Bitcoin (BTC) Price: Falls Below $90,000 As Fed Holds Rates and Geopolitical Tensions Rise

TLDR

- Bitcoin fell below $90,000 after the Federal Reserve held interest rates steady at its January meeting as expected.

- Over 22% of Bitcoin supply is currently held at a loss, increasing the risk of further price drops if key support levels break.

- Glassnode analysts say Bitcoin rallies will remain short-lived until the realized profit/loss ratio stays above 5, indicating renewed liquidity.

- Monthly Bitcoin inflows to Binance are at their lowest level since 2020, suggesting investors are holding rather than selling.

- President Trump threatened military action against Iran, creating fresh geopolitical risk as gold hits new all-time highs above $5,300.

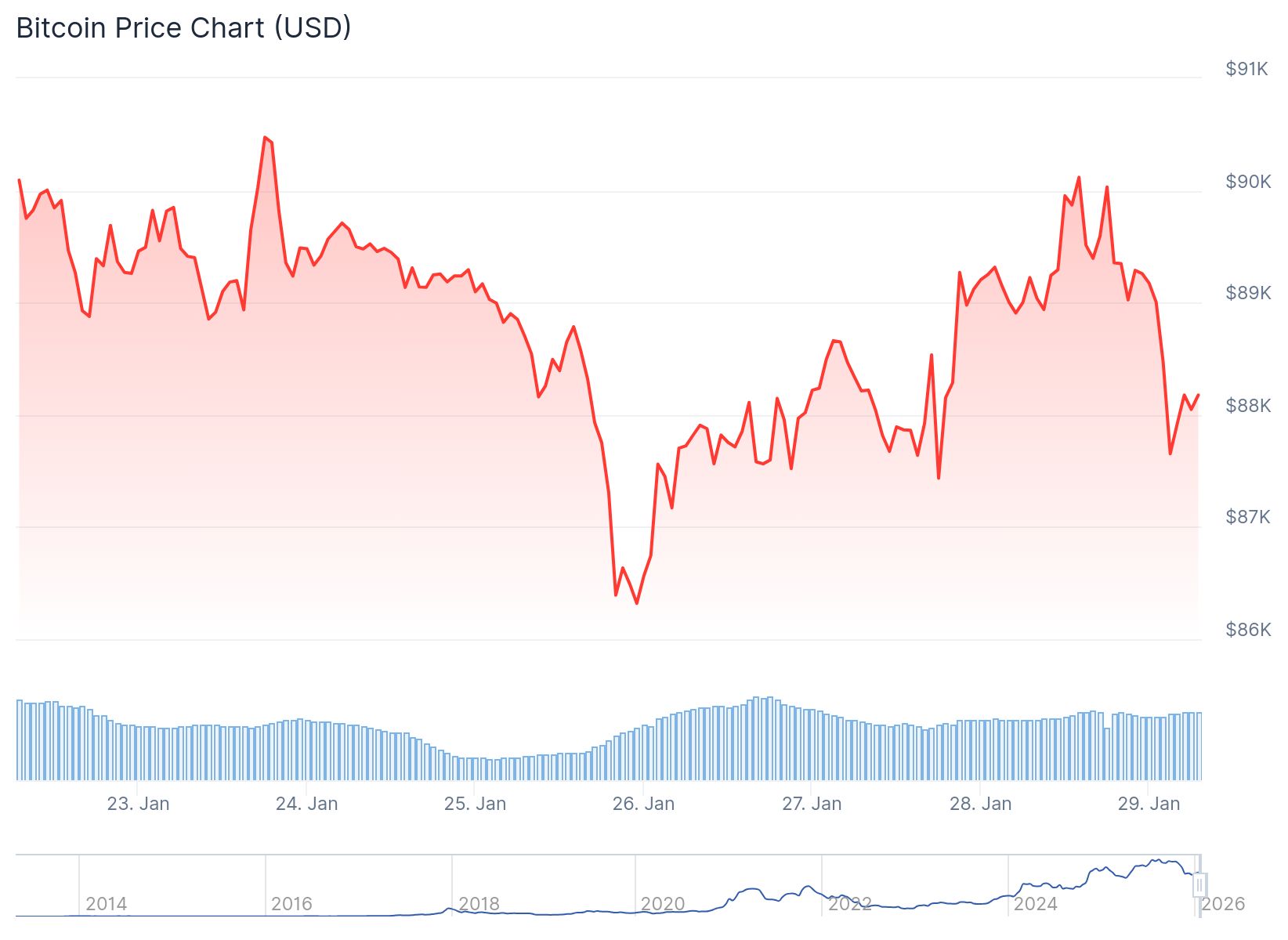

Bitcoin dropped below $90,000 on Wednesday after briefly reclaiming the psychological level earlier in the day. The decline followed the Federal Reserve’s decision to keep interest rates unchanged at its two-day policy meeting.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The world’s largest cryptocurrency traded at $89,564 by mid-afternoon, up just 1.3% for the day. Bitcoin had benefited from broad dollar weakness earlier in the week after President Donald Trump downplayed concerns about the greenback’s slide.

The Federal Reserve’s decision to hold rates steady came as widely expected by markets. Investors are now focused on Chair Jerome Powell’s remarks for signals on when rate cuts might begin. Lower interest rates typically support Bitcoin by reducing the opportunity cost of holding non-yielding assets.

Market analysts say Bitcoin needs to break convincingly above $90,000 and hold that level to encourage fresh buying. David Morrison, senior market analyst at Trade Nation, noted that $100,000 would become the next target if Bitcoin can maintain support above $90,000.

However, Morrison warned that a break below $85,000 could easily happen given current market conditions.

Liquidity Concerns Limit Rally Potential

Glassnode analysts identified liquidity as the key metric preventing a sustained Bitcoin recovery. The on-chain analytics firm said price rallies will remain short-lived until the realized profit/loss ratio on a 90-day moving average stays above 5.

This ratio has consistently signaled renewed liquidity inflows during past price recoveries. Strong mid-cycle recoveries over the past two years only occurred once the metric crossed this threshold.

More than 22% of the circulating Bitcoin supply is currently held at a loss. This condition was previously seen in early 2022 and mid-2018, both periods that preceded further price declines.

The high percentage of underwater supply increases correction risk. If Bitcoin fails to hold key support levels, selling from long-term holders could resume.

CryptoQuant data shows monthly Bitcoin inflows to Binance are averaging roughly 5,700 BTC. This represents less than half the long-term average of 12,000 BTC and marks the lowest level since 2020.

Lower exchange inflows typically indicate investors are holding rather than preparing to sell. Crypto analyst Darkfost called this a positive signal despite ongoing consolidation and macroeconomic uncertainty.

Geopolitical Tensions Add Pressure

President Trump issued a warning to Iran on Truth Social, stating that a massive Armada is heading toward the country. He urged Iran to quickly negotiate a deal without nuclear weapons.

Trump warned that the next attack would be “far worse” than previous actions. The Iranian Mission to the U.N. responded that it was ready for dialogue but would “defend itself and respond like never before” if pushed.

Polymarket data shows a 65% chance of a U.S. strike against Iran by June 30. Such an escalation would likely increase geopolitical tensions and pressure risk assets like Bitcoin.

Gold has surged to new all-time highs above $5,300 as investors move to safe-haven assets. The precious metal is up more than 90% over the past 12 months while Bitcoin struggles to maintain recent gains.

James Harris, CEO of Tesseract Group, noted that crypto is underperforming the very assets it was designed to supplant. Gold appears to be clawing back market share from Bitcoin as investors reprice geopolitical and fiscal risk.

Bitcoin exchange inflows to Binance remain near their lowest levels since 2020 at approximately 5,700 BTC per month.

The post Bitcoin (BTC) Price: Falls Below $90,000 As Fed Holds Rates and Geopolitical Tensions Rise appeared first on CoinCentral.

You May Also Like

And the Big Day Has Arrived: The Anticipated News for XRP and Dogecoin Tomorrow

Tokenized Assets Shift From Wrappers to Building Blocks in DeFi