Schiff’s Revenge: Gold Bug Mocks Bitcoin’s Slump While HYPER Outpaces Traditional Safe Havens

Quick Facts:

Peter Schiff is using Bitcoin’s price stagnation to promote gold, but he overlooks the massive infrastructure growth occurring on Bitcoin Layer 2s.

Peter Schiff is using Bitcoin’s price stagnation to promote gold, but he overlooks the massive infrastructure growth occurring on Bitcoin Layer 2s. Bitcoin Hyper integrates the Solana Virtual Machine (SVM) to bring high-speed smart contracts to Bitcoin, fixing the utility issues critics often cite.

Bitcoin Hyper integrates the Solana Virtual Machine (SVM) to bring high-speed smart contracts to Bitcoin, fixing the utility issues critics often cite. While spot Bitcoin chops, smart money has poured over $31M into the Hyper presale, with whales accumulating significant positions.

While spot Bitcoin chops, smart money has poured over $31M into the Hyper presale, with whales accumulating significant positions.

Peter Schiff is having a moment. Gold is flirting with all-time highs while Bitcoin struggles to hold critical support, giving the notorious gold bug ample room to post ‘I told you so,’ although not that directly.

His argument hasn’t changed since 2011: gold is real, while Bitcoin is, in his eyes, a speculative vehicle relying entirely on the ‘greater fool’ to keep spinning.

To be fair, the data gives him some ammo. Global tension and sticky inflation have sent institutional money running back to traditional shelters. Bitcoin’s volatility makes it an easy target for critics right now.

But staring at the daily chart misses the point. The real story isn’t the asset price of $BTC, it’s the massive infrastructure overhaul happening under the hood.

While Schiff takes victory laps, developers are fixing the utility gaps he loves to mock. The ‘pet rock’ thesis is crumbling as Layer 2s bring smart contracts to the chain.

This divergence, stagnant L1 price versus hyper-active L2 builds, suggests smart money is rotating toward utility. Leading the charge? Bitcoin Hyper ($HYPER), a project that has quietly outpaced traditional safe haven inflows by securing over $31M in early backing.

Solving The Utility Crisis With High-Speed SVM Integration

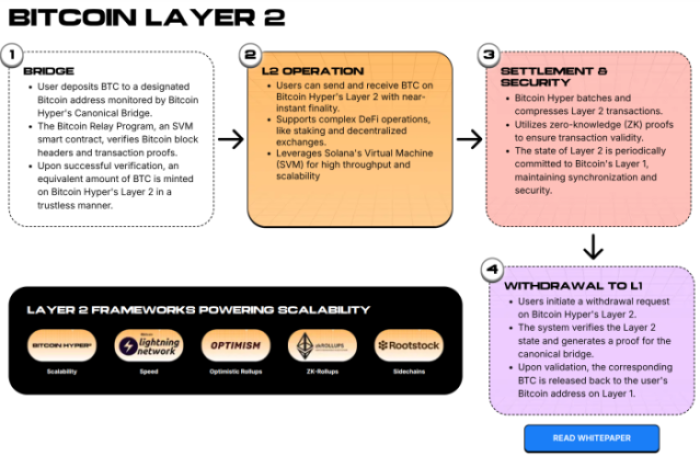

Critics (Schiff included) are right about one thing: Bitcoin is slow. A 10-minute block time kills most DeFi applications before they start. Bitcoin Hyper dismantles this argument by plugging the Solana Virtual Machine (SVM) directly into a Bitcoin Layer 2.

It creates a hybrid beast: Bitcoin’s security, Solana’s speed. We’re talking sub-second finality and negligible costs. It unlocks payments and complex DeFi protocols that simply couldn’t exist on Bitcoin before.

It creates a hybrid beast: Bitcoin’s security, Solana’s speed. We’re talking sub-second finality and negligible costs. It unlocks payments and complex DeFi protocols that simply couldn’t exist on Bitcoin before.

How? It uses a combo of zk-rollups, the SVM and a decentralized canonical bridge to bring speed, and programability to developers. It aims to solve the blockchain trilemma of old, taking $BTC from a store of value to an active participant in today’s crypto economy. Find out more in our ‘What is Bitcoin Hyper‘ guide.

It’s a similar scaling playbook that worked for Ethereum (but not the same approach/tech), finally coming to the market leader. Sophisticated actors aren’t waiting for spot $BTC to rebound; they’re betting on this convergence.

buy your $HYPER from its official PRESALE page

Smart Money Rotates Into The $31M Presale Phenomenon

While the broader market chops sideways, capital is flooding into the Bitcoin Hyper ecosystem. The numbers are hard to ignore: the official presale page reports raising over $31M. In a market riddled with uncertainty, that’s a serious flight to quality infrastructure.

Traders watching the on-chain flows will notice the shift. Data from Etherscan reveals whale wallets scooping large plays. The biggest single buy, $500K, hints that big players are positioning for an infrastructure boom while retail worries about candles.

The token, currently sitting at $0.0136751, offers an entry into a modular system where Bitcoin L1 settles, and the SVM L2 executes. But it’s also a yield play. Unlike Schiff’s gold (which just sits in a vault gathering dust), $HYPER offers high APY staking immediately after TGE, featuring a unique 7-day vesting structure for presale stakers.

The accumulation pattern looks distinct. It mirrors the early days of Stacks or Matic, smart money front-running a new ‘GDP’ for the Bitcoin network. By enabling developers to write in Rust and deploy dApps that settle on Bitcoin, the project creates intrinsic value that even a die-hard gold bug would struggle to dismiss.

JUMP INTO THE $HYPER PRESALE

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments, including presales and Layer 2 tokens, carry significant risks due to market volatility. Always conduct your own due diligence.

You May Also Like

Trump roasts Mike Johnson for saying grace at prayer event: 'Excuse me, it's lunch!'

Where Can You Turn $1,000 Into $5,000 This Week? Experts Point Towards Remittix As The Best Option