Shiba Inu Price Targets 70% Surge Amid Whales Buying Spree

Shiba Inu price has pulled back and moved into a technical bear market after falling by 20% from its highest level this month.

- The Shiba Inu price has formed a cup-and-handle pattern.

- Data shows that whales have continued to accumulate SHIB this month.

- The supply of Shiba Inu tokens on exchanges has plunged.

Shiba Inu (SHIB) token was trading at $0.000013 on Thursday, down from this month’s high of $0.00001600. It remains about 32% above its lowest point this month.

Shiba Inu whales are accumulating

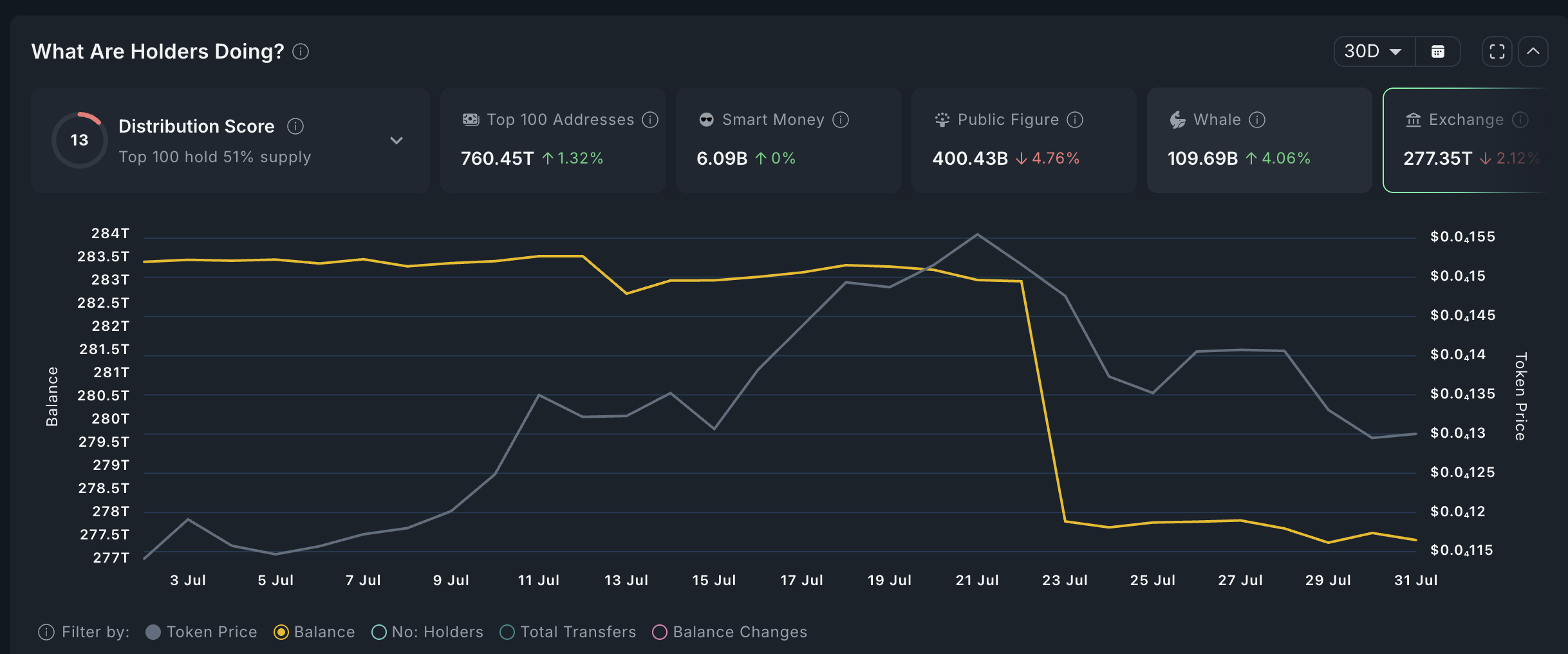

Nansen data shows that whales have continued to accumulate the SHIB token in recent months, a sign they expect it to keep rising. These whales hold over 109.69 billion tokens, up sharply from this month’s low of 105 billion. Whale accumulation is usually a signal that investors anticipate a price rebound.

Most importantly, the ongoing whale buying has come at a time when the supply of SHIB coins on exchanges has been in freefall. There are now 277.37 trillion tokens on centralized and decentralized exchanges, down from 283 trillion earlier this month.

Exchange balances fall when investors move their tokens to self-custody, typically expecting a price recovery. Historically, most tokens surge when exchange outflows are in an upward trajectory.

The other catalyst for SHIB price is that Ethereum is on the cusp of jumping to $4,000. It has jumped by 175% from its lowest level this year, and its technicals and ETF inflows point to more gains. SHIB price does well when Ethereum is rising.

Still, SHIB price faces potential risks. For example, Shibarium, its layer-2 network, is no longer growing. It holds just $2.47 million in total assets, down 1% in the last 30 days. This is notable since most chains added assets in July, with combined TVL rising to $282 billion.

Another potential risk for Shiba Inu price is that futures open interest has dropped in recent weeks.

Shiba Inu price technical analysis

Technicals suggest that SHIB price is on the cusp of a strong rebound amid whale accumulation. It has formed a cup-and-handle pattern, whose upper side is at $0.00001600 and the lower side is at $0.000010. This lower side also coincides with the double bottom, whose neckline is at $0.00001760.

The ongoing pullback is part of the handle section of the cup-and-handle pattern. Measuring the cup’s depth of 36% from its upper side gives a target price of $0.00002185, up over 70% from the current level.

You May Also Like

Strategy to initiate a bitcoin security program addressing quantum uncertainty

Copy linkX (Twitter)LinkedInFacebookEmail

Strategic Shift Impacts Crypto Trading Landscape