Ethereum (ETH) Price: Network Activity Jumps as Traders Eye $3,300

TLDR

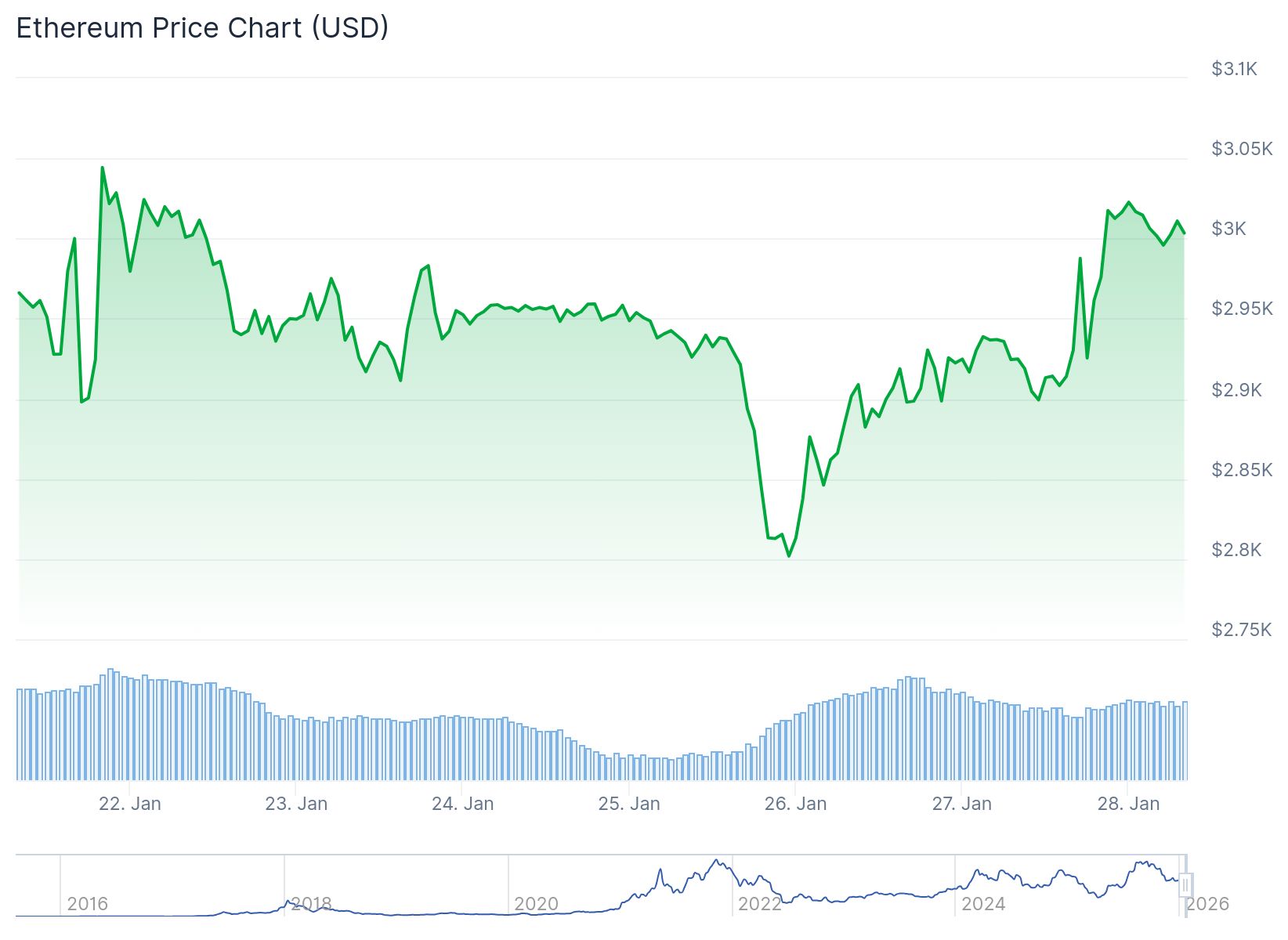

- Ethereum price recovered from $2,800 to break above $3,000 after experiencing a 15.9% correction

- Weekly transactions on Ethereum layer-2 networks reached 128 million, with total ecosystem DEX volumes hitting $26.8 billion

- Network fees on Ethereum increased 19% in the past week while average transaction costs dropped to $0.20

- Professional traders shifted back to neutral positioning after five days of favoring put options

- Ethereum maintains dominance in total value locked despite competition from BNB Chain and Solana

Ethereum price fell 15.9% over seven days ending Sunday, triggering $910 million in liquidations for traders using leverage on long positions. The decline pushed ETH down to $2,800, a level that had provided support for two months.

Ethereum (ETH) Price

Ethereum (ETH) Price

The price managed to hold above $2,850 before starting a recovery wave. ETH cleared the $2,900 and $2,920 resistance levels before breaking back above $3,000. A high was formed at $3,030 during the recovery.

The price is now trading above $2,980 and the 100-hour simple moving average. A bullish trend line has formed with support at $2,970 on the hourly chart.

Network Activity Shows Strong Growth

Ethereum layer-2 networks recorded 128 million transactions over the past week. This total surpassed both BNB Chain and Tron in transaction volume.

Base, Polygon, Arbitrum and Optimism all contributed to the growth in layer-2 activity. The Fusaka upgrade in December 2025 boosted network data capacity and introduced transaction batch workflows.

Network fees on Ethereum increased 19% over the last week. Meanwhile, competitors Tron and Solana saw declines in their fee revenues during the same period.

Average transaction fees on Ethereum dropped to $0.20, down from $0.50 in November 2025. The network processed 16.4 million weekly transactions while keeping fees below $0.20 during periods of high demand.

Decentralized Exchange Volumes Rise

Weekly DEX volumes on Ethereum reached $13 billion, up from $8.15 billion four weeks ago. The total Ethereum ecosystem, including layer-2 networks, hit $26.8 billion in DEX volume.

Source: DefiLlama

Source: DefiLlama

Solana leads with $30 billion in weekly DEX volume. However, the combined Ethereum ecosystem shows growing capital inflows across its platforms.

The shift in DEX activity represents a return to Ethereum after perpetual contracts trading peaked in August 2025. Lower transaction fees have made the network more attractive for traders.

Options Market Turns Neutral

Professional traders moved back to neutral positioning between call and put options on Monday and Tuesday. This followed five days where put options dominated the market.

The ETH options put-to-call volume ratio at Deribit reached 2x on Sunday, marking the highest level in over four months. The peak in put option volume occurred after ETH dropped below $2,800.

Ethereum maintains dominance in total value locked across decentralized finance platforms. This shows continued investor preference for the network despite competition from other chains.

The price faces immediate resistance near $3,030 and $3,050. A clear move above $3,065 could send the price toward $3,120. Further gains could push ETH toward $3,180 or $3,200 in the near term.

The post Ethereum (ETH) Price: Network Activity Jumps as Traders Eye $3,300 appeared first on CoinCentral.

You May Also Like

YZi Labs Binance Deposit: A $6.63M Signal That Could Shake the ID Token Market

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more