The post Crypto Fear Hits Extreme Levels as Bitcoin Dips Below $65,000 appeared first on Coinpedia Fintech News The Crypto Fear and Greed Index fell to extreme The post Crypto Fear Hits Extreme Levels as Bitcoin Dips Below $65,000 appeared first on Coinpedia Fintech News The Crypto Fear and Greed Index fell to extreme

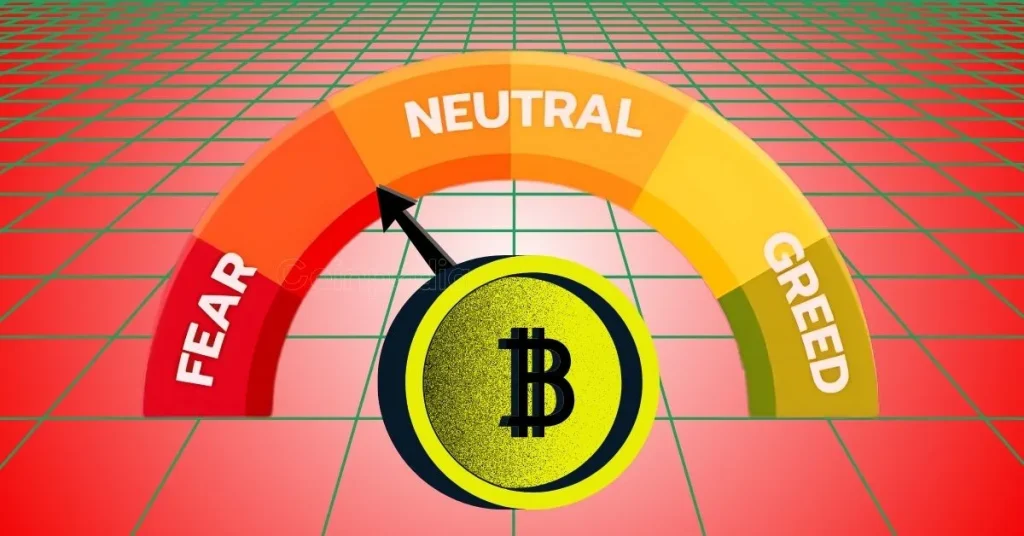

Crypto Fear Hits Extreme Levels as Bitcoin Dips Below $65,000

The post Crypto Fear Hits Extreme Levels as Bitcoin Dips Below $65,000 appeared first on Coinpedia Fintech News

The Crypto Fear and Greed Index fell to extreme fear levels of 5-9, the lowest since the June 2022 Terra and FTX crashes, as Bitcoin briefly dropped below $65,000 before recovering. The cryptocurrency saw a single-day decline of over $10,000, wiping out significant market value and triggering widespread liquidations. U.S. spot Bitcoin ETFs recorded $434.1 million in net outflows on February 5, led by BlackRock’s IBIT, reflecting growing caution among institutional investors.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact [email protected] for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

YZi Labs Binance Deposit: A $6.63M Signal That Could Shake the ID Token Market

BitcoinWorld YZi Labs Binance Deposit: A $6.63M Signal That Could Shake the ID Token Market In a significant on-chain transaction detected on March 21, 2025, an

Share

bitcoinworld2026/02/10 17:30

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more

Share

Coinstats2025/09/18 06:02

U.S. Crypto ETF Boom Expected In 2026 After SEC Clears Listing Path

Over 100 crypto-linked ETFs are expected to launch in the U.S. in 2026 following SEC regulatory changes, signaling a major expansion of institutional and retail

Share

Metaverse Post2026/01/07 22:32