These Altcoins Suffered the Most as Bitcoin Fell to New Local Lows: Market Watch

Bitcoin’s price actions only worsened after the Saturday crash on Monday morning as the asset charted a fresh multi-month low of just over $74,000.

The altcoins bled out heavily as well once again, with ETH being one of the poorest performers lately. XMR is also down by a substantial percentage in the past 24 hours.

BTC Rebounds From Local Lows

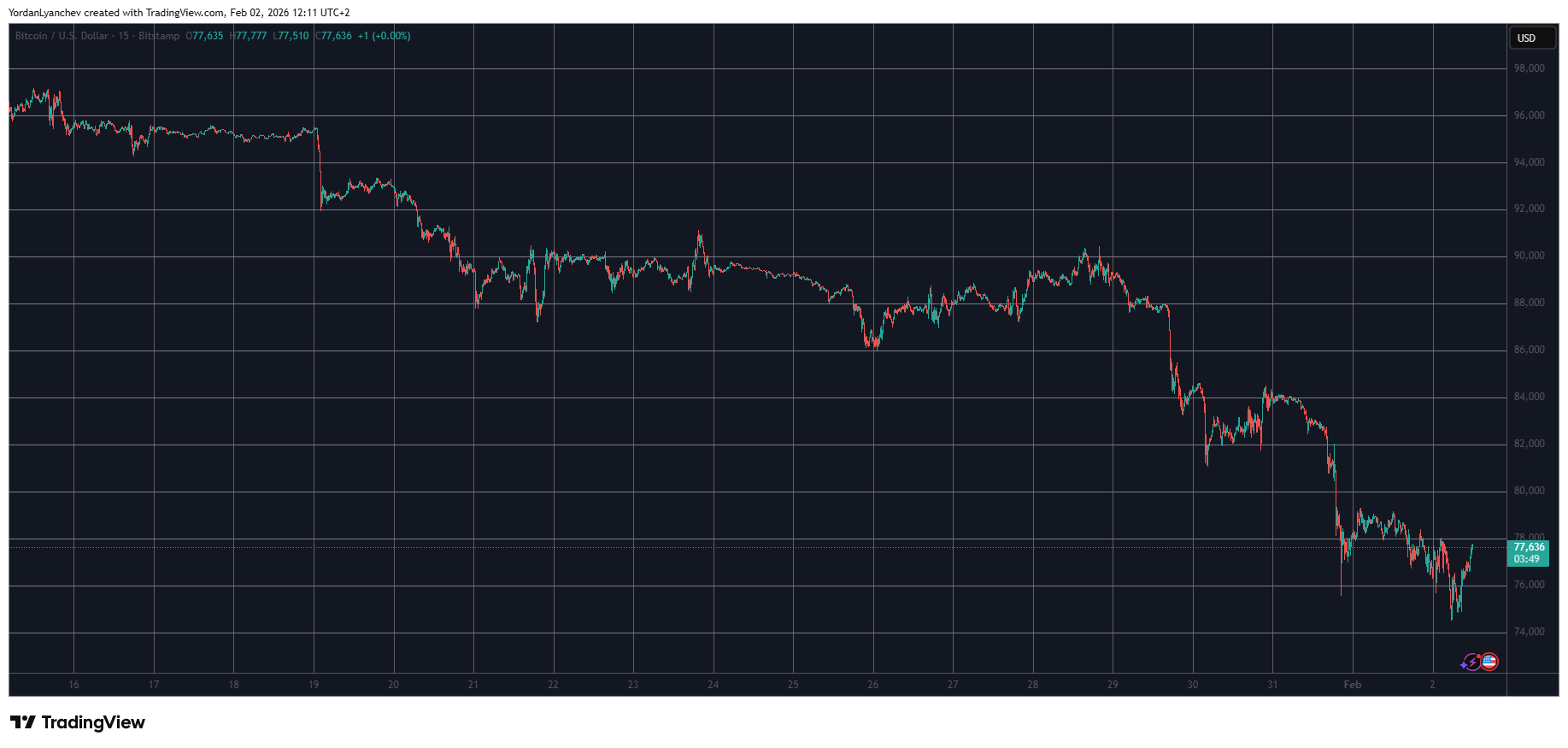

It was less than a week ago, last Wednesday, when the primary cryptocurrency challenged the $90,000 resistance. However, whether it was the Fed’s decision to stop cutting the interest rates, or the quickly rising tension in the Middle East, the asset failed to break through and began a prolonged correction.

At first, it crashed to $81,000 on Thursday. The bulls staged a minor rebound on Friday to $84,000, but they lost control of the market on Saturday afternoon when BTC nosedived once again.

This time, the cryptocurrency plummeted to under $76,000 for the first time since April last year, leaving over $2.5 billion in liquidations. After an unsuccessful recovery attempt on Sunday, bitcoin slumped once again on Monday morning to $74,400. This meant that it had lost over $15,000 in just several days.

It has recovered some ground since then and now sits close to $78,000 amid what’s expected to be another volatile week. Its market cap struggles at $1.550 trillion, while its dominance over the alts is at just over 57.5% on CG.

BTCUSDU Feb 2. Source: TradingView

BTCUSDU Feb 2. Source: TradingView

Alts That Bled Out

Ethereum was hit hard over the past several days. It stood above $3,000 last Wednesday but dumped toward $2,100 earlier today. Despite recovering to almost $2,300 now, it’s still 5.5% own on the day. XMR is the other notable daily loser, down to $400.

XRP, BNB, SOL, DOGE, ADA, BC, LINK, and XLM are also well in the red daily, while Pi Network’s native token tapped another all-time low hours ago. In contrast, MYX has soared by 13.5%, followed by 10% surge from M.

The total crypto market cap went down by $300 billion since Saturday and $500 billion since last Wednesday to $2.650 trillion.

Cryptocurrency Market Overview Daily Feb 2. Source: QuantifyCrypto

Cryptocurrency Market Overview Daily Feb 2. Source: QuantifyCrypto

The post These Altcoins Suffered the Most as Bitcoin Fell to New Local Lows: Market Watch appeared first on CryptoPotato.

You May Also Like

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC