$1.5B liquidated as Bitcoin drops 13% and market liquidity, attention pull back

Bitcoin extended its sharp weekly decline after more than $1.5 billion in leveraged long positions were liquidated, triggering a liquidity squeeze that pushed prices down over 13% and dragged institutional flows, market participation, and media attention lower across the crypto sector.

- More than $1.5 billion in leveraged long positions were liquidated in late January, accelerating Bitcoin’s decline and deepening short-term market stress.

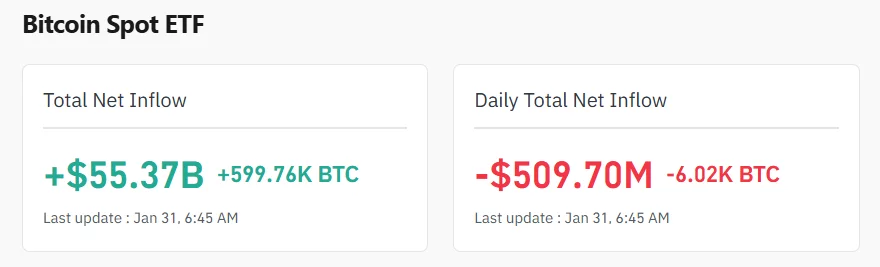

- Spot Bitcoin ETFs recorded roughly $509 million in net outflows, signaling a temporary pullback by institutional investors amid risk-off conditions.

- Prolonged drawdowns tend to reduce public interest and media engagement, making visibility and disciplined communication harder for crypto projects during downturns.

Bitcoin extended its sharp selloff this week, falling more than 13% over seven days as a wave of forced liquidations, ETF outflows, and declining leverage drained liquidity from crypto markets. The market is witnessing the most severe short-term drawdowns since late 2025.

Liquidations drive the selloff

At the center of the decline was a cascade of long liquidations. Between January 29 and 31, more than $1.5 billion in leveraged long positions were wiped out, according to Coinglass data, marking the largest single-day liquidation event since November 2025. The forced selling amplified downside momentum as stop-losses were triggered and margin calls accelerated the drop.

Once key support levels break, leveraged positions are automatically closed, pushing prices lower regardless of broader market conviction. This dynamic helps explain the speed and depth of the decline, which outpaced typical spot-driven corrections.

Institutional flows turn negative

Pressure on Bitcoin intensified as institutional capital retreated from regulated crypto exposure. Spot Bitcoin exchange-traded funds recorded net outflows of approximately $509 million on January 31, signaling a shift toward risk reduction among asset managers and allocators.

The recent outflows suggest that institutional participants are rotating capital away from Bitcoin, at least temporarily, amid broader risk-off sentiment and deteriorating technical conditions.

Bear markets weigh on crypto visibility and media attention

Beyond price action, prolonged drawdowns tend to reshape the broader crypto information landscape. During risk-off phases, declining prices are often accompanied by falling public interest, reduced search activity, and weaker traffic across crypto-focused media.

According to the latest Outset Data Pulse report on US crypto media traffic, Outset PR identified a direct correlation between Bitcoin price dynamics and readership trends across major crypto publications. As BTC enters sustained downturns, overall traffic consistently contracts, reflecting reduced retail engagement and lower speculative appetite.

This drop in attention creates a secondary challenge for the industry: visibility becomes harder to maintain precisely when clarity matters most.

Strategic communication as a defensive asset

In this environment, communication strategy becomes less about amplification and more about discipline. With fewer active market participants and shrinking media bandwidth, messaging that lacks structure or continuity is more likely to be ignored.

Outset PR highlights that during bear-market conditions, projects that maintain consistent narrative frameworks and substance-driven content rather than relying on hype tend to preserve mindshare more effectively.

As crypto markets continue to digest the recent deleveraging cycle, visibility risks are likely to persist alongside price volatility. For Web3 projects, the ability to sustain a clear narrative through downturns may prove as important as product execution itself.

BTC technical structure remains fragile

From a technical perspective, Bitcoin sits below its 100-day moving average at 93,937, which can signal counter-trend moves rather than confirmed reversals. The Momentum indicator remains deeply negative at −12,152, and the MACD at −2,120 continues to signal sell conditions, suggesting that bearish pressure has not yet fully exhausted itself.

Oversold readings can precede short-term bounces, but without a decisive reclaim of key moving averages accompanied by rising volume and improving market breadth, upside moves are likely to be corrective rather than structural.

A market in reset mode

The current environment reflects a broader reset mode. Markets tend to stabilize once forced selling subsides, but sustained recoveries typically emerge only after leverage rebuilds under more conservative positioning and spot demand returns.

For now, Bitcoin appears caught between the aftershocks of a leverage-driven unwind and the absence of new capital willing to step in aggressively. Until participation recovers, volatility may remain elevated and rallies vulnerable.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8