A $2B Ethereum Bet Unwinds as Leverage Finally Breaks

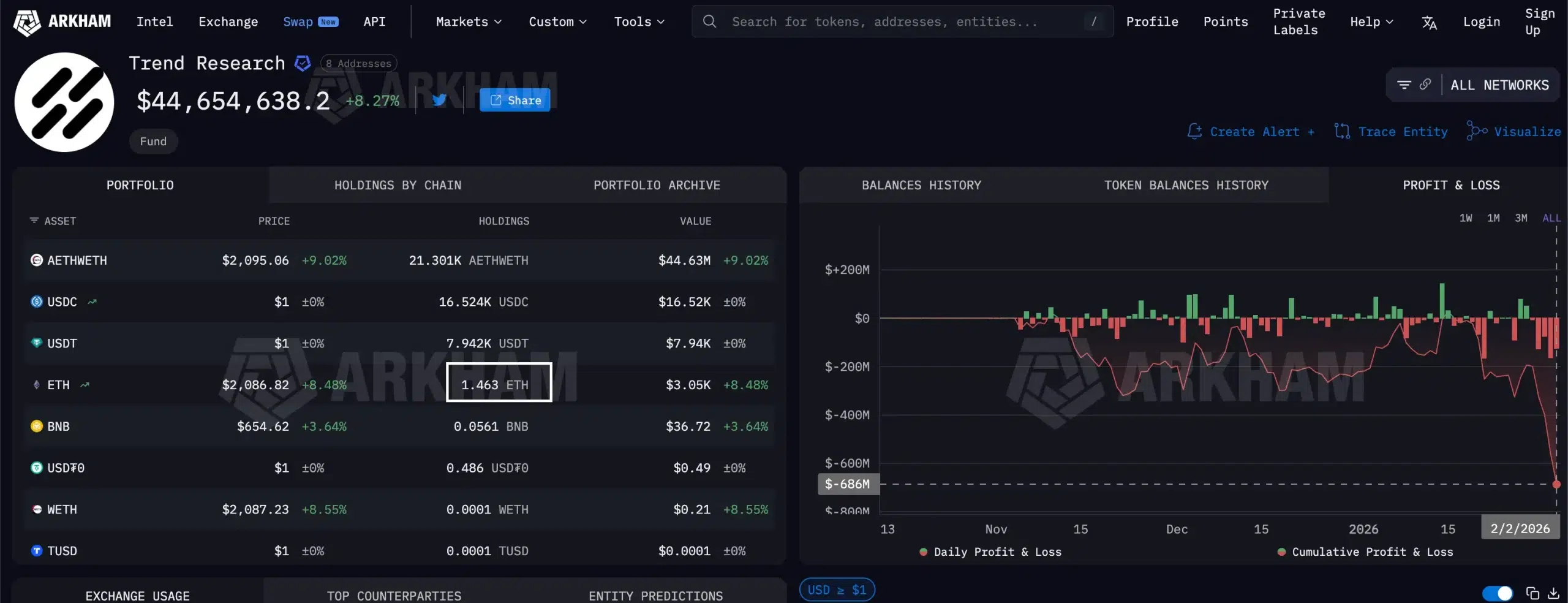

As Ethereum slid toward $1,750, Trend Research was forced into one of the largest on-chain deleveraging events in recent history, unwinding a leveraged position estimated near $2 billion to avoid total liquidation.

The collapse didn’t come from a single liquidation, but from a structure that stopped working once price momentum turned decisively lower.

The episode places renewed focus on how concentrated leverage behaves when market structure fails, and how quickly risk management turns into forced selling once thresholds are breached.

How the Position Was Built and Why It Failed

Trend Research, led by Jack Yi, constructed its exposure using a classic looping strategy. ETH was deposited as collateral, stablecoins were borrowed against it, and those proceeds were used to acquire additional ETH, amplifying directional exposure as long as price trended higher.

Source: https://www.coindesk.com/markets/2026/02/07/ether-s-recent

Source: https://www.coindesk.com/markets/2026/02/07/ether-s-recent

That structure is resilient only while collateral value remains comfortably above liquidation levels. As ETH broke below key supports this week, collateral buffers compressed rapidly. Once price approached the danger zone, the firm faced a binary choice: sell aggressively or risk cascading liquidation on Aave.

Forced Deleveraging at Scale

To stabilize the position, Trend Research sold more than 191,000 ETH, injecting heavy sell-side pressure into an already fragile market. The realized loss from these defensive sales is estimated around $686 million, making the event one of the largest documented DeFi deleveraging episodes tied to a single entity.

While the liquidation was partially controlled rather than fully automated, the mechanical effect was similar. Supply hit the market at speed, exacerbating downside momentum during a period of thin liquidity.

Yi’s Response: Risk Control, Not Capitulation

Despite the magnitude of the loss, Yi has framed the move as risk management, not abandonment of the thesis. He has emphasized that reducing leverage was necessary to preserve long-term optionality, even if it meant crystallizing losses in the short term.

Yi remains openly bullish on the broader cycle, reiterating targets that place Bitcoin above $200,000 and Ethereum above $10,000 during the 2026–2027 window. The message is clear: leverage was cut, conviction was not.

Market Impact and the Aftermath

The liquidation contributed materially to the weakness seen across early February. Large, visible sales removed bids, widened spreads, and reinforced bearish psychology just as ETH was struggling to reclaim higher levels. At the time of writing, ETH is trading near $2,023, still vulnerable to further stress if confidence does not rebuild.

From a structural standpoint, the unwinding removes a significant overhang. A heavily leveraged position that had become a latent risk is now largely neutralized. That reduces tail risk for the network, even as it leaves a psychological mark on participants.

What Comes Next

Attention is now shifting to remaining leverage pockets. Analysts at Lookonchain and others are monitoring two major liquidation clusters tied to other large holders. If ETH fails to hold the $2,000 area, further forced selling remains possible.

For the broader market, the lesson is familiar but timely. Leverage amplifies conviction on the way up, but it dictates outcomes on the way down. Trend Research’s unwind marks a painful reset, one that clears structural risk while underscoring how unforgiving market mechanics become once price acceptance breaks.

The post A $2B Ethereum Bet Unwinds as Leverage Finally Breaks appeared first on ETHNews.

You May Also Like

Propel to Report Q4 and Full Year 2025 Financial Results and Announces Dividend Increase

UK crypto holders brace for FCA’s expanded regulatory reach