Dogecoin Price Forecast: Qubic community votes to target DOGE after Monero attack

- Dogecoin price slips 4% on Monday, approaching key support at $0.21, a close below could trigger further downside.

- The Qubic community has voted to target Dogecoin, following a recent 51% attack on Monero.

- NPL data show DOGE holders realizing losses while short positions among traders continue to rise.

Dogecoin (DOGE) price trades in red, slipping 4% at the time of writing on Monday, bringing it closer to the critical $0.21 support level; a firm close below could extend further downside. The decline comes as the Qubic community, which recently carried out a 51% attack on Monero (XMR), voted to target DOGE memecoin next. On-chain and derivatives data further highlight bearish sentiment, with DOGE holders realizing losses and rising short bets among traders.

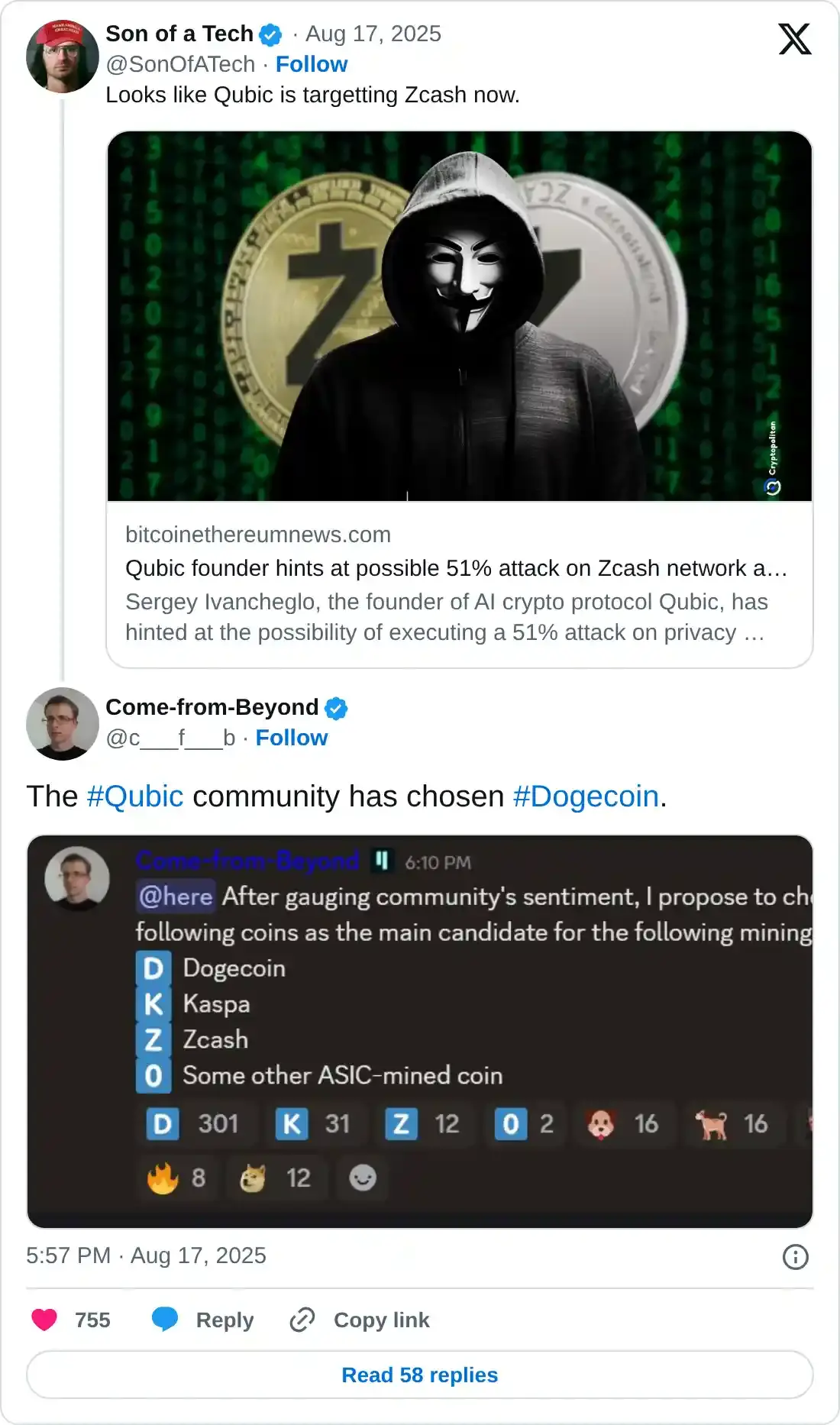

Qubic community targets Dogecoin

Sergey Ivancheglo, Qubic’s lead developer, posted on X on Sunday that the Qubic community has voted to target Dogecoin next. The community had several choices for the next target, including Dogecoin, Kaspa (KAS), Zcash (ZEC), and some other ASIC-mined coin.

The mining pool had recently carried out a 51% attack on Monero last week, which had caused a sharp decline in its price. The community’s shift towards targeting other proof-of-work blockchains could spell trouble for these blockchain-based monetary networks.

DOGE holders realize losses while bearish bets reach a monthly high

Santiment’s Network Realized Profit/Loss (NPL) indicator computes a daily network-level Return On Investment (ROI) based on the coin’s on-chain transaction volume. Simply put, it is used to measure market pain. Strong spikes in a coin’s NPL indicate that its holders are, on average, selling their bags at a significant profit. On the other hand, strong dips imply that the coin’s holders are, on average, realizing losses, suggesting panic sell-offs and investor capitulation.

In Dogecoin’s case, the NPL indicator dipped from 2.68 million to -271.41 million from Thurday to Friday, the lowest dip since July 2022. This negative downtick indicates that the holders were, on average, realizing losses and increasing selling pressure.

Dogecoin NPL chart. Source: Santiment

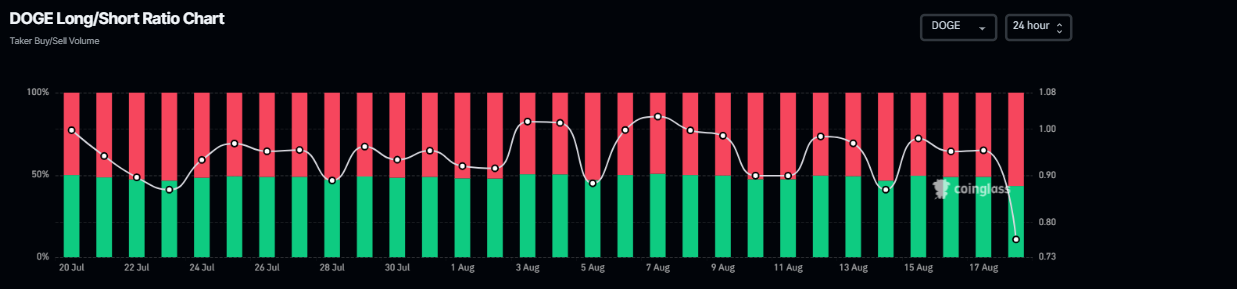

Coinglass’s long-to-short ratio reads 0.79 on Monday, marking the highest level in over a month. A ratio below one suggests bearish sentiment in the market as traders are betting that Dogecoin’s price will fall.

Dogecoin long-to-short chart. Source: Coinglass

Dogecoin Price Forecast: DOGE nears key support zone

Dogecoin price faced a rejection from its daily level at $0.24 on Thursday and declined 8.58%. However, it found support around its daily level of $0.21 and recovered 4.6% until Sunday. At the time of writing on Monday, it trades down by 4% nearing its daily support at $0.21.

If DOGE closes below $0.21, it could extend the decline toward its weekly support at $0.18.

The RSI on the daily chart is hovering at its neutral value of 50, indicating indecision among traders. The MACD lines also converge against each other, which further supports the indecisiveness thesis.

DOGE/USDT daily chart

However, if DOGE recovers, it could extend the recovery toward its daily resistance level at $0.24.

You May Also Like

What crashed Bitcoin? Three theories behind BTC's trip below $60K

Fed Decides On Interest Rates Today—Here’s What To Watch For