The market value of AI Agent far exceeds that of DeFi Summer, or will it replicate the DeFi-style market trend?

Author: Nancy, PANews

Dominant narratives emerge in every crypto cycle, and AI+ is undoubtedly one of the biggest themes of this bull market. In particular, the AI Agent craze is grabbing most of the liquidity on the chain, and there are more and more discussions in the market about crypto AI being in a similar DeFi Summer cycle. In this article, PANews will compare the market development scale of crypto AI and DeFi, and explore the similarities and differences in the development of these two fields.

The market value of 48 billion exceeds that of DeFi Summer. Whether DeFi can be successfully replicated has caused controversy.

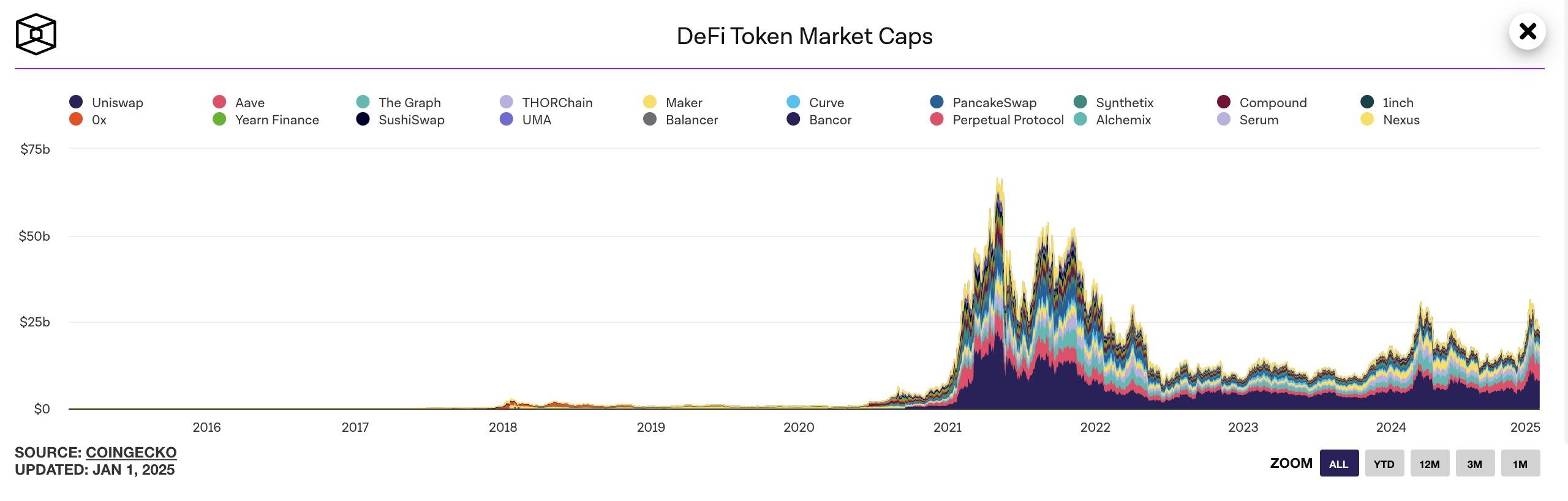

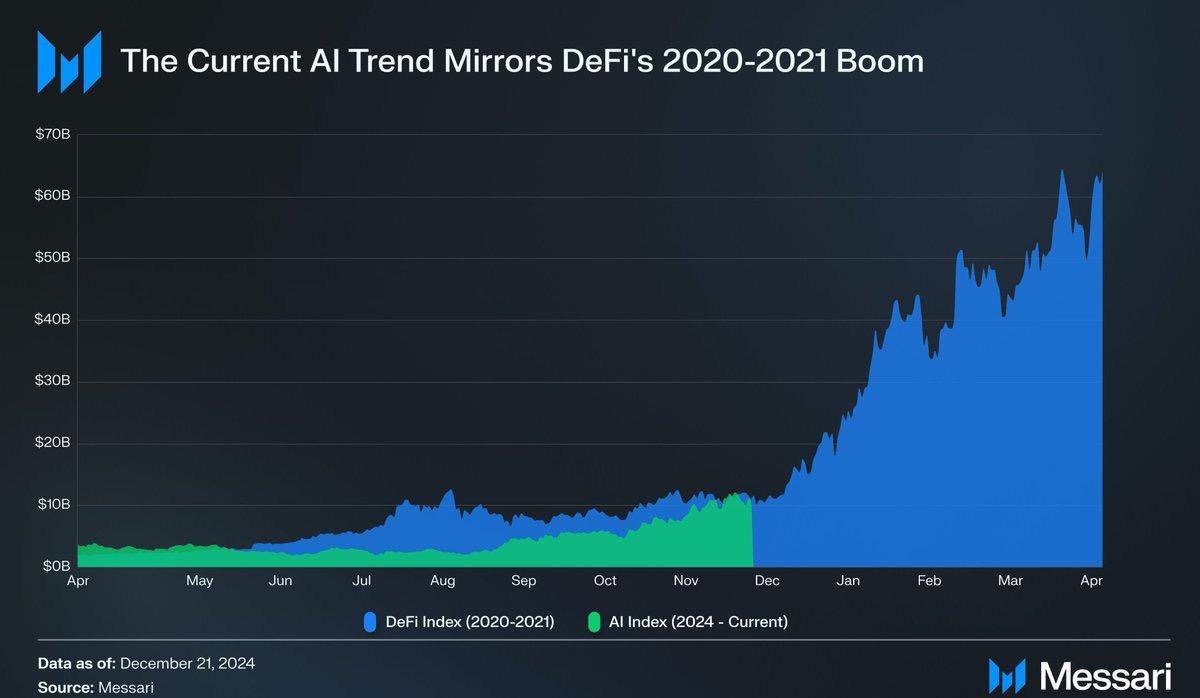

According to Coingecko data, as of January 2, the market value of the crypto AI sector has reached $48.8 billion, far exceeding the market value of DeFi during the "DeFi Summer". According to The Block data, after DeFi's explosive growth in 2020, its market value peaked at $6.04 billion, and it did not break through the $50 billion mark until mid-April 2021, when the market had gradually matured and diversified. This comparison shows that the explosive power of crypto AI has surpassed the early development stage of DeFi, showing a stronger advantage in market appeal and growth potential.

In particular, the AI Agent segment has continued to explode during this period. According to CoinGecko data, as of January 2, the market value of AI Agent has reached US$16.93 billion, accounting for 34.7% of the entire encrypted AI track, which is equivalent to the total market value of DeFi protocols in January 2021. Taking the leading projects Virtuals Protocol (US$5.02 billion) and ai16z (US$2.7 billion) as examples, the sum of their market values has surpassed the market value of all DeFi protocols at the end of 2020, further highlighting the rapid development of the AI track. The leading DeFi projects Uniswap and Aave had the highest circulating market values of US$22.05 billion and US$6.58 billion, respectively, in the last bull market.

From the perspective of capital investment, DeFi has attracted a lot of venture capital injection after its rapid development. Crypto AI is also at a similar stage. More and more funds are beginning to flow into the AI field, and investment in crypto AI has surged. According to the 2024 financing report compiled by PANews , the DeFi field received $1.69 billion in 296 investments and financings in 2024. As an emerging category, AI projects have grown rapidly this year, with nearly 100 disclosed financing events, of which 15.2% received tens of millions of dollars in funding, with a funding scale of around $600 million.

Although the data of the crypto AI track is impressive, the market still has different views on whether its development cycle can be similar to DeFi. For example, Messari pointed out in its latest report that AI Agent will peak in the first quarter of 2025 and will not recover. There are several reasons: (1) AI Agent has not yet proved that its product adaptability is sufficient to support market speculation; (2) The success of Alt-L1 is based on the clear demand for block space during the DeFi boom, but AI Agent lacks both demand and a clear user base; (3) The launch of AI Agent relies on market speculation, but this speculation cycle will collapse when the market realizes that they will remain just playthings for the foreseeable future.

There are also views that AI has similar development potential as DeFi. For example, crypto KOL @ 0xWizard said that 2020 can be called the "Cambrian Explosion of DeFi", and 2025 is likely to be the "Cambrian Explosion of AI Agent". Various Ai+Crypto gameplays in the future will take shape next year. Researcher Haotian believes that the advent of AI Agent is like the DeFi Summer in the blockchain in 2020, which will produce a huge new "bubble" narrative cycle of Build+Speculation. Although the AI Agent ecosystem does not even have exclusive infra conditions, from the perspective of ecological plasticity, the industry narrative opportunities brought by AI Agent are much greater than DeFi.

Former Spartan Group member @0xJeff predicted that 2025 will be called the Agentic era, and Agentic L1 will reach a market value of $100 billion, similar to the L1 valuation cycle in 2020-21; DeFi will reach the TVL high of more than $200 billion in the previous cycle with the help of AI Agent.

Regarding the valuation of AI-based MEME coin projects, crypto KOL @Rui said that in the early MEME market, the valuation of a project was closely related to whether it could be listed on an exchange, especially a top exchange. However, with the rise of AI Agent and market changes, the original valuation system based on exchange logic for large-cap MEME has become ineffective. People's valuation expectations for projects are not about which exchanges they will be listed on, but what kind of ecosystem they will create. For projects that already have an ecosystem, the valuation can be determined based on the proportion of their ecosystem; for single projects or "wild system" projects, the key to valuation is whether it can break through the $100 million market value. Below this market value, it relies more on communication, community and early funding support.

Four commonalities from cultural influence to capital efficiency

The combination of technology and capital is the core driving force for the development of the crypto industry. In the last bull market, DeFi reshaped the crypto financial world through decentralized platforms and smart contracts. Today, crypto AI is changing the way the crypto market operates in a more intelligent and automated way. From the current perspective, the two have similarities in cultural influence, technical foundation, entry barriers and capital efficiency.

Stalk Culture

As one of the core narratives of the last round of crypto bull market, DeFi itself has a spirit of rebellion against traditional finance. Many DeFi projects attract attention through humorous and spoof naming methods (such as various food series) while providing real financial functions. Initially, the market even classified DeFi as a liquidity game rather than a pure financial tool, but this culture of breaking the "seriousness" of traditional finance unexpectedly inspired reflection and discussion on the traditional financial system, and quickly accumulated a large number of developers and users.

Similar to the meme culture in the early DeFi narrative, the popularity of crypto AI also relies on the cultural power of MEME. The rise of AI Agent not only relies on technological innovation and application value, but also quickly gathers emotions through humorous and playful MEME methods, thereby stimulating the interest and participation of users on the chain, including allowing new groups such as developers and researchers outside the circle to join in a more relaxed and interactive way.

Technical foundation

With its support in smart contracts, token standards and developer ecosystem, Ethereum's flexibility provides a strong technical foundation for the rise of DeFi. It not only allows developers to innovate financial products based on demand, but its decentralized and open source mechanisms also provide users with a fair and transparent financial platform.

The rise and popularity of this cycle of crypto AI narratives also began with the explosive progress of AI technology, especially the emergence of large language models (such as ChatGPT), which made people see the huge potential of combining artificial intelligence technology with blockchain. At the same time, the rapid improvement of AI large model capabilities has also enabled more intelligent on-chain applications, such as trading strategies, market forecasting, smart contract automation and data analysis, thus providing new perspectives and impetus for crypto technology innovation.

Barriers to entry

Compared with the traditional financial system that requires complicated procedures, bank accounts and credit checks, DeFi can provide an open and transparent financial service method without intermediaries through blockchain and smart contracts. With only a crypto wallet and a small amount of crypto assets, you can freely engage in activities such as lending, trading, and liquidity provision without being restricted by region or economic background.

Compared with traditional encryption tools and platforms, AI Agent provides a more intelligent and automated operation method, allowing users to easily get started without having to deeply understand complex technical details and professional trading knowledge and experience. At the same time, high-quality AI Agent projects have also broken the high thresholds of previous VC and centralized exchanges (CEX) and other platforms through low participation thresholds and convenient operation paths, which not only provides more participation opportunities for individual investors, but also opens up a lower-cost and more decentralized innovation channel for developers and project parties.

The combination of AI Agent and MEME culture also lowers people's cognitive threshold for encryption AI technology, especially for users with non-technical backgrounds, and breaks the high-threshold image of technical projects, making participation in this field more diversified, relaxed and entertaining.

Capital efficiency

In the DeFi narrative, capital efficiency has always been one of the core driving forces. DeFi can greatly improve the efficiency of capital use through decentralized platforms, smart contracts and automation mechanisms. These platforms have attracted a large number of institutional funds and retail users to enter the market by providing high APY and capital returns. Since there is no need for intermediaries and traditional bank processing, funds can flow in a shorter time and obtain higher returns, greatly improving the capital efficiency of the market.

AI Agent can help users achieve more efficient fund operations in the crypto market through the automation and intelligent processing of artificial intelligence technology. Unlike traditional manual intervention, AI Agent can automatically perform tasks such as trading, asset management, and risk control based on real-time market data, helping users seize market opportunities and avoid emotional decisions and human errors, thereby greatly improving the operational efficiency of funds. In addition, the AI Agent project provides more users with the opportunity to redistribute benefits through the on-chain execution mechanism, allowing participants to enjoy the project's growth dividends with a low threshold.

Four major differences from technology-driven to user-involved

Although DeFi and crypto AI have shown similar momentum and potential in driving innovation in the crypto market, they differ significantly in several key aspects. These differences are not only reflected in the complexity of the technology and the breadth of application scenarios, but also in the different ways of market driving forces and user participation.

Application

The main focus of DeFi is on-chain finance, and the main innovations are concentrated on the construction of financial instruments such as decentralized exchanges (DEX), automated market makers (AMM), and lending agreements. Although these innovations have subverted the traditional financial system, their application scenarios are relatively concentrated and clear. In contrast, the application scope of crypto AI is wider, involving multiple fields such as on-chain finance, AI-generated content (AIGC), NFT, smart contract automation, and data analysis. Although crypto AI is more complex in terms of technological integration, this also enables it to reach more markets and user needs. In the future, with the technological development of large-scale AI models, more cross-domain innovations and applications will be promoted.

Technology driving force

DeFi's technological innovation is mainly based on blockchain and smart contracts, and it promotes innovation in the decentralized financial ecosystem. Its core driving force comes from decentralized transactions, permissionless financial innovation, and automatic execution of smart contracts. Crypto AI narratives, on the other hand, have complex and diverse technical drivers, ranging from financial fields such as trading strategies and risk management to a wider range of applications such as content generation, personalized recommendations, and data analysis.

User Groups

The main user group of DeFi is native users on the chain, who usually have strong financial operation experience. In addition to attracting crypto natives, crypto AI can also attract a large number of users with non-technical backgrounds, including content creators, developers, and technical researchers, and has significant advantages in popularity and market coverage.

Market value driven

The market value of DeFi projects is mainly determined by factors such as the amount of locked positions, the listing and liquidity of exchanges, and is more dependent on the frequency of use of financial instruments on the platform and the degree of user participation. The market operation is relatively direct and transparent. Relatively speaking, the market value logic of encrypted AI projects is more complex and has a higher degree of uncertainty. It not only depends on the depth and breadth of technological innovation, but also needs to consider the ecological influence of the project and the development potential of actual application scenarios. It also means that whether the encrypted AI narrative can continue depends on the combination of technological progress and user needs, and there are higher risks and potential.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse