91,000 and $3,100 support levels currently remain unchanged. Implied volatility is also at a relatively low level and continues to decline, with a slight bearish skew in the front-end market just before Trump's inauguration.

Despite the muted reaction in volatility markets, cryptocurrencies are not out of the woods yet. The macro storm is still looming, with upcoming releases of Producer Price Index (Jan 14), Consumer Price Index (Jan 15), and Initial Jobless Claims (Jan 16) all likely to add fuel to the fire. As the U.S. economy heats up, this week will be a real test for cryptocurrencies to see if they can function as a hedge against inflation.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse