AI Capital Expenditure Skyrockets: Amazon’s $200B Gamble and Google’s $185B Bet Face Investor Scrutiny

BitcoinWorld

AI Capital Expenditure Skyrockets: Amazon’s $200B Gamble and Google’s $185B Bet Face Investor Scrutiny

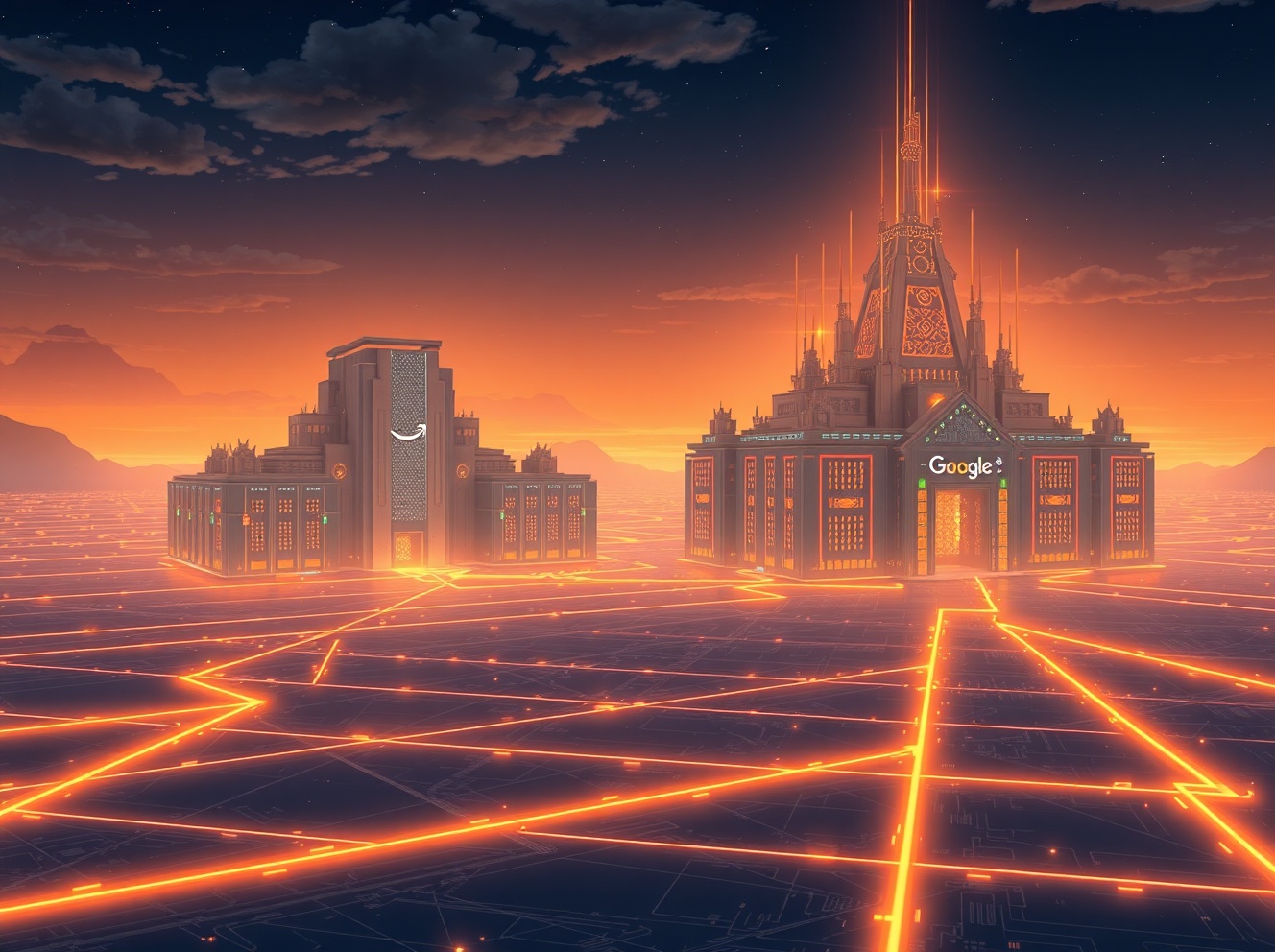

In a dramatic escalation of the artificial intelligence arms race, Amazon and Google have unveiled staggering capital expenditure projections for 2026, committing nearly $400 billion combined to infrastructure. This massive AI capital expenditure surge, however, has triggered immediate investor anxiety, casting a shadow over the industry’s high-stakes bet on computational supremacy. The fundamental question now reverberates through Wall Street and Silicon Valley alike: what tangible prize justifies this unprecedented financial outlay?

The Staggering Scale of AI Capital Expenditure

Recent quarterly earnings reports have transformed into declarations of financial warfare in the AI sector. Amazon now projects a monumental $200 billion in capital expenditures throughout 2026. This figure represents a sharp increase from its $131.8 billion outlay in 2025. The company’s spending spans a broad frontier, including AI, custom chips, warehouse robotics, and low earth orbit satellites. Consequently, Amazon’s vast physical logistics network complicates a pure AI analysis, as some costs fund automation converting existing facilities.

Meanwhile, Google positions itself as a close contender. The search giant announced a projected range of $175 billion to $185 billion for 2026 capital expenditures. This marks a near doubling from its $91.4 billion spend the previous year. This aggressive investment strategy underscores a core belief within tech leadership: controlling high-performance compute capacity is the definitive strategic advantage for the AI era. Therefore, this spending is not merely operational but existential, aimed at securing a foundational resource.

The Competitive Landscape of Tech Infrastructure

The AI capital expenditure race reveals a clear hierarchy among technology titans. While Amazon and Google set the pace, other major players have announced significant, yet comparatively lower, investment plans. Meta, reporting last week, projected a range of $115 to $135 billion for 2026. Microsoft, while lacking an official 2026 projection, reported a quarterly capital expenditure figure of $37.5 billion. If sustained, this annualizes to roughly $150 billion, placing it in a strong third position.

Oracle, once hailed as an AI infrastructure leader, now projects a comparatively modest $50 billion. This divergence highlights different strategic approaches and balance sheet capacities. The following table summarizes the projected 2026 capital expenditure landscape for major AI competitors:

| Company | Projected 2026 Capex | 2025 Capex (for context) |

|---|---|---|

| Amazon | $200 billion | $131.8 billion |

| $175-$185 billion | $91.4 billion | |

| Meta | $115-$135 billion | Not specified in source |

| Microsoft (annualized est.) | ~$150 billion | Based on Q1 rate |

| Oracle | $50 billion | Not specified in source |

This collective investment surge reflects a shared conviction. Tech executives fundamentally view advanced computing power as the scarce resource of the coming decade. They argue that only companies with sovereign control over their infrastructure supply chains will thrive. This logic drives the frantic construction of data centers worldwide.

Investor Backlash and the Profitability Paradox

Despite the strategic rationale, financial markets have reacted with pronounced skepticism. Each company announcing these massive figures saw its stock price decline. Notably, companies projecting higher spends generally experienced sharper drops. This reaction presents a critical paradox for the industry. Traditionally, businesses succeed by maximizing revenue and minimizing costs. The current AI infrastructure playbook inverts this principle, prioritizing immense upfront investment with future returns remaining theoretical.

This investor unease is not confined to companies with unclear AI monetization strategies. Even firms like Microsoft and Amazon, which possess robust cloud businesses and seemingly straightforward paths to AI monetization, faced pressure. The numbers simply exceed the comfort threshold for many shareholders. For instance, Google’s announcement contributed to investor questions about sustainable growth, while Amazon’s projection prompted analysis of its broader capital allocation.

The Broader Implications for the AI Industry

This capital expenditure race creates significant ripple effects across the global economy and technology sector. First, it accelerates the concentration of AI development capability within a few well-funded corporations. Second, it strains supply chains for critical components like advanced semiconductors, cooling systems, and power infrastructure. Third, it raises questions about energy consumption and environmental sustainability at this unprecedented scale.

Furthermore, the spending informs competitive dynamics beyond the cloud giants. Startups and mid-sized firms must increasingly rely on these platforms for compute access, potentially cementing an oligopoly. The industry narrative has shifted from software innovation to infrastructure scale. Key drivers of this spending include:

- Model Scale: Training next-generation AI models requires exponentially more compute.

- Inference Demand: Running AI applications for billions of users needs vast, low-latency infrastructure.

- Vertical Integration: Building custom AI chips (like Google’s TPUs or Amazon’s Trainium) requires huge fabrication investments.

- Geopolitical Strategy: Ensuring data sovereignty and compute resilience across different regions adds cost.

Conclusion

The AI capital expenditure race, led by Amazon and Google’s historic investments, defines the current technological epoch. While the strategic intent is clear—to secure computational dominance in an AI-driven future—the financial markets have delivered a stark verdict of concern. The ultimate prize remains undefined: is it market share in cloud services, ownership of foundational AI models, or the creation of entirely new economic platforms? Moving forward, tech giants will likely face intense pressure to demonstrate how these hundreds of billions in infrastructure spending translate into profitable, sustainable businesses. The year 2026 will serve as a crucial test, revealing whether this monumental AI capital expenditure was visionary investment or a spectacular misallocation of resources.

FAQs

Q1: What is AI capital expenditure, and why is it so high?

AI capital expenditure refers to the funds companies spend on physical assets for artificial intelligence, primarily data centers, servers, and networking equipment. It is exceptionally high because training and running advanced AI models require immense computational power, which demands building massive, specialized infrastructure at a scale never seen before.

Q2: How does Amazon’s $200B capex differ from Google’s?

Amazon’s projected $200 billion spending encompasses a wider array of projects beyond pure AI data centers, including robotics for its logistics network and its Project Kuiper satellite internet constellation. Google’s $175-$185 billion projection is more focused on its core technical infrastructure, including data centers and the hardware for its AI research and cloud services.

Q3: Why are investors worried about this high spending?

Investors are concerned because these expenditure levels are historically unprecedented and compress near-term profitability. There is skepticism about whether the expected future revenues from AI products and services will generate a sufficient return on such a colossal investment, leading to stock price declines following the announcements.

Q4: Who is winning the AI infrastructure race?

Based on projected 2026 capital expenditure, Amazon currently leads with $200 billion, followed closely by Google with up to $185 billion. Microsoft is estimated in third place, with Meta and Oracle trailing. However, “winning” is not solely about spending amount but also efficiency, technological innovation, and successful product commercialization.

Q5: What happens if this level of investment doesn’t pay off?

If the anticipated AI revolution fails to generate proportional economic returns, companies could face significant financial write-downs, reduced competitiveness, and intense shareholder pressure. It could lead to a major industry contraction, consolidation, and a strategic pivot away from pure scale towards more efficient, targeted AI investments.

This post AI Capital Expenditure Skyrockets: Amazon’s $200B Gamble and Google’s $185B Bet Face Investor Scrutiny first appeared on BitcoinWorld.

You May Also Like

Strategy to initiate a bitcoin security program addressing quantum uncertainty

Copy linkX (Twitter)LinkedInFacebookEmail

Strategic Shift Impacts Crypto Trading Landscape