South Korea Moves Ahead With Stablecoin Regulation Bill

South Korea is preparing to introduce a regulatory framework for stablecoins in a few months. In particular, the Financial Services Commission (FSC) is expected to submit the bill to the National Assembly in October.

Stablecoin Framework Designed to Reduce Dollar Dependence

According to lawmaker Park Min-kyu, the FSC briefed him on the policy direction and confirmed the timeline. The framework is part of the second phase of South Korea’s Virtual Asset User Protection Act, and is similar to the US’ recently passed GENIUS Act.

The upcoming bill will define rules for stablecoin issuance, collateral management and internal control systems, and regulators are aiming to give the market clear guidance while ensuring consumers are protected.

The push for stablecoin rules comes as South Korea seeks to reduce its reliance on dollar-pegged tokens.

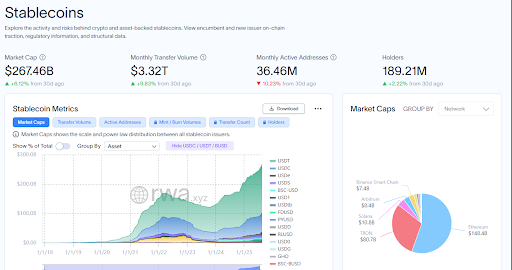

As of writing, the stablecoin market is dominated by USD-backed assets like Tether’s USDT and Circle’s USDC. Data from RWA.xyz even shows that dollar-based stablecoins account for as much as 99.8 per cent of the $266.7 billion market.

Source: Rwa.xyz

Source: Rwa.xyz

South Korea’s government sees this as a risk to its monetary sovereignty.

Several bills have already been submitted to mitigate this, including the Digital Asset Basic Act, the Act on the Issuance and Circulation of Value-Stable Digital Assets and the Act on Payment Innovation Using Value-Pegged Digital Assets.

The upcoming FSC proposal will bring these efforts together under a unified framework.

South Korea Banks and Tech Firms Support Stablecoin Plans

The country’s largest banks and other institutions are already preparing for the shakeup.

Banks like KB Kookmin, Woori, Shinhan, and Hana have all expressed interest in providing services around stablecoins. These banks are also considering a meeting with Circle’s President, Heath Tarbert, to look into collaborating on stablecoin technology.

South Korea is not alone in pursuing local stablecoins. Its neighbour, Japan, is also close to launching its first yen-backed stablecoin, with fintech firm JPYC expecting approval soon.

These moves show that Asian countries are making active efforts to strengthen their domestic currencies.

Stablecoin regulation is also gaining speed in other parts of the world. The United States recently introduced the Genius Act, which was signed by President Donald Trump.

In essence, South Korea’s upcoming bill is likely an attempt to keep up with international developments like these, on its terms.

Concerns From the Central Bank

While the government and private sector are moving forward, the Bank of Korea has raised alarms.

For example, Governor Lee Chang-yong has argued that only licensed banks should issue won-pegged stablecoins. He warned that allowing multiple issuers could undermine the country’s ability to manage foreign currencies.

This move shows the need for balance as far as regulators are concerned. Stablecoins offer a great deal of potential for innovation when it comes to payments and finance. However, they can also be risky if they are not controlled properly.

The upcoming bill is expected to address these issues by setting strict requirements for issuers.

The post South Korea Moves Ahead With Stablecoin Regulation Bill appeared first on Live Bitcoin News.

You May Also Like

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus

Tether Advances Gold Strategy With $150 Million Stake in Gold.com