Crypto crash to end soon? Recovery possible, key indicators show

The crypto crash accelerated this week, with Bitcoin price plunging to $60,500, its lowest level since October 2024, and the market capitalization of all coins moving to $2.2 trillion.

- The crypto crash accelerated this week as most coins tumbled.

- The Fear and Greed Index has fallen to extreme levels.

- Technical analysis suggests that it has become highly oversold.

Why the crypto crash is happening

The ongoing crypto market retreat is influenced by a mix of global economic concerns and investor sentiment. Rising tensions between the U.S. and Iran have added uncertainty, with both sides issuing warnings that any escalation could impact the region and potentially affect oil prices. However, there are no confirmed reports of U.S. military action, and any link between geopolitical fears and crypto price movements is speculative.

Bitcoin and altcoins also dropped as investors rotated out of risk assets and into value ones. A good example of this is the stock market, where the tech-heavy Nasdaq 100 Index has slumped, while value ETFs like the Vanguard Value ETF and the Schwab US Dividend ETF have soared to record highs.

Additionally, the rising crypto ETF outflows and soaring liquidations put more pressure on these assets. Spot Bitcoin (BTC) ETFs shed over $689 million in assets this year and are in their fourth consecutive month in the red. Similarly, Ethereum ETFs have shed over $149 million in assets.

Crypto liquidations have also soared in the past few days. That jumped by over 122% in the last 24 hours to over $2 billion.

On the positive side

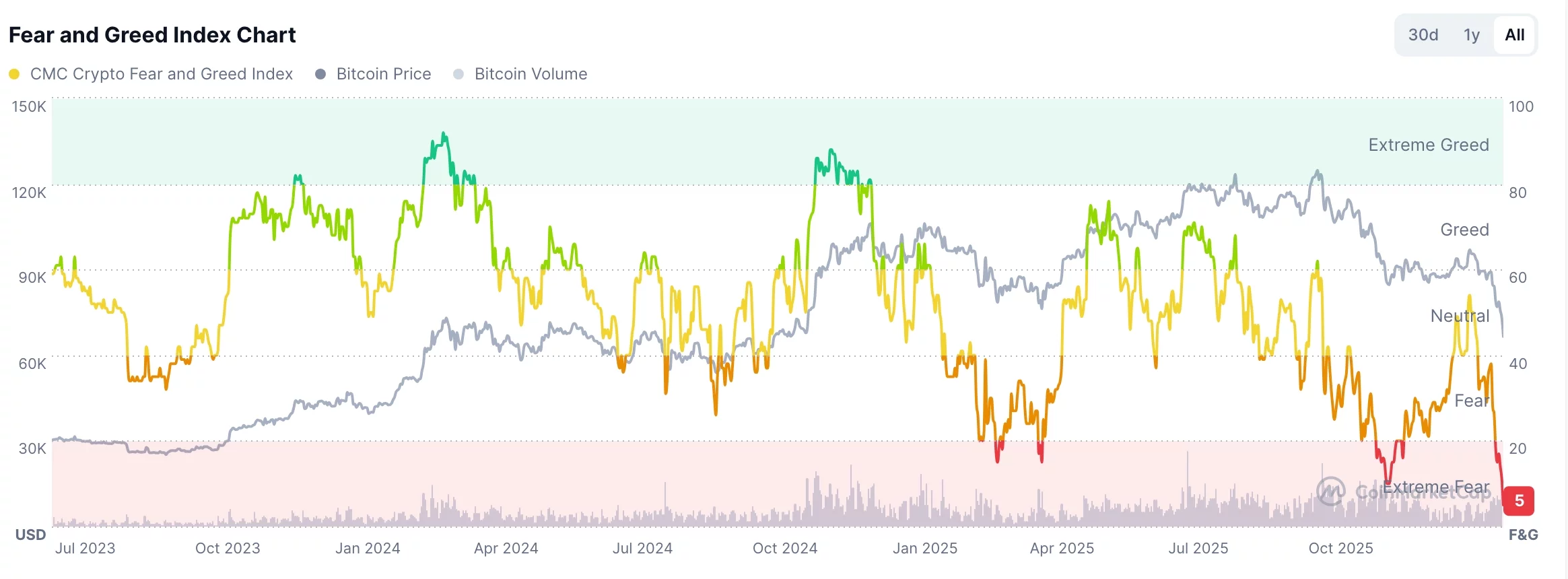

There are some key signs that suggest a crypto recovery is coming soon. First, the Crypto Fear and Index has slipped to 5. That’s the lowest level in years.

In most cases, crypto bull runs normally start when the index moves to the extreme fear zone. Similarly, crypto prices typically drop when they move into the extreme greed zone.

A good example of this is what happened in December, when it moved into the extreme greed zone at 10. Bitcoin and other altcoins rebounded in January, with BTC nearing $100,000. Before that, the index moved to the extreme fear zone in April last year and then rebounded to a record high after Trump changed his tune on tariffs.

Crypto Fear and Greed Index chart | Source: CMC

Crypto Fear and Greed Index chart | Source: CMC

Technical analysis also suggests that Bitcoin may rebound soon. For example, Bitcoin’s Relative Strength Index has moved to the oversold level of 27 for the first time since November 2022. Bitcoin has always rebounded whenever it moved to these oversold levels.

At the same time, Bitcoin has fallen to the rising wedge target. As the chart below shows, the widest point of this pattern was ~42%. It has then fallen by over 42% from the breakout point.

BTC price chart | Source: crypto.news

BTC price chart | Source: crypto.news

You May Also Like

Regulatory Clarity Relief, On-Chain Stress, Cautious Price Action

Vaadin Launches Swing Modernization Toolkit, Enabling Java Teams to Run Desktop Applications in the Browser