Applied Digital Statistics 2026: Secrets Behind the Surge

Applied Digital stands at the forefront of digital infrastructure, designing and operating next‑generation data centers built for high‑performance computing (HPC) and artificial intelligence (AI) workloads across North America. The firm’s rapid buildout of scalable compute capacity underpins critical services for enterprise AI training and HPC customers, while expanding its presence in crypto mining hosting. As digital transformation accelerates, this infrastructure supports major breakthroughs in machine learning and compute‑intensive industries. Read on to explore the latest statistics shaping Applied Digital’s growth.

Editor’s Choice

- HPC Hosting generated approximately $85.0 million of revenue in the same quarter.

- Applied Digital’s Polaris Forge 1 site operates at 100 MW capacity, with a second 150 MW facility underway.

- A $5 billion, 15‑year lease with a U.S. hyperscaler adds 200 MW of AI infrastructure demand.

- Company recognized as the Best Data Center in the Americas 2025.

- Applied Digital has roughly 205 employees as of 2026.

- Prospective lease revenue across Polaris Forge 1 now exceeds $11 billion over 15 years.

Recent Developments

- In fiscal Q2 2026, Applied Digital’s total revenues climbed to $126.6 million, compared with $36.2 million in Q2 2025.

- Year‑over‑year cost of revenues rose 344%, reflecting rapid expansion.

- Selling, general, and administrative expenses increased 119% over the prior year.

- Net interest expense jumped 292% in the quarter.

- Applied Digital signed a $5 billion hyperscaler lease for 200 MW capacity at Polaris Forge 2.

- CoreWeave lease deals contribute a combined $11 billion in projected lease revenue over 15 years.

- The company’s AI infrastructure focus led the stock to rise over 325% year‑to‑date in 2025.

- Plans to spin off and merge the cloud business with EKSO Bionics move forward in 2026.

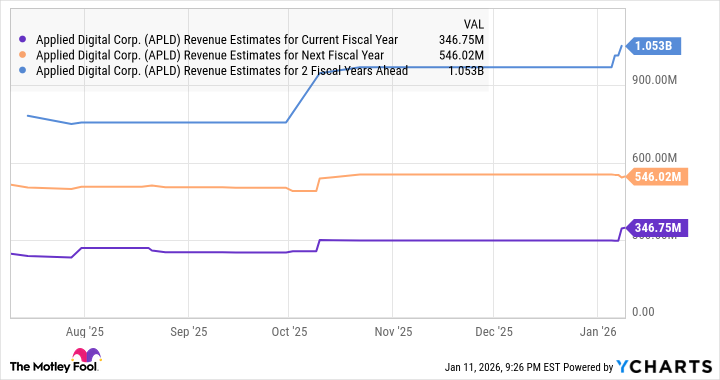

Applied Digital Revenue Estimates Overview

- Applied Digital’s current fiscal year revenue is projected at $346.75 million, reflecting the company’s near-term earnings baseline from HPC, AI infrastructure, and hosting operations.

- Analysts forecast Applied Digital’s next fiscal year revenue to reach $546.02 million, representing a significant step-up in topline growth driven by expanding data center capacity.

- Revenue estimates for the two fiscal years ahead surge to $1.053 billion, signaling expectations that Applied Digital will cross the $1 billion annual revenue milestone as long-term contracts and AI workloads scale.

- The progression from $346.75 million to $1.053 billion highlights strong multi-year revenue momentum, underpinned by increased demand for high-performance computing and AI-focused infrastructure.

- These forward-looking estimates suggest Applied Digital’s business model is transitioning from early-stage expansion toward large-scale, recurring revenue generation supported by long-term customer commitments.

(Reference: The Motley Fool)

(Reference: The Motley Fool)

Overview of Applied Digital

- In fiscal Q1, Applied Digital generated $64.2 million in revenue, up 84% year over year, with a net loss of $27.8 million from continuing operations.

- Q2 fiscal revenue reached $126.6 million, representing approximately 250% year-over-year growth, with Data Center Hosting contributing $41.6 million.

- Adjusted EBITDA for fiscal Q1 stood at approximately $0.5 million, with an adjusted net loss of about $7.6 million or $0.03 per share.

- The company ended fiscal Q1 with cash, cash equivalents, and restricted cash of $114.1 million and total debt of $687.3 million.

- Applied Digital expanded its long-term lease agreements with CoreWeave to a total contract value of approximately $11 billion.

- The company secured an initial $112.5 million draw from a $5 billion preferred equity facility with Macquarie Asset Management to fund future infrastructure projects.

- Built data center capacity totals about 150 MW, with an additional 300 MW under construction and a multi-gigawatt pipeline targeting 1,200–2,500 MW over five years.

Applied Digital High‐Performance Computing (HPC) Hosting Statistics

- Polaris Forge 1 Building 1 achieved full 100 MW energized capacity with Phase II RFS in November 2025.

- Polaris Forge 1 campus fully leased for 400 MW to CoreWeave across three buildings under 15-year contracts.

- HPC Hosting revenue reached $85.0 million in Q2 FY2026, up from $26.3 million in Q1, driven by $73.0 million in tenant fit-outs.

- Polaris Forge 2 breaks ground for initial 280 MW, scalable beyond, with a 200 MW hyperscaler lease projecting $5 billion revenue.

- Six-month HPC Hosting revenue totaled $111.3 million for the period ended November 30, 2025.

- Polaris Forge 1 is designed to expand to 1 GW with liquid cooling, yielding $2.7 billion lifecycle savings over 30 years.

- 400 MW CoreWeave leases at Polaris Forge 1 are expected to generate $11 billion in lease revenue over 15 years.

- Multi-GW pipeline supports 2 GW+ development via $5 billion Macquarie funding for HPC projects.

Core Products and Services

- Data Center Hosting produced $41.6 million in Q2 fiscal revenue from 286 MW facilities at full capacity in Jamestown (106 MW) and Ellendale (180 MW).

- Long-term HPC leases with CoreWeave total 400 MW at Polaris Forge 1, projecting $11 billion in revenue over ~15 years.

- HPC Hosting generated $85.0 million in Q2 fiscal revenue, including $73.0 million from tenant fit-out services and $12.0 million from rental revenues at Polaris Forge 1.

- HPC Hosting tenant fit-out services contributed $26.3 million in Q1 fiscal revenue for the 100 MW Polaris Forge 1 facility, nearing ready-for-service.

- Data Center Hosting delivered $37.9 million in Q1 fiscal revenue, up 9% year-over-year from increased capacity utilization.

- Facilities feature proprietary waterless direct-to-chip liquid cooling targeting a PUE of 1.18 and near-zero water consumption.

AI Data Center Capacity and Utilization

- Polaris Forge 2 signed a 200 MW hyperscaler lease, projecting $5 billion in revenue over 15 years.

- Combined Polaris Forge 1 & 2 leased capacity totals 600 MW with two major hyperscalers.

- CoreWeave leases secure 400 MW at Polaris Forge 1, generating $11 billion in contracted revenue over 15 years.

- Polaris Forge 2 hyperscaler holds the first right of refusal for an additional 800 MW on a 1 GW campus.

- Polaris Forge 1 Building 1 at 100 MW is fully energized and ready for service for CoreWeave.

- Initial 200 MW at Polaris Forge, 2 phases online starting 2026, reaching full capacity by 2027.

- Delta Forge 1 campus targets 430 MW total utility power supporting up to 300 MW critical IT load.

Data Center Locations and Infrastructure Footprint

- Polaris Forge 1 in Ellendale, North Dakota, hosts 400 MW critical IT under CoreWeave leases.

- Polaris Forge 2 in Harwood, North Dakota, leases 200 MW to a U.S. hyperscaler with 1 GW expansion potential.

- Combined Polaris Forge 1 & 2 footprint totals 600 MW leased critical IT load.

- Polaris Forge 1 Building 1 (100 MW) achieved full Ready for Service in late November 2025.

- Polaris Forge 2 spans 900+ acres supporting 280 MW initial utility scale-up.

- Delta Forge 1 campus in the southern U.S. breaks ground for 430 MW total power.

- North Dakota sites leverage low-cost power, targeting PUE 1.18 with waterless cooling.

- The infrastructure pipeline exceeds 2 GW across Polaris and Delta Forge campuses.

- Polaris Forge’s position for multi-GW ambition by 2030 in energy-rich regions.

- Ellendale (180 MW) and Jamestown (106 MW) data centers operate at full capacity.

Balance Sheet and Liquidity Metrics

- Total debt stood at $2.6 billion, mostly maturing after 2030.

- Total assets reached $5.2 billion, with liabilities at $3.2 billion at the end of Q2 FY2026.

- Stockholders’ equity approximated $2.1 billion post-major financings.

- Completed $2.35 billion senior secured notes offering at 9.25% due 2030.

- Macquarie’s preferred equity facility supplies up to $5 billion for infrastructure.

- Funded over $1.6 billion in property and equipment for data center development.

Client Base and Key Partnerships

- CoreWeave leases 400 MW at Polaris Forge 1 under 15-year contracts worth $11 billion.

- U.S. hyperscaler commits 200 MW at Polaris Forge 2 for $5 billion over 15 years.

- CoreWeave fit-out services generated $73.0 million in Q2 FY revenue.

- Macquarie Asset Management partnership provides up to $5 billion in preferred equity for expansions.

- Additional CoreWeave lease adds 150 MW at Polaris Forge, boosting total commitments.

- Hyperscaler holds the first right of refusal for 800 MW more at Polaris Forge 2.

- Partnerships secure $16 billion total contracted revenue from major AI/HPC clients.

- Client base includes AI model developers occupying 100% of the operational 600 MW capacity.

- Utility agreements enable low-cost power for a 1 GW+ pipeline across North Dakota sites.

Contracted Backlog and Future Revenue Visibility

- Contracted AI data center backlog totals $16 billion from Polaris Forge leases.

- CoreWeave 400 MW leases generate $11 billion over 15 years at Polaris Forge 1.

- Hyperscaler 200 MW lease adds $5 billion over 15 years at Polaris Forge 2.

- ~40% of backlog is realizable within 24 months via phased capacity deliveries.

- FY2026 revenue projected at $550–650 million, up 30–38% from backlog.

- 600 MW leased capacity underpins multi-year cash flow visibility.

- 250 MW additional pipeline supports lease negotiations for $7 billion+ revenue.

- Long-term leases transition to recurring revenue post $111.3 million six-month HPC.

- Macquarie $5 billion funding accelerates backlog conversion to operating cash.

Cash Flow and Capital Expenditure Statistics

- Operating cash flow used $97.9 million for the six months ended November 30, 2025.

- Investing cash flow used $818.5 million, mainly for property/equipment purchases.

- Capex totaled $801.5 million for data center/power infrastructure in six months.

- Financing cash inflow of $3.1 billion, driven by $2.4 billion debt borrowings.

- Q1 operating cash used $82.0 million amid $64.2 million in revenue.

- Q2 operating cash used $15.8 million with $126.6 million in revenue ramp.

- Macquarie preferred equity drew $900 million total for Polaris Forge buildouts.

- Tenant fit-outs generated $99.3 million in cash inflows from CoreWeave in six months.

- Net cash increased $2.2 billion for the six months ended November 30, 2025.

- Macquarie development loan adds $100 million initial for new campus pre-leases.

Valuation Ratios and Market Multiples

- Price-to-sales (P/S) ratio stands at 29.63 trailing twelve months.

- Forward P/S ratio measures 25.86, reflecting AI growth expectations.

- The price-to-book (P/B) ratio is 6.15 amid infrastructure asset buildup.

- Price-to-earnings (P/E) ratio remains negative at -63.88 due to losses.

- Debt-to-equity ratio at 1.26 or 126% with leveraged expansion.

- Market cap reached $9.3 billion with an enterprise value of $9.96 billion.

- Analyst consensus price target $42.90, ranging $37–$56.

- EV-to-sales ratio 57.40 trailing, EV/EBITDA 1703.52.

- Current ratio 4.82, quick ratio 3.42, bolstering liquidity.

Share Structure and Ownership Breakdown

- Institutions hold 65.67% of shares, with 296 buyers adding $972.11 million in the last 12 months.

- Insiders own 9.87%, including CEO Wes Cummins with 22.49 million shares.

- Retail and public own 17.39%, mutual funds/ETFs 25.53%.

- Private entities hold 9.6% via Cummins Family Ltd (7.83%, 17.59 million shares).

- Shares outstanding total 225.07 million with 173.16 million float (76.94%).

- Outstanding shares grew 25.4% year-over-year amid financings.

- BlackRock (7.17%, 16.14 million) and Vanguard (5.99%, 13.49 million) are among the top institutions.

- Insiders sold $8.6 million in 4 transactions in January 2026.

Institutional and Insider Ownership Statistics

- Institutions accumulated $972.11 million in shares with 296 buyers vs 112 sellers over the last 12 months.

- Insiders sold $8.6 million across 4 transactions in January 2026.

- Mutual funds/ETFs hold 25.53%; top funds include Vanguard (13.49 million shares).

- 296 institutional owners increased their stakes; 112 decreased in the recent quarter.

- Retail trading volume spiked 200% around Q2 earnings/lease announcements.

- The top 10 institutions own 41.2%, led by Hood River (21.27 million shares).

- Insider ownership 9.87%; no buys reported in the last 6 months.

- Institutional ownership rose to 65.67% from 62.9% year-over-year.

- Strategic AI investors boosted positions 45% post-CoreWeave/Macquarie deals.

- Average daily volume is 35.2 million shares amid a 173.16 million float.

Frequently Asked Questions (FAQs)

Applied Digital has roughly $16 billion in contracted lease revenue from long‑term AI data center deals.

The company drew $562.5 million from Macquarie Asset Management’s preferred equity facility.

APLD stock’s 52‑week range spanned from approximately $3.31 to $42.27.

Year‑to‑date APLD returns were ~38%, outpacing the S&P 500’s ~1.37% over the same period.

Conclusion

Applied Digital’s financial and trading narrative today reflects a transition from construction‑heavy infrastructure development toward monetization as AI and HPC demand accelerate. The stock’s performance underscores strong investor appetite for long‑term leased revenue and strategic data center positioning, even as traditional profitability metrics lag.

Valuation multiples highlight growth expectations, while market cap expansion and diverse ownership suggest robust participation across retail and institutional segments. With foundational leasebacks, expanding compute capacity, and evolving client partnerships, Applied Digital remains a key play in the AI infrastructure landscape moving forward.

The post Applied Digital Statistics 2026: Secrets Behind the Surge appeared first on CoinLaw.

You May Also Like

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds

Why Vitalik Says L2s Aren’t Ethereum Shards Now?