Monero Price Forecast: $420 Inbound Says Experts & Is Unknown New Rollblock A Home Run?

Monero (XMR) has faced turbulence after recent setbacks, but analysts now predict a rebound toward $420 as privacy coins regain investor attention. The forecast highlights renewed confidence in Monero’s core value of secure and censorship-resistant transactions.

Meanwhile, Rollblock (RBLK), a new GameFi platform built on Ethereum, is gaining traction as a potential breakout. With $11.4 million raised, 12,000+ live games, and a deflationary token model, experts suggest Rollblock could be a surprise home run.

Rollblock Emerges as One of the Best Crypto Presales of 2025

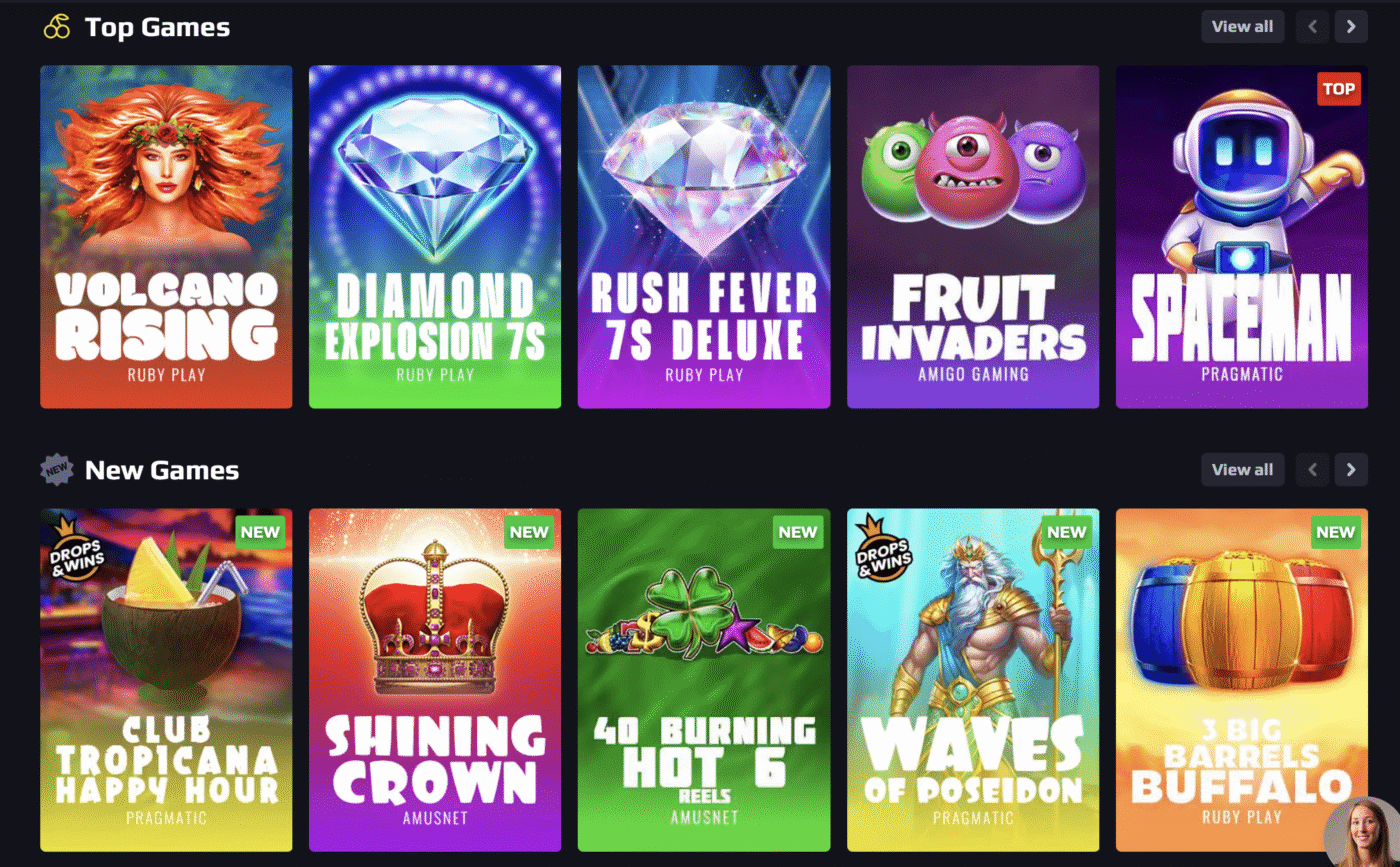

Rollblock is proving that GameFi can deliver real value. Built on Ethereum, the crypto gaming platform hosts over 12,000 AI-powered games, from live dealer tables to sports prediction markets, with every outcome verified on-chain for complete transparency.

Getting started is simple, as deposits are supported by more than 50 cryptocurrencies and fiat options like Visa, Mastercard, Apple Pay, and Google Pay. Gamers are welcomed with bonuses up to $1,100 and exclusive VIP rewards linked to their RBLK holdings.

Below are the key drivers behind Rollblock’s growth:

- Over $15 million in wagers processed

- Wide payment flexibility across crypto and fiat

- Continuous game releases and platform upgrades

- Thousands of daily active users with over 55,000 onboarded

Beyond payments, Rollblock’s native token, RBLK, fuels staking and feature unlocks while operating under a deflationary model. Each week, up to 30% of revenue is used for buybacks, with 60% burned to reduce supply and 40% rewarded to stakers as passive income.

The Rollblock presale is emerging as one of the best in 2025, raising $11.4 million, with RBLK surging by 500% to $0.068. YouTube influencers like Professor Crypto point to its adoption and revenue-driven model as proof that more rallies are coming.

Monero Under Pressure After Darknet Setback

Monero (XMR) has fallen to $270.82, down 3.73% in the past week and 17% over the month, as the network grapples with two severe blows. The biggest hit came with the shutdown of the largest darknet marketplace, erasing thousands of daily transactions and weakening short-term activity. Experts argue this drop is temporary, pointing to Monero’s core strength: enabling private, censorship-resistant transactions.

Source

Source

While its role in anonymous transfers remains central, the network’s response in the coming days will be crucial. If Monero can reassure its community and reinforce network security, investor confidence may return. However, failure to steady the situation could kickstart one of the most damaging episodes in Monero’s history.

Why Rollblock Could Outperform Monero in 2025

Monero (XMR) continues to appeal to investors who value steady growth and reliable returns. Nonetheless, Rollblock (RBLK) is emerging as a bold alternative with far greater upside potential. The table below shows how Rollblock compares to Monero:

| Metrics | Rollblock (RBLK) | Monero (XMR) |

| Utility | 12,000+ games, sportsbook, staking, revenue share | Private and censorship-resistant transactions |

| Price | $0.068 (presale price after 500% rally) | $270 |

| Staking/reward | Up to 30% APY; rakebacks; VIP bonuses | None; mined via PoW |

| Catergory | Web3 crypto gaming platform | Privacy-focused cryptocurrency |

At just $0.068 per token, Rollblock offers a ground-floor entry into a project already backed by real utility and rapid adoption. With forecasts of a 500% rise before the presale ends and a possible 100x surge post-launch, RBLK is shaping up as one of the best cryptos to buy this cycle.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post Monero Price Forecast: $420 Inbound Says Experts & Is Unknown New Rollblock A Home Run? appeared first on Blockonomi.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse