Chain games bravely enter the AI Agent track. Why did the game character Freya become popular and shortlisted for Binance Alpha?

Author: Zen, PANews

As AI Agent narratives become more and more popular, many projects in the gaming industry have also begun to enter the market. Recently, Illuvium announced a partnership with Virtuals Protocol, saying that it will use Virtuals' AI technology and its GAME LLM framework to provide NPCs with dynamic and intelligent behaviors, providing players with an immersive experience. The auto chess game Planet Mojo has launched AI Agent Mr. WWA (Winston Wylde Alexande), and the token WWA will be used as a platform reward token, and plans to launch an AI Agent game.

However, before these well-known blockchain game projects entered the market, a blockchain game had already taken the lead in entering the field of AI agents with its top-notch game Freya, and was recently shortlisted for Binance Alpha.

Starfall Chronicles: The Game World Where Freya Was Born

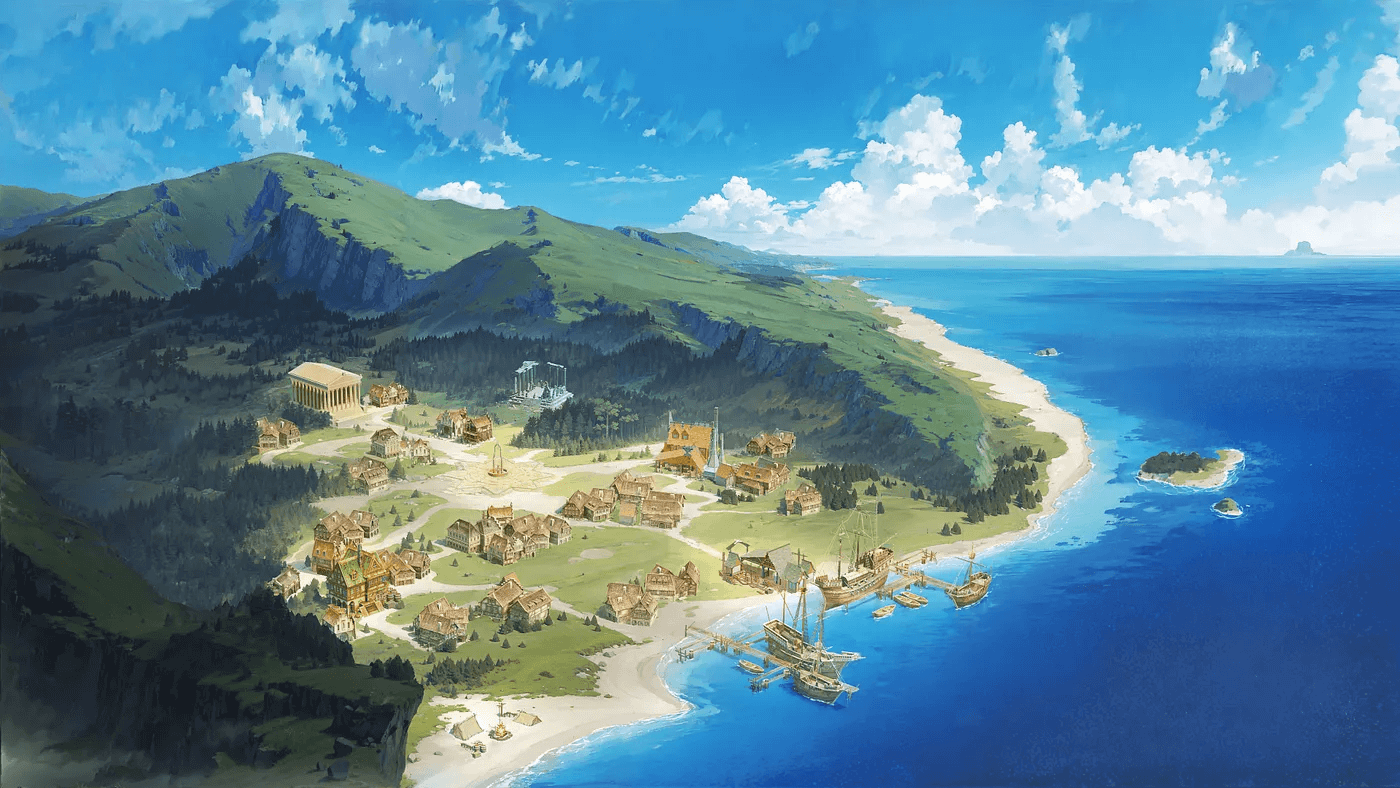

Starfall Chronicles is an AI-driven roguelike fantasy RPG developed by Rosentica. The project plans to create a strategic combat system and deep, customizable character creation, and the game background takes place in the dynamic, ever-changing universe of the Exploration Age driven by autonomous AI companions and NPCs. The alpha version of Starfall Chronicles was released in November 2024, and the beta version is scheduled for January 2025. According to an announcement released by Immutable in December last year, Starfall Chronicles will also be launched on the platform.

The excellent art and visual design currently displayed by the game is mainly due to the chief artist Sangsoo Jeong, a well-known Korean concept artist and illustrator who has collaborated with Riot Games' "League of Legends" many times and drawn many original skin paintings.

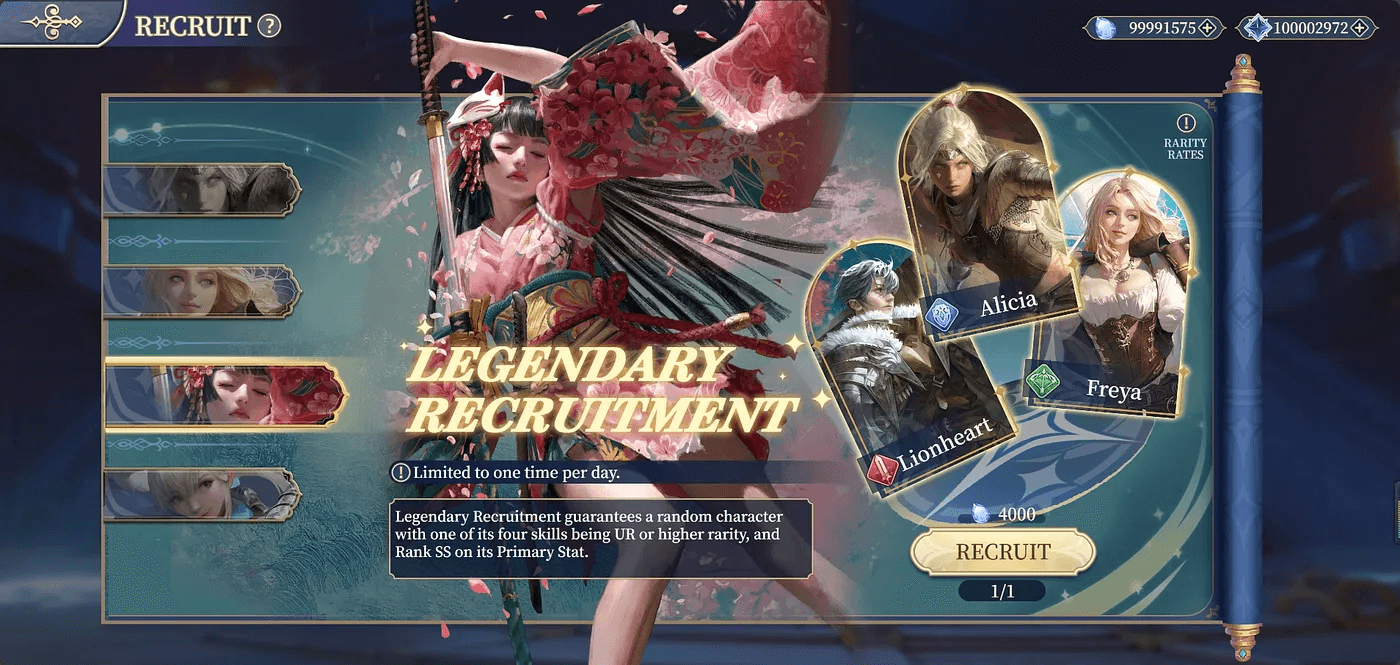

In addition, Rosentica hopes to attract players through rich storylines and deep and complex game characters. Currently, 9 characters have been released, including Freya, Vera, Lionheart, etc. Players can obtain characters through recruitment. The permanent recruitment of characters is divided into six types: ordinary, elite, legendary, knight, warrior, and ranger. There will also be limited-time recruitment and temporary recruitment.

Starfall Chronicles also uses the Fateweaver Gacha system, which ensures that each character recruited by the player has random skills and attributes, ensuring that each individual is unique. In order to enhance the player's customization ability, Rosentica has also developed a complex talent tree system, which allows players to deeply customize their characters by configuring different skills according to their personal game style and preferences. In addition, each character has a random attribute growth level, ranging from C to SS, and even includes a randomly assigned constellation.

Game Mechanics of Starfall Chronicles

In the game, when the battle begins, the mercenaries of both sides will be deployed according to the grid formation set by the player before the battle. The battle is carried out in rounds and orders. Each round represents a complete cycle, during which all surviving mercenaries will have a chance to act, and they will act in the order of speed attributes, with faster units being able to act first. When all mercenaries of one side are completely eliminated, the battle ends. In the current open version, only CLASH (single-player PVP mode) is open, and the details of the tournament (multiplayer PVP mode) and the sailing mode will be disclosed before the Beta test.

The above gameplay is actually not very innovative, nor is it very relevant to the popular AI agents. However, in the recently disclosed Infinity 7 mode, the project team said that each of the nine main characters will be an intelligent, adaptive AI agent that can continuously evolve based on player interactions and preferences. These characters are designed to be truly alive, with personality, behavior, and decision-making processes that can respond organically to player behavior.

It is worth mentioning that only $Freya of the nine main characters will be tokenized and applied to utilities that are not limited to the game. In Infinity 7, players can spend $Freya to permanently change their personality, likes, dislikes, and even core worldviews to match their preferences and affect their roles in the unfolding story. Because there are no pre-written events, players can freely choose their own goals and actions. The entire story changes dynamically based on the player's choices, and everything will be dynamically generated by the procedural narrative engine and adaptive behavior simulation system.

$Freya token functionality and staking mechanism

In addition to being used for in-game consumption, $Freya also includes participating in governance voting, accessing the rarest functions, and being used for staking and revenue distribution. According to DexScreener data, as of the morning of January 10, the market value of $Freya was approximately US$15.6 million.

As mentioned above, the most common function of $Freya tokens in the game is to personalize characters. In order to prevent the instability of the $Freya token market price from affecting the player's consumption experience, Starfall Chronicles fixes the in-game $Freya consumption price to an amount equivalent to the US dollar. Players do not need to worry about market fluctuations, and the consumption experience is more stable and intuitive.

In addition, redrawing a character's skills and improving the character's random attribute growth ranking are the rarest functions in the game. They cannot be obtained through resources such as lotteries, upgrades, or battle tickets, but can only be unlocked with $Freya tokens.

In terms of community governance, the project team plans to introduce the Sunflower Roundtable, which will allow players to decide the future direction of the game through proposals and voting. To submit proposals and vote, players need to hold a certain amount of $Freya. Players can vote on changes involving skill adjustments, character remakes, game mode game mechanism adjustments, storyline direction and function design, as well as changes in game systems, difficulty, rewards, etc.

$Freya adopts a deflationary economic model. 20% of each token transaction will be permanently destroyed, thereby reducing the total supply. The remaining $Freya will be redistributed to token holders according to the staked amount. $Freya holders can stake tokens in <Stardust Gate> and receive dividends for all $Freya consumed in the game.

Through these mechanisms, $Freya token holders will not only benefit from the appreciation in value of the token, but will also be able to share in profits through the game’s success and revenue, becoming indirect investors and dividend beneficiaries of Starfall Chronicles.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse