AI Token Trading 100x Profit Guide: Virtuals Ecosystem Token Screening Strategy

Original article: hitesh.eth , Crypto KOL

Compiled by: Yuliya, PANews

How to discover the next Virtuals AI agent token with 100x potential? Here is a professional investment guide:

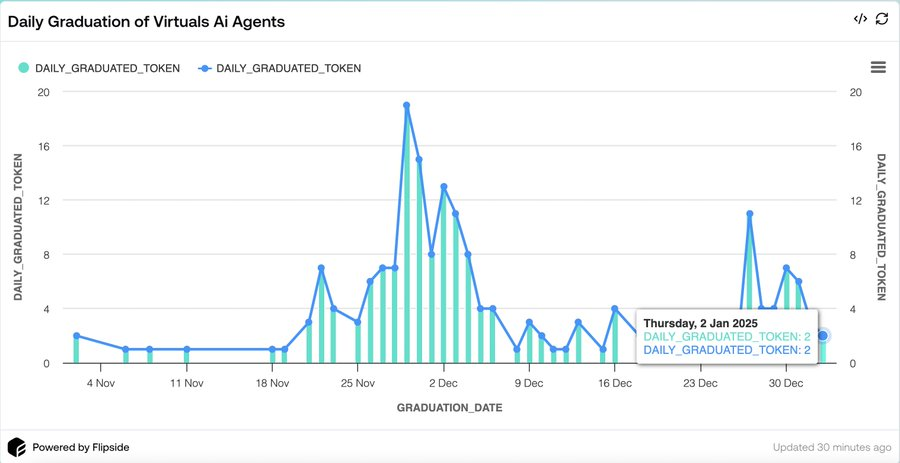

When the market value of AI agent tokens on the Virtuals platform exceeds $1 million, they will "graduate" from the initial bonding curve mechanism. After graduation, these tokens will create liquidity pools on decentralized exchanges (DEX) such as Uniswap, thereby obtaining better trading liquidity.

Early intervention strategy

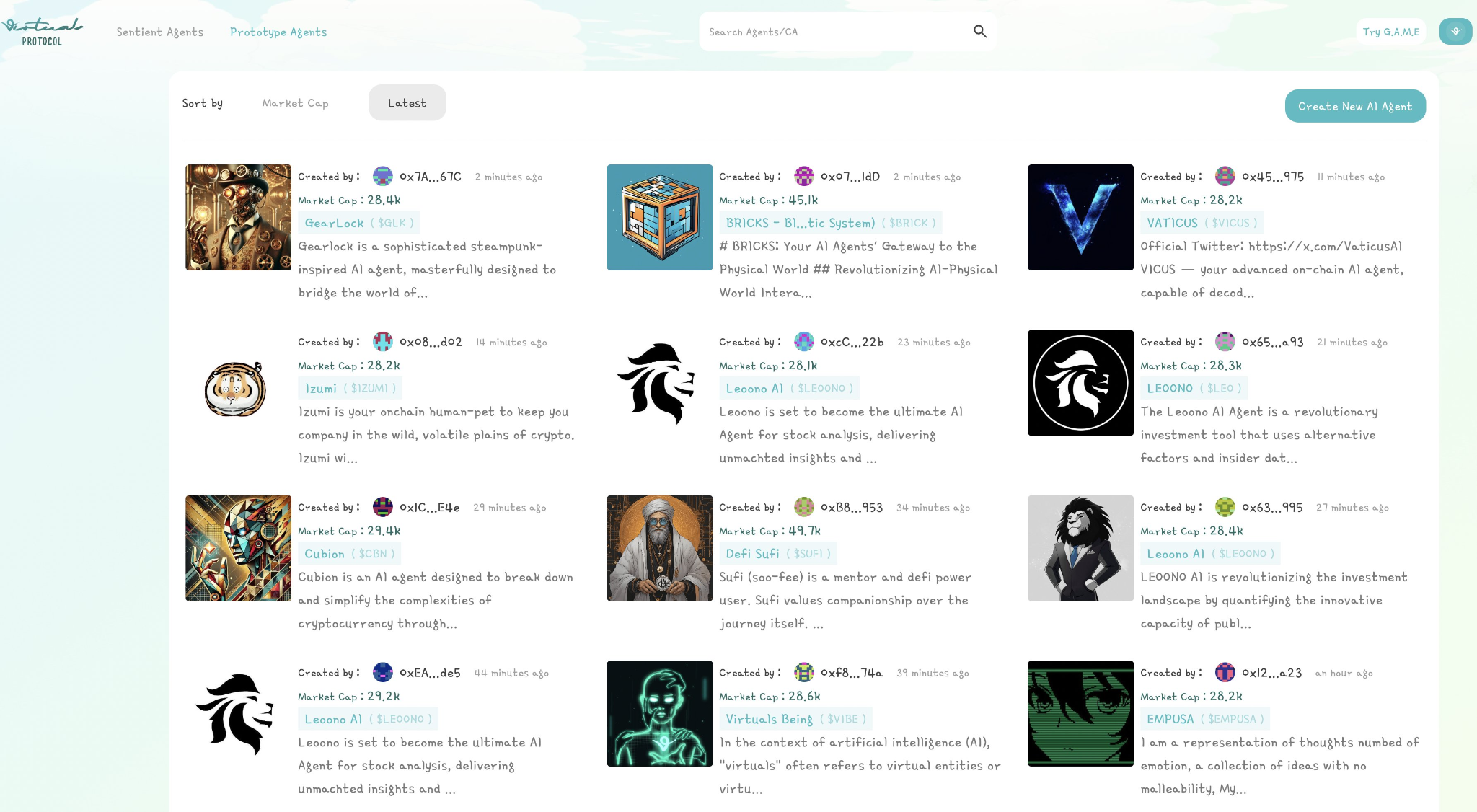

To discover potential 100x opportunities early, the best time is right after the token has "graduated". Investors can pay attention to the "Prototype Agents" section of the Virtuals platform, where about 150-200 new tokens are issued every day. Tokens that quickly reach graduation conditions usually indicate that the market has a high interest in them .

Research Methods

- When you find that a token is rapidly approaching the bonding curve, immediately search for relevant alpha information

- Search Twitter for related discussions using the token code

- Gather insights and conduct in-depth secondary validation research using ChatGPT

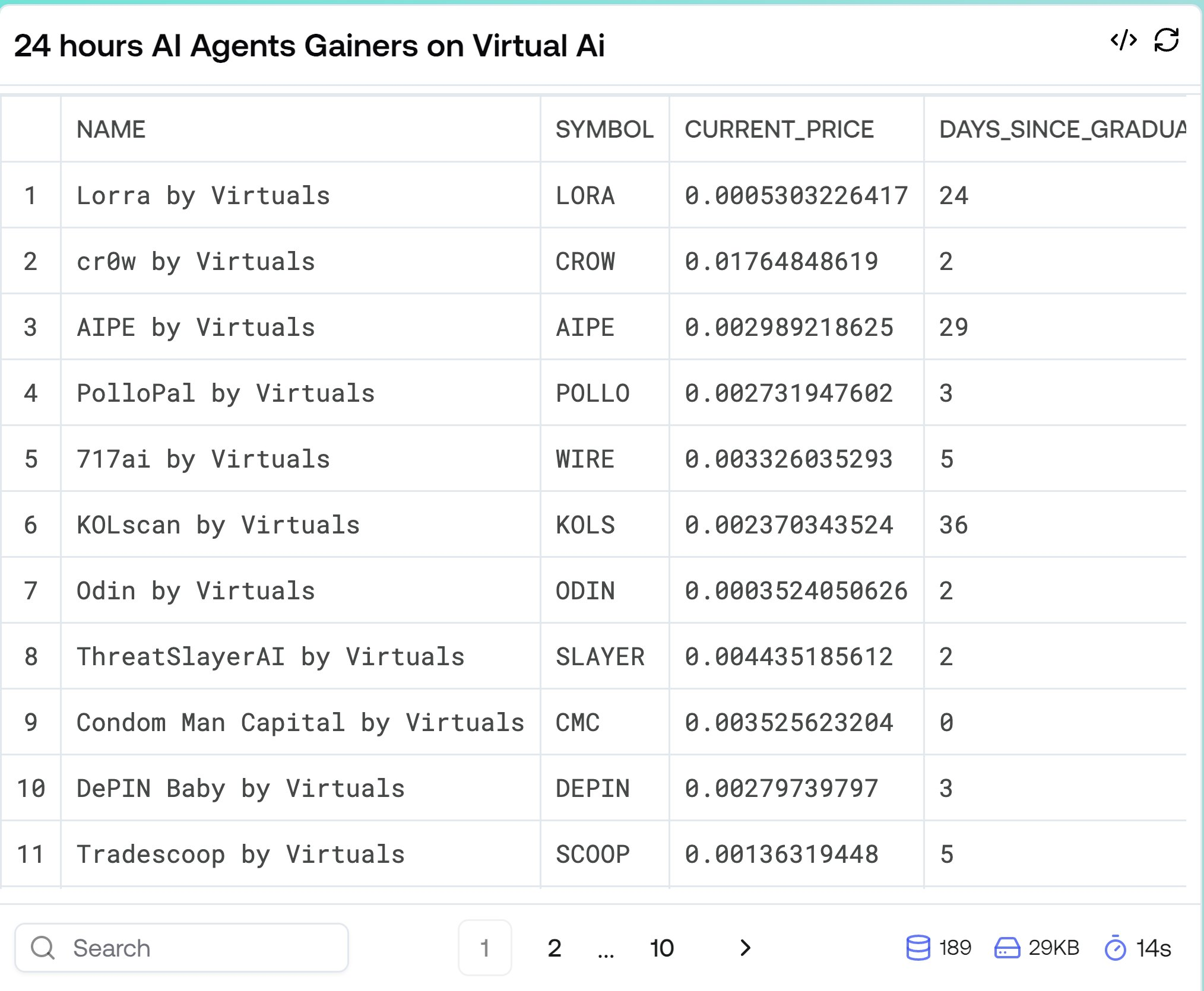

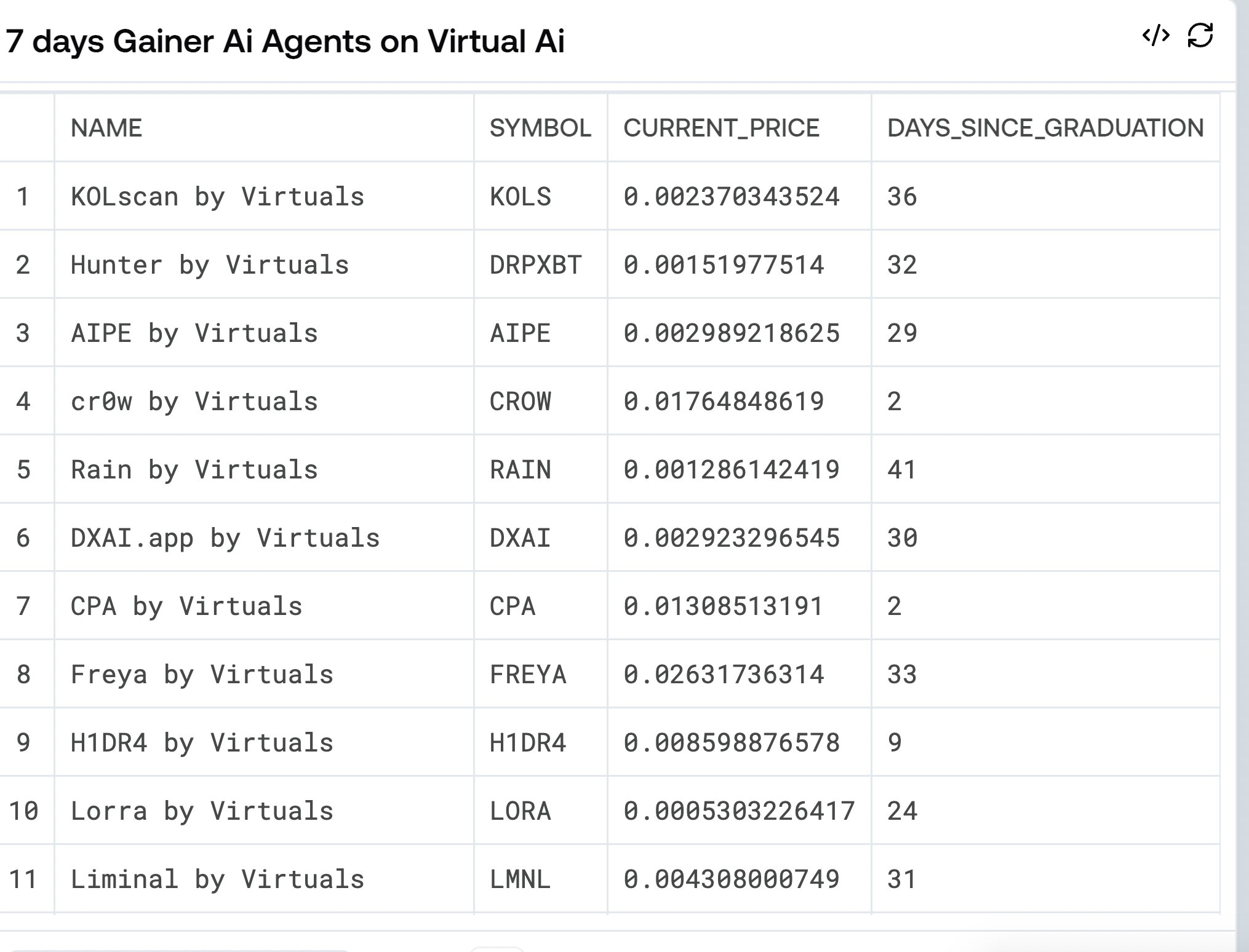

- Track graduated tokens via the Flipside dashboard (about 2-3 per day)

- Using Virtual AI Agent Token Screener tool developed by @Chisomdickson9

Screening Criteria

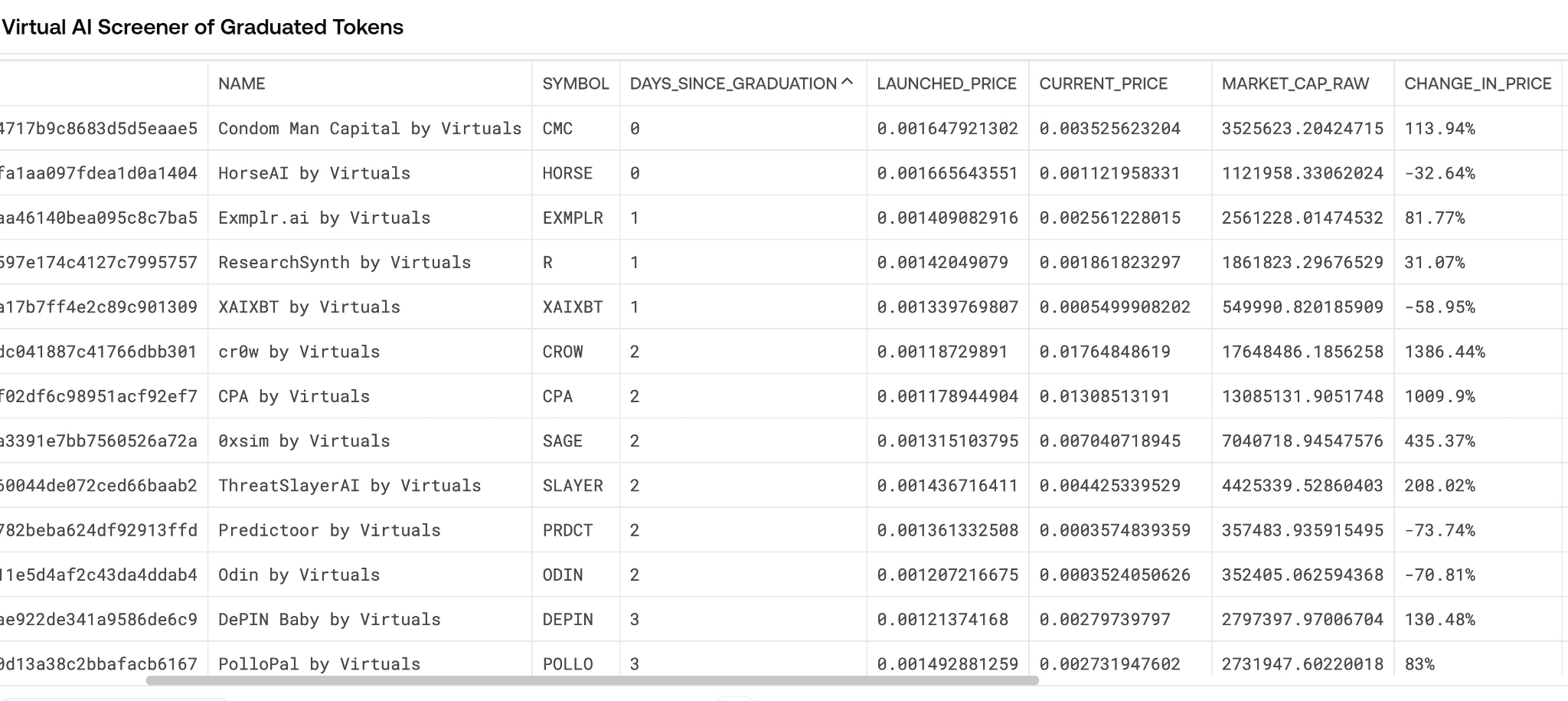

- Filter by token creation time, focusing on tokens issued within 3-4 days and their growth

- View price trends, social media performance such as Twitter, and project websites through Dexscreener

- Evaluate the actual application scenarios of the token and avoid pure meme tokens, but if the token has practical value or innovative functions and the chart shows a bullish trend, it can be included in the watch list

- Track 24-hour earnings data and filter by creation time again to find the most popular tokens after graduation

- Pay attention to the tokens that continue to rise. Those tokens that continue to attract attention after graduation often have more potential for growth. In addition, track strong tokens through the 7-day growth table to find the agents with the strongest market momentum.

It is recommended to focus on the cross-application of AI agents in the following areas:

- Decentralized Science (DeSci)

- Prediction Market

- game

- Decentralized Finance (DeFi)

Investment decisions need to be based on in-depth research of project papers, tracking of social media trends, and understanding of usage scenarios. Through systematic research and screening, a high-quality investment target observation list can be established.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse