Bitcoin Price Roars Above $70,000 After Days of Sell-Offs

Bitcoin Magazine

Bitcoin Price Roars Above $70,000 After Days of Sell-Offs

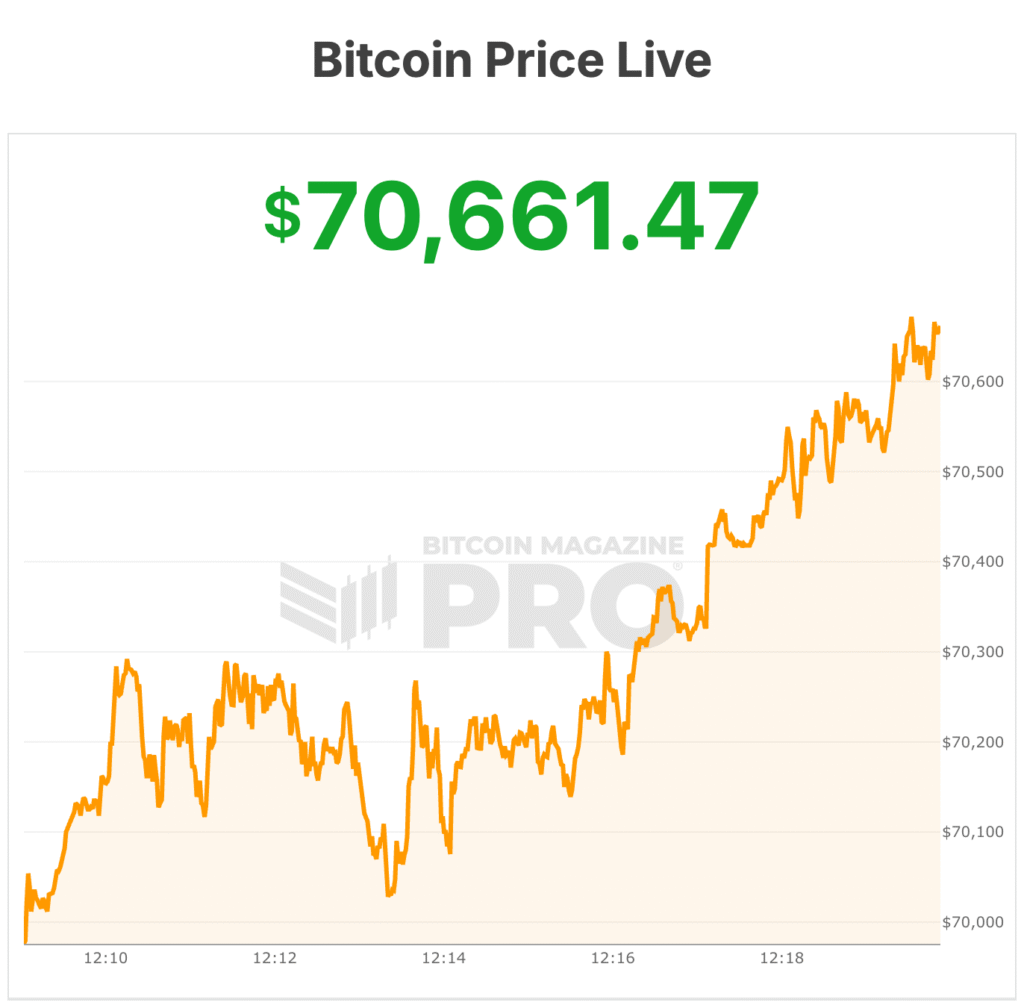

The bitcoin price rebounded sharply Friday after a steep sell-off over the previous 24 hours, climbing briefly above $70,000, a jump of $10,000 from its $60,000 low earlier in the 24-hour session.

The move came after several turbulent market sessions that saw the flagship cryptocurrency break key psychological support levels in a matter of hours. On Thursday, February 5, the Bitcoin price plunged as global financial markets deteriorated, with major stock indices sliding sharply and pushing investors out of riskier assets.

The sudden downturn was linked to broader macroeconomic stress, including weak earnings reports and steep declines in technology stocks, which intensified a flight to safety among traders.

Data compiled Thursday showed Bitcoin’s value dipping to its lowest since late 2024, signaling growing bearish sentiment among market participants.

The digital asset had retreated more than 40% from its all-time high above $126,000 reached in October 2025, underscoring the severity of the downturn.

Also, as the bitcoin price collapsed yesterday, forced liquidations boomed with over $1 billion in positions wiped out over the past 24 hours, predominantly long bets facing automatic close-outs as BTC broke key levels.

Crypto stocks rebound as Bitcoin price recovers

Despite Thursday’s losses, Bitcoin price’s rebound Friday saw prices climb from the $60,000 region back above the $70,000 mark, reflecting a nearly 15% recovery from intraday lows.

Crypto-related stocks saw massive gains as well. Strategy ($MSTR) shares were up 21% on the day, while Coinbase ($COIN) and Circle ($CRCL) and Robinhood ($HOOD) shares all jumped 10-15%

Bitcoin-linked equities also posted sharp gains, led by MARA Holdings (MARA), which climbed 21.03% to $8.14, and TeraWulf (WULF), up 19.55% to $14.25. Riot Platforms (RIOT) rose 16.54% to $14.05, while Cipher Mining (CIFR) added 15.47% to $14.66.

Bitmine Immersion Technologies (BMNR) increased 15.43% to $20.08, and Core Scientific (CORZ) gained 10.43% to $16.36. Neptune Digital Assets (NDA) also advanced, rising 11.43% to $0.78

During the drop, the iShares Bitcoin Trust (IBIT), a spot Bitcoin ETF managed by BlackRock that lets investors gain exposure to Bitcoin without holding the crypto directly, crushed its daily volume record with about $10 billion worth of shares traded — even as its price plunged 13%, marking the second‑worst one‑day drop since the fund’s launch.

Currently, bitcoin is trading at $70,661.

This post Bitcoin Price Roars Above $70,000 After Days of Sell-Offs first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Regulatory Clarity Relief, On-Chain Stress, Cautious Price Action

Vaadin Launches Swing Modernization Toolkit, Enabling Java Teams to Run Desktop Applications in the Browser