Did Vitalik Buterin Just Kill Ethereum Layer-2s? Here’s What He Said

Vitalik Buterin is signaling a major reframing of Ethereum’s layer-2 narrative: not the death of rollups, but the end of the idea that L2s are shards whose primary job is scaling the network. With L1 fees now low and gas limit projected to rise sharply in 2026, he argues the rollup-centric roadmap’s original premise no longer fits the reality on the ground.

Buterin opened his X post on Feb. 3 by pointing to two pressures that have been building in parallel: L2s have moved to “stage 2” far more slowly than expected, and Ethereum mainnet is scaling in its own right. In his telling, those trends break the old mental model in both directions.

“Ethereum needs to scale,” he wrote, recapping what he framed as the original thesis. “The definition of ‘Ethereum scaling’ is the existence of large quantities of block space that is backed by the full faith and credit of Ethereum… block space where, if you do things (including with ETH) inside that block space, your activities are guaranteed to be valid, uncensored, unreverted, untouched, as long as Ethereum itself functions. If you create a 10000 TPS EVM where its connection to L1 is mediated by a multisig bridge, then you are not scaling Ethereum.”

The punchline is blunt: “This vision no longer makes sense.” Buterin says L1 doesn’t need L2s to serve as “branded shards” if base-layer capacity is expanding, and he’s increasingly skeptical that many L2s either can or want to meet the security and control expectations that label implies. He pointed to at least one L2 that, in his words, “may never want to go beyond stage 1,” citing not only technical concerns around ZK-EVM safety but also customer-driven regulatory requirements that “require them to have ultimate control.”

Ethereum Layer-2’s Need To Change

That’s not presented as an indictment so much as a categorization shift. If an L2 retains ultimate control, it may still be a valid product for its users, Buterin suggested, but it shouldn’t be marketed as “scaling Ethereum” in the strict sense envisioned by the rollup-centric roadmap. In that context, he argues, “we should stop thinking about L2s as literally being ‘branded shards’, with the social status and responsibilities that this entails.”

Instead, he sketches a spectrum model: some L2s can be tightly backed by ETH’s security guarantees, while others can be looser and more optional depending on user needs. That spectrum framing implicitly makes room for app-specific chains, different trust models, and non-EVM environments—without forcing them into a single “rollup as shard” storyline.

For L2 teams, Buterin’s guidance is straightforward: stop anchoring your identity on scaling alone. If you’re handling ETH or Ethereum-issued assets, he argues “stage 1 at the minimum” matters; otherwise, you’re effectively operating as “just a separate L1 with a bridge.” The real differentiator, in his view, should be features and properties that a larger L1 still won’t provide—whether that’s specialized execution environments, privacy, sequencing characteristics like ultra-low latency, or non-financial use cases.

Buterin says he’s become “more convinced of the value of the native rollup precompile,” especially once Ethereum has enshrined the ZK-EVM proof verification it “need[s] anyway to scale L1.” The idea is a protocol-level precompile that verifies ZK-EVM proofs and is treated as part of Ethereum itself, meaning it would “auto-upgrade along with Ethereum,” and if it shipped with a bug, “Ethereum will hard-fork to fix the bug.”

That last point is the subtext: he wants a path where trustless verification and interoperability are easier to achieve without a “security council,” and where rollups can add custom features while still anchoring their EVM correctness directly to Ethereum. He also tied this direction to the prospect of synchronous composability: transactions that can safely span L1 and L2 liquidity with tight coupling, referencing ongoing research on combining preconfirmations with based rollups and real-time proving.

Buterin’s conclusion leaves room for uncomfortable outcomes. A permissionless ecosystem will produce chains with “trust-dependent, or backdoored, or otherwise insecure” elements, he wrote, calling that “unavoidable.” The job, as he frames it, is to make guarantees legible to users while strengthening Ethereum’s base layer, suggesting that the next phase of L2 competition may be less about who “scales Ethereum,” and more about who can credibly define, and prove, what they’re actually offering.

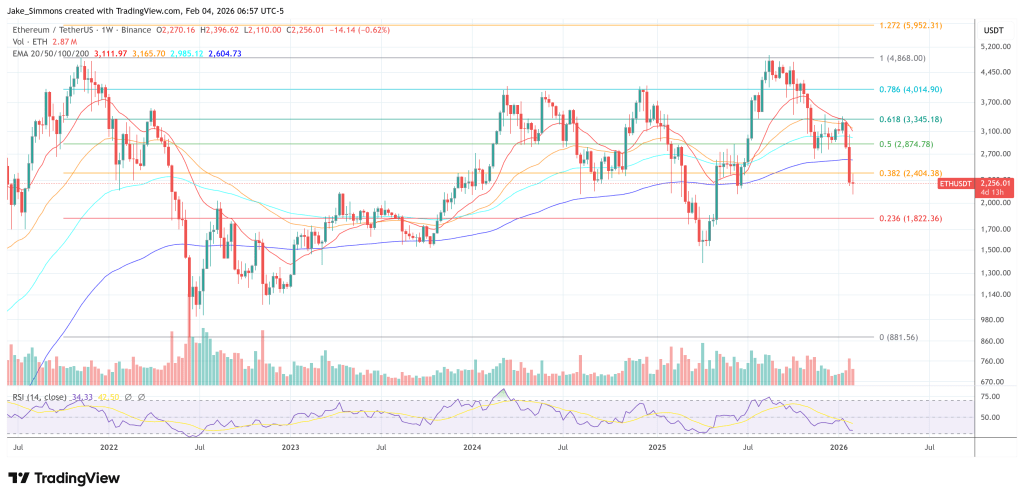

At press time, ETH traded at $2,256.

You May Also Like

Trump roasts Mike Johnson for saying grace at prayer event: 'Excuse me, it's lunch!'

Where Can You Turn $1,000 Into $5,000 This Week? Experts Point Towards Remittix As The Best Option