Daily Market Update: Bitcoin and Stock Futures Climb Following Weekend Market Selloff

TLDR

- Bitcoin climbed back to $79,000 on Tuesday after weekend selling pushed prices below $75,000, triggering billions in derivatives liquidations across crypto markets.

- The sell-off may have ended a bearish pattern that began in October 2025, with Bitcoin testing its April 2025 lows around $74,000 before bouncing back.

- U.S. stock futures gained on Tuesday morning with S&P 500 futures up 0.3% and Nasdaq 100 futures rising 0.7% as markets extended Monday’s rally.

- Palantir stock surged 6% after hours on strong quarterly results while Nvidia dropped 3% on reports OpenAI is seeking alternative chip suppliers.

- Asian markets jumped 2.4% in their strongest session since April as risk sentiment improved following sharp weekend losses in stocks and commodities.

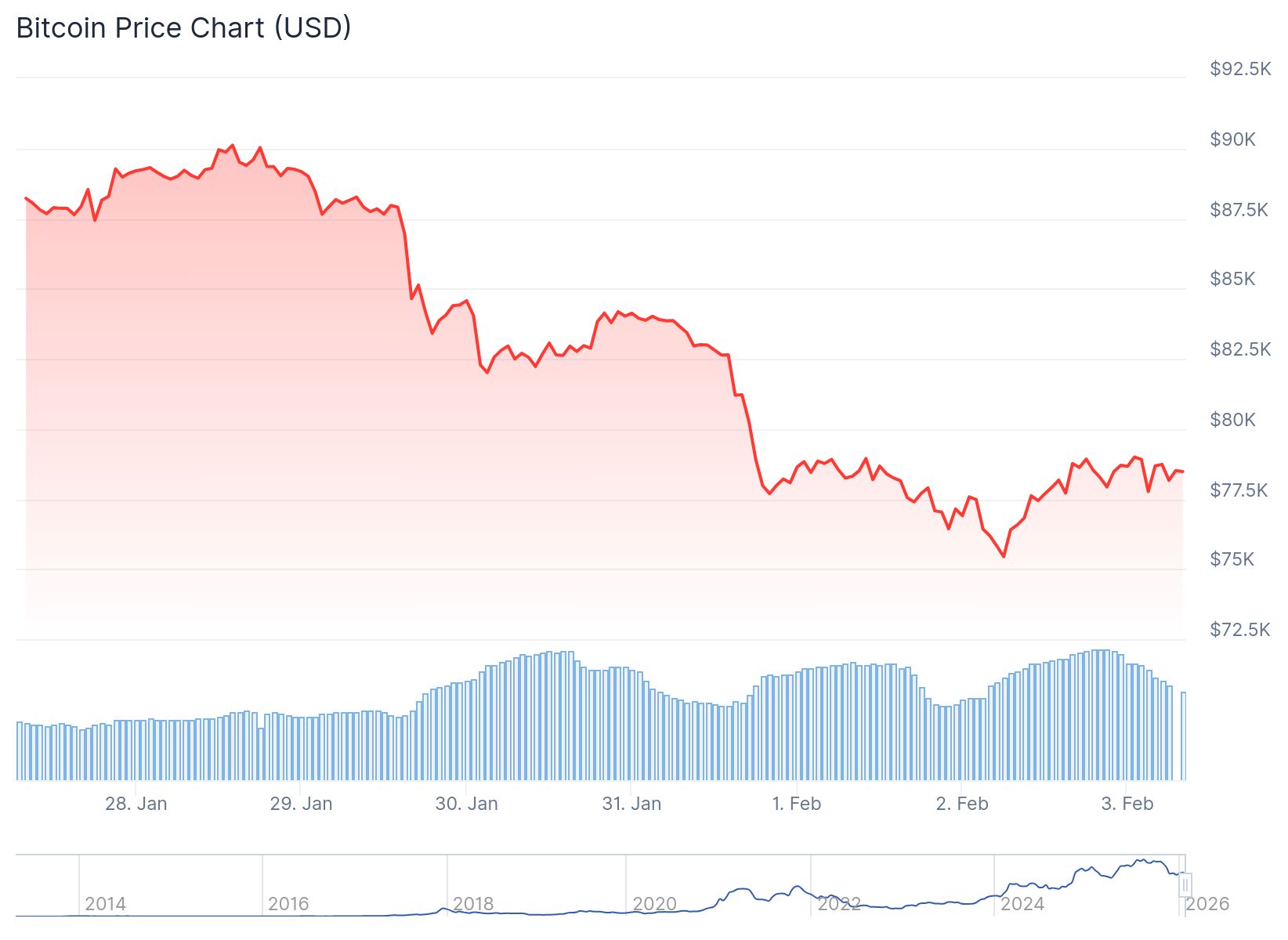

Bitcoin bounced back to $79,000 during Asian trading hours on Tuesday after plunging below $75,000 over the weekend. The recovery comes after a severe sell-off that wiped billions from crypto markets and triggered widespread liquidations.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Ether rose above $2,340 while Solana, BNB, XRP and Cardano posted gains between 3% and 6% over 24 hours. Most large-cap cryptocurrencies still show weekly losses up to 20% despite the Tuesday rebound.

The weekend crash featured heavy long liquidations as thin market liquidity amplified selling pressure. Traders faced broad risk-off sentiment while tech companies reported mixed earnings results.

CF Benchmarks analysts believe the sell-off may mark the end of a bearish sequence starting from October 10, 2025. Bitcoin briefly fell below its April 2025 lows near $74,000 during the weekend decline.

Selby noted massive long liquidations occurred during the weekend move. He pointed to regulatory uncertainty and early signs of hawkish Federal Reserve policy repricing as factors pressuring Bitcoin prices.

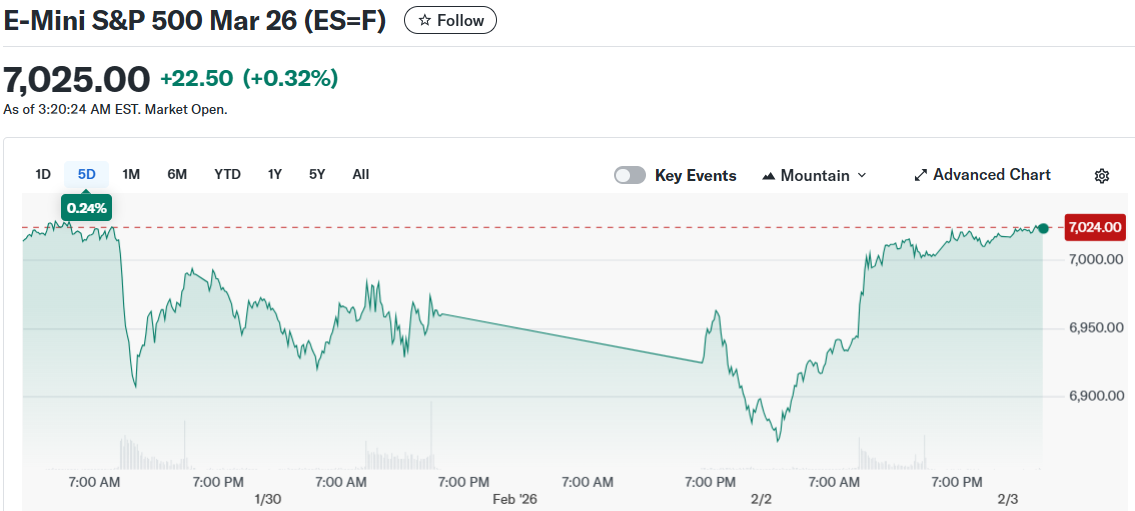

Stock Markets Extend Rally

U.S. stock futures climbed Tuesday morning after Monday’s strong performance. S&P 500 futures gained 0.3% while Nasdaq 100 futures advanced 0.7%. Dow Jones Industrial Average futures traded flat after a 500-point gain Monday.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Asian equity markets rebounded sharply after their worst selloff in two months. The MSCI Asia Pacific Index jumped 2.4% in its best session since April. South Korean stocks surged over 5% as investor sentiment improved.

Tech Earnings Drive Market Action

Palantir shares jumped approximately 6% in after-hours trading following better-than-expected fourth-quarter earnings. The data analytics company issued optimistic forward guidance for upcoming quarters.

Nvidia fell nearly 3% during regular hours on news OpenAI is delaying a $100 billion deal. Reports suggest OpenAI expressed dissatisfaction with Nvidia chips and is exploring alternative hardware options.

Advanced Micro Devices reports earnings Tuesday while Amazon and Alphabet release results later this week. Over 100 S&P 500 companies are scheduled to report quarterly earnings this week.

Investors are monitoring tech earnings for signs artificial intelligence spending is converting to improved margins and profit growth. Microsoft received tepid market reaction to its earnings last week.

Gold and silver futures declined Monday after steep losses late last week. Precious metals retreated from recent highs as crowded positioning unwound rather than macro factors driving the moves.

The U.S. government entered another partial shutdown, which may postpone data releases this week. Friday’s monthly jobs report faces potential delay due to the shutdown.

The post Daily Market Update: Bitcoin and Stock Futures Climb Following Weekend Market Selloff appeared first on Blockonomi.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8